FILTERS

SEARCH BY KEYWORD

Oct 2, 2024

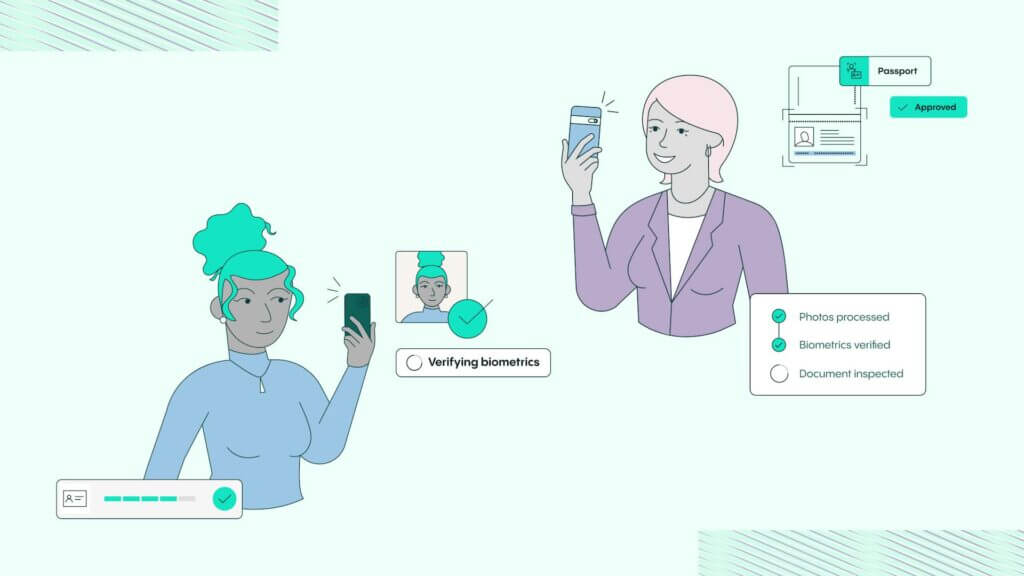

Prevent fraud, build trust: The power of digital Identity Verification

IDV Articles

View

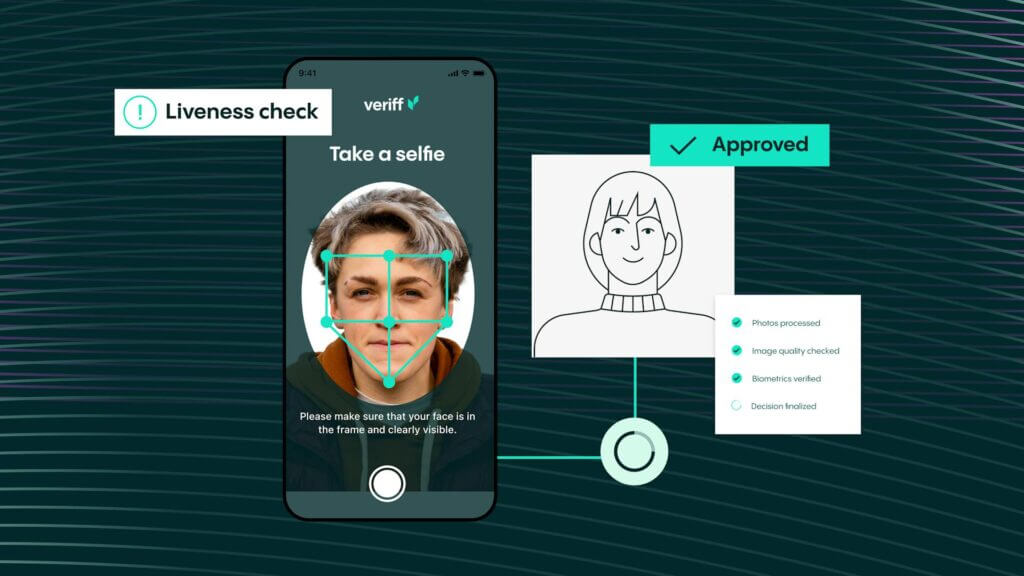

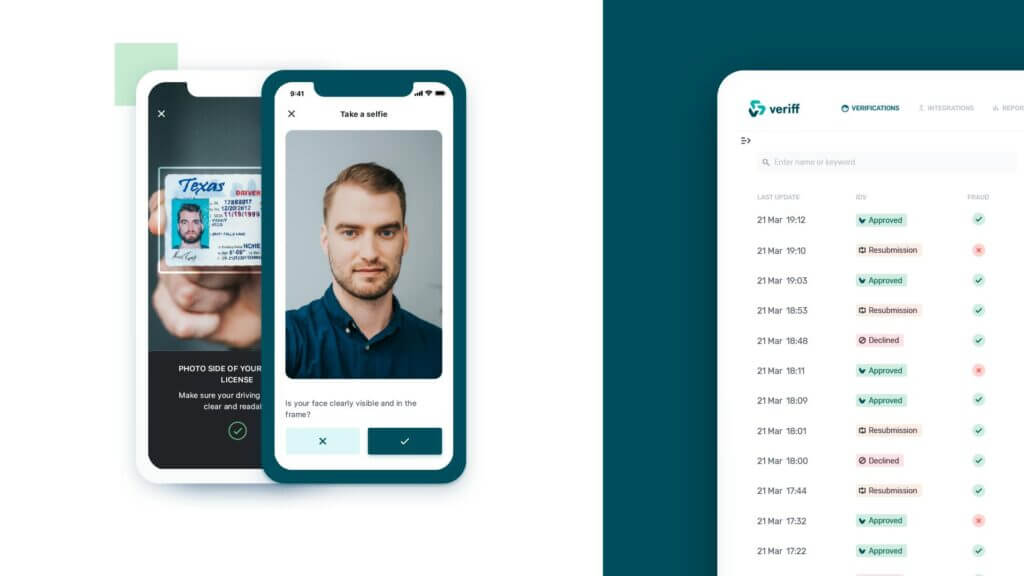

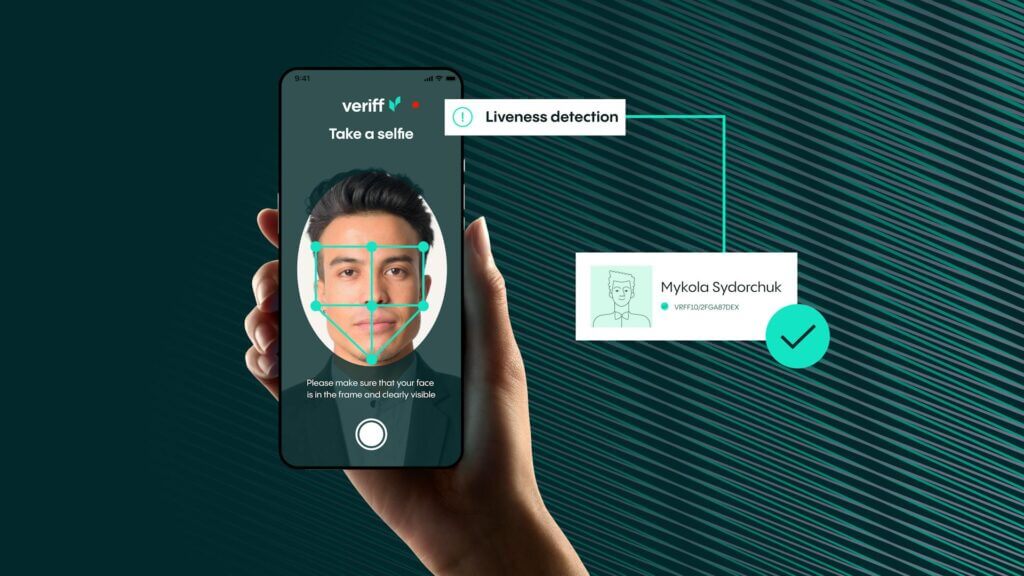

Sep 16, 2024

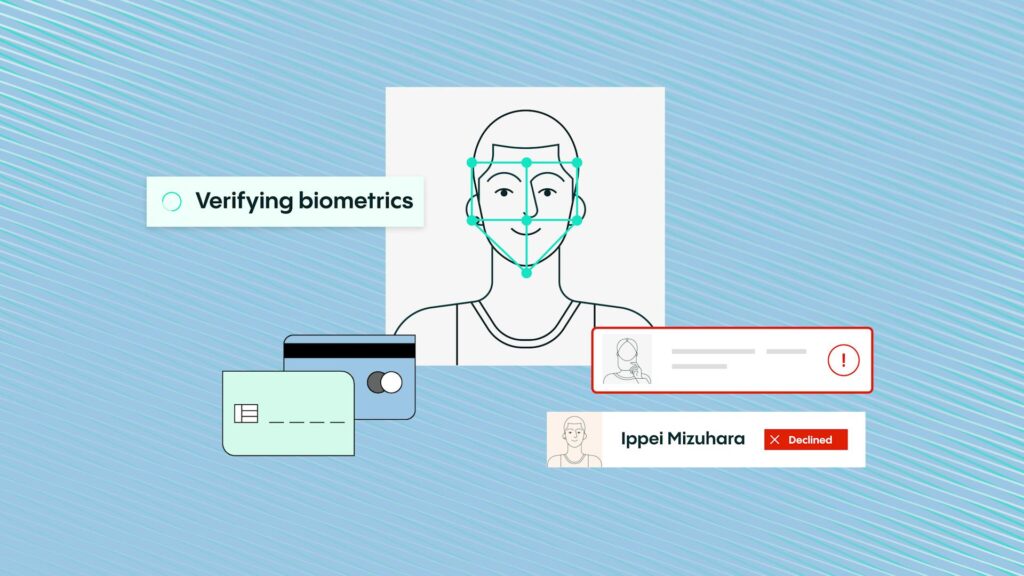

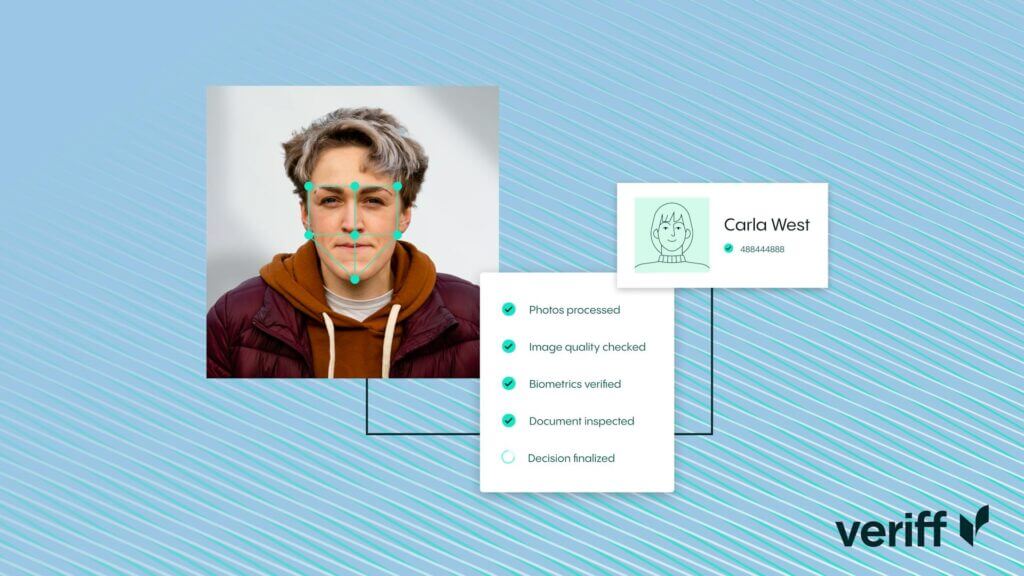

Veriff achieves iBeta Level 2 biometric liveness detection compliance

IDV Articles

ViewSubscribe for insights

FAQs

What is the Identity Verification Education Center and why is it important?

The Identity Verification Education Center is a comprehensive library of articles on how to ensure security, prevent fraudulent activities, and minimize identity fraud risks. This hub is essential for businesses that need to comply with global regulations, keep customers safe, build trust online and harness customer-powered growth. Here are the three most important pieces of information about the Identity Verification Education Center:

- The Identity Verification Education Center offers current insights on enhancing customer acquisition through your identity verification process flow.

- The Identity Verification Education Center boasts a comprehensive library of articles on user experience, expertly navigating identity verification challenges, and ensuring customer retention without compromising security, KYC, or other regulatory requirements.

- The Identity Verification Education Center is designed to be user-friendly and easy to navigate, making it a convenient resource for businesses of all sizes.

What types of businesses can benefit from using the Identity Verification Education Center?

Any business that needs to identify new customers can benefit from using the Identity Verification Education Center. This includes financial services institutions, such as banks and insurance companies, as well as non-financial services institutions, such as law firms and accounting firms.

What are the benefits of using the Identity Verification Education Center?

There are several benefits to using the Identity Verification Education Center for your business. Here are the three most important benefits of using the Identity Verification Education Center:

- Keep up with evolving global regulations: The identity verification process is constantly evolving, and it can be challenging for businesses to keep track of changing requirements. The Identity Verification Education Center provides up-to-date information on regulatory changes, ensuring that your business stays compliant.

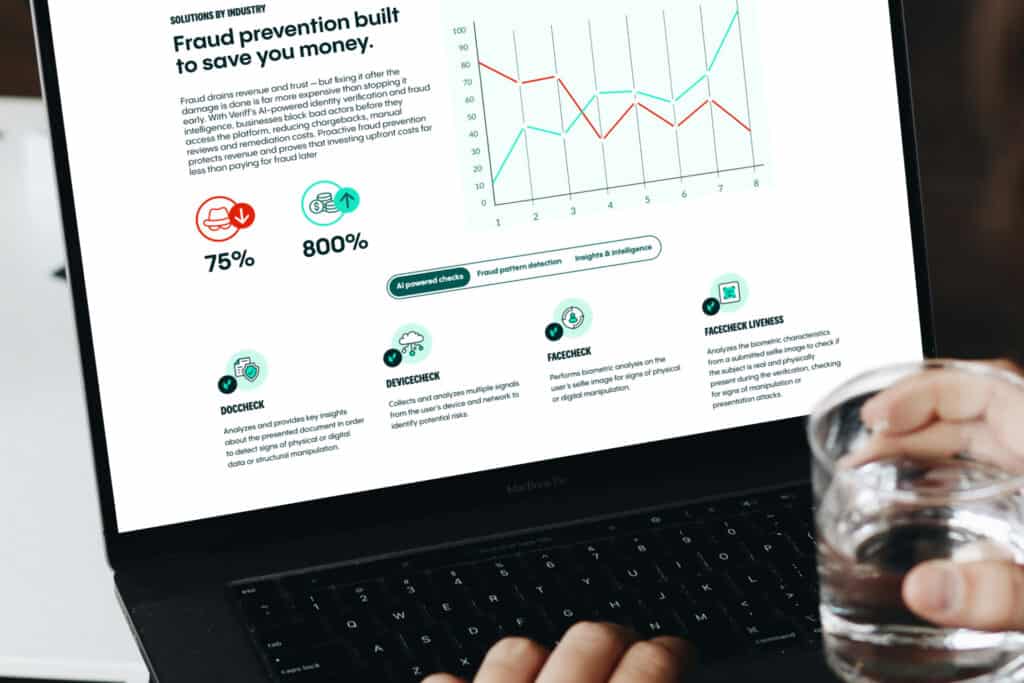

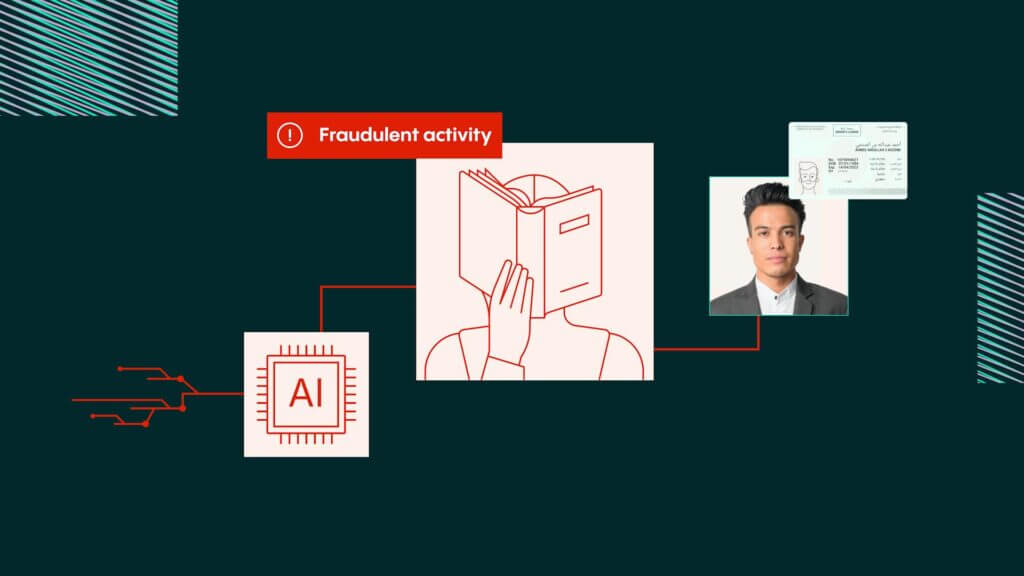

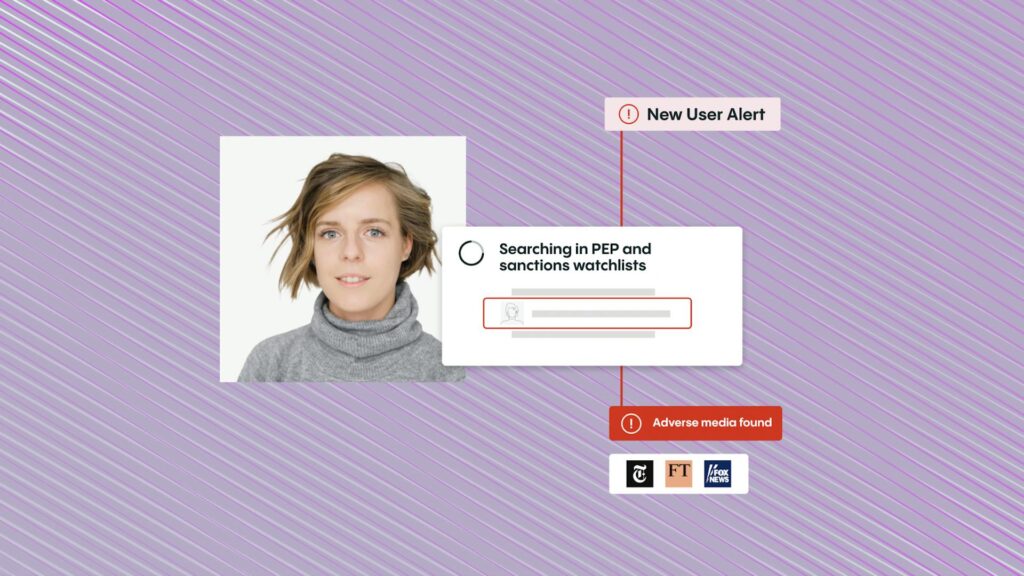

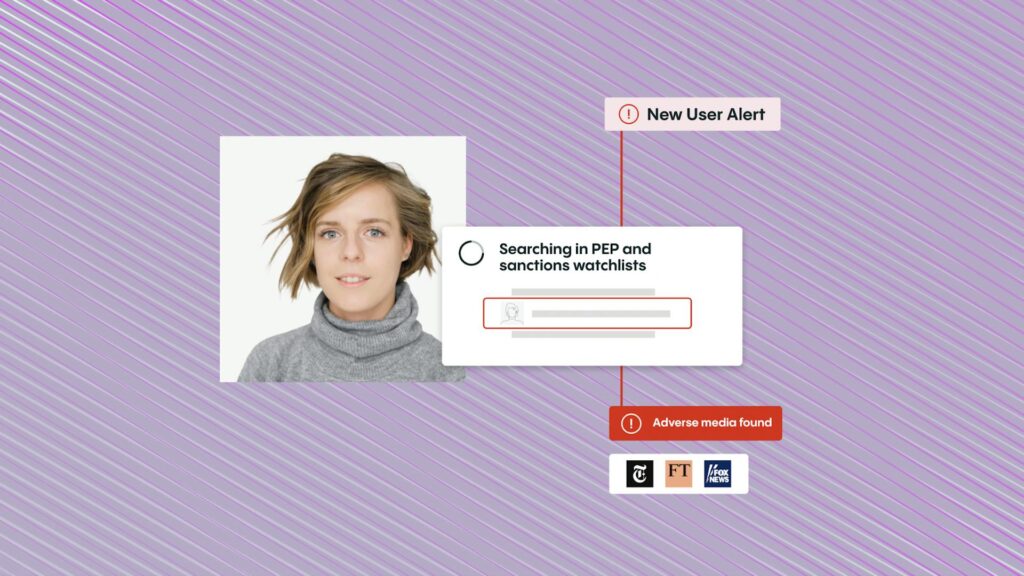

- Prevention of fraudulent activities is crucial in today’s digital landscape. By providing expert insights, tips, and comprehensive guides on fraud prevention strategies, businesses can safeguard themselves against potential threats and protect their assets effectively.

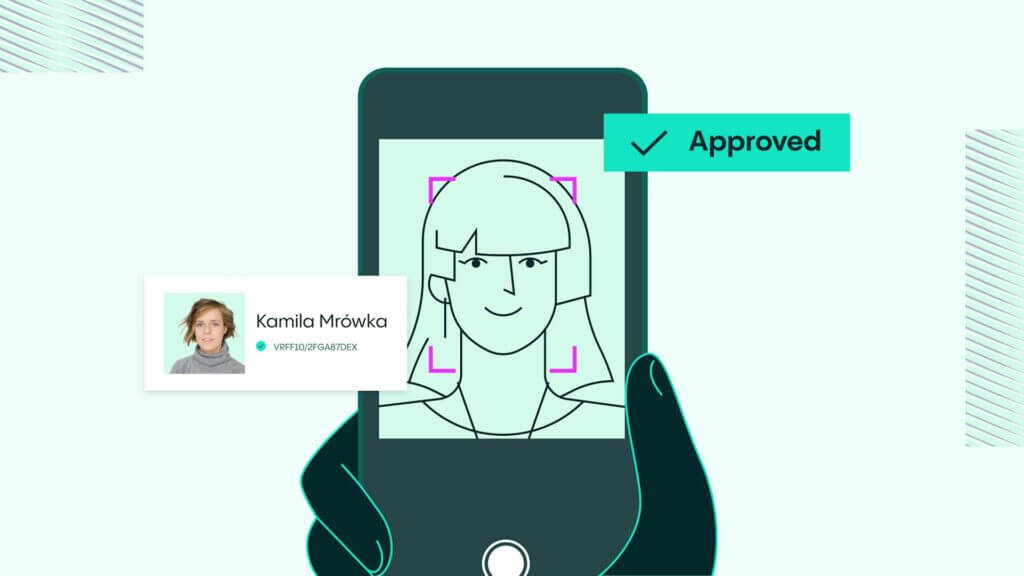

- Enhance results: by swiftly and securely grasping the identity verification process, your business can establish online trust, operate securely, and enhance customer satisfaction and loyalty.

How does the Identity Verification Education Center ensure the security of its platform?

The Identity Verification Education Center ensures the security of its platform through various measures:

- Secure hosting: The platform is hosted on secure servers, with regular backups and security updates to prevent any potential breaches.

- Encryption: All data transmitted through the platform is encrypted, ensuring that sensitive information remains protected at all times.

- Compliance with regulations: The Identity Verification Education Center complies with global regulations, such as GDPR and KYC, to ensure that businesses using the platform also remain compliant.

- Ongoing monitoring: The platform is constantly monitored for any suspicious activity, and any potential threats are swiftly addressed to maintain a secure environment for users.

Talk to us

Our identity verification experts are ready to help you optimize your processes, onboard more genuine customers faster, and keep bad actors out.