IDV Article

Self-serve Identity Verification for startups: Scale with confidence, build trust, stay compliant

For those managing a startup or small business, balancing product development, customer outreach, and daily tasks with changing compliance rules can be a challenge. Processes like Identity Verification (IDV) and Know Your Customer (KYC) are more than just legal requirements—they are fundamental to establishing trust, stopping fraud, and securing your business’s future growth.

Managing a startup or small business involves juggling product development, customer acquisition, and day-to-day operations, all while staying on top of compliance obligations. Identity verification for startups and small businesses is no longer just a regulatory hurdle. These solutions are essential for building a trustworthy and secure organization. Today, adopting a self-serve IDV and KYC platform is a smart move that can save time, reduce costs, and support rapid growth.

This blog explores the specific challenges startups and small businesses face with traditional IDV solutions and demonstrates why self-serve models are the best fit. We’ll highlight key features, essential benefits, and how a leading provider like Veriff can help your business scale while staying compliant.

The problem with traditional KYC/IDV for startups and small businesses

Historically, IDV for startups and small businesses involved tedious, manual processes: in-person checks, gathering physical documents, and employing staff to review every submission. For companies that need to act fast, these obstacles can be a major setback—especially with fraud risks on the rise.

The rising cost of fraud

Fraud is a growing concern for startups and small businesses of all types. The Association of Certified Fraud Examiners estimates that organizations loses 5% of annual revenue to fraud. Meanwhile, the global digital IDV market is projected to hit $18 billion by 2027, showing the urgency of robust verification measures. Small businesses are targeted more frequently than large enterprises. Research reveals every $1 lost to fraud actually costs U.S. businesses $4.23 after fines, fees, and reputation damage.

Most alarmingly for IDV for startups and small businesses, digital fraud is accelerating. In 2023, 70% of businesses reported increased fraud attempts, with synthetic ID fraud and account takeovers as the fastest-growing threats. Without the right IDV platform, startups and small businesses risk financial loss, regulatory trouble, and customer mistrust.

Inefficiency and high costs

Manual IDV processes are both time-consuming and costly. Small businesses and startups rarely have the extra resources to hire dedicated compliance teams or pay for legacy verification services. Processing times can slow to a crawl—up to 3-5 days per customer—resulting in delayed onboarding and dissatisfied users. Ultimately, inefficient IDV can hold back business growth.

Poor customer experience

In competitive markets, identity verification must provide a fast, seamless customer onboarding process. Nearly 40% of users will abandon the sign-up if verification isn’t quick and user-friendly. Every missed opportunity here has a direct impact on conversions and long-term success. Learn the essentials of creating a great customer onboarding experience in this best practices guide.

Compliance risks

Regulatory expectations for identity verification are getting stricter, with evolving AML and KYC laws worldwide. For startups and small businesses without robust legal teams, managing compliance is risky. Non-compliance can lead to fines exceeding $5 billion globally, reputation losses, and business interruptions. Learn more about the key identity verification regulations shaping AML compliance in this global guide.

Scalability Issues

Manual IDV solutions work for a handful of clients, but can’t keep up as your business grows. As volume increases, so do delays, mistakes, and compliance gaps. When choosing IDV for startups or IDV for small businesses, scalability is non-negotiable.

The solution: Self-Serve IDV for startups and small businesses

A modern self-serve IDV platform empowers startups and small businesses to manage identity verification with efficiency and confidence. Forget manual reviews—automate verification and focus on what matters: building your business. Whether you’re handling dozens or thousands of verifications, self-serve solutions keep you moving at startup speed. Learn how automated identity verification delivers superior accuracy, speed, and convenience—eliminating friction compared to manual solutions.

The benefits of self-serve IDV for startups and small businesses

Adopting a self-serve IDV model brings tangible benefits for startups and small companies:

1. Unmatched cost-effectiveness

Self-serve IDV for startups and small businesses is affordable and flexible. Pay-as-you-go or subscription pricing ensures you’re only billed for what you use—perfect for lean teams prioritizing product and customer growth.

2. Seamless scalability

Modern self-serve IDV solutions handle growth effortlessly. Whether onboarding 10 or 10,000 users, your verification processes remain fast and accurate. This means your IDV for small businesses scales as you do.

3. Efficient operations

Self-serve IDV for startups reduces manual work and boosts operational efficiency. Advanced AI checks IDs, faces, and detects fraud instantly—freeing up your team to innovate and grow.

4. Simplified compliance

Top self-serve IDV providers are designed with regulations in mind. Automated audit trails, clear reporting, and up-to-date compliance workflows keep your business protected and regulator-ready.

5. Exceptional user experience

Quick, intuitive verification means users can sign up with less friction, reducing drop-offs and improving satisfaction. For startups and small businesses, providing a frictionless IDV experience is a competitive advantage.

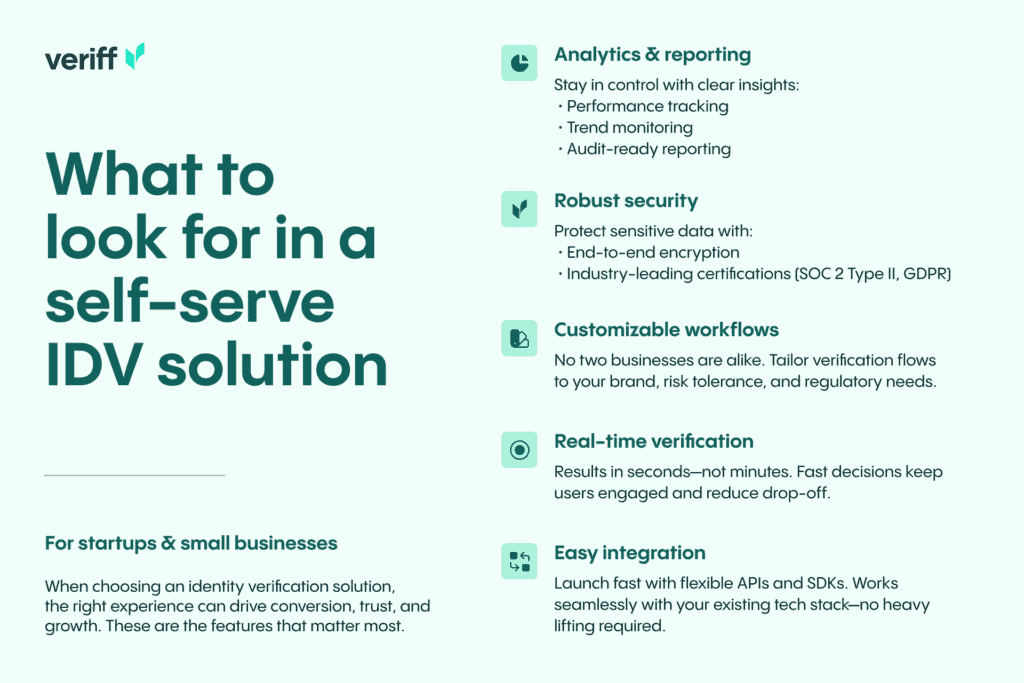

What to look for in a self-serve IDV solution for startups and small businesses

When selecting IDV for startups or small businesses, the right features make all the difference:

- Real-time verification: Choose a platform that delivers results in seconds, critical for user satisfaction.

- Robust security: Ensure end-to-end encryption and top-tier certifications (like SOC 2 Type 2, GDPR compliance) to protect sensitive data.

- Customizable workflows: Every startup and small business is unique. Personalize your verification flows to match your brand, risk profile, and legal requirements.

- Analytics and reporting: Access detailed dashboards to monitor performance, track trends, and stay on top of audits.

- Easy integration: Look for APIs and SDKs that fit with your tech stack, so your team gets up and running with minimal hassle.

Meet Veriff: The ideal self-serve IDV solution for startups and small businesses

When it comes to IDV for startups and IDV for small businesses, Veriff stands out as a leading self-serve platform. Designed with small companies in mind, Veriff offers powerful features with a user-friendly experience. Sign up, integrate, and launch fast—with pay-as-you-go pricing that fits your growth stage and budget. Veriff supports IDs from 230+ countries and territories, giving your startup or small business the global reach you need. Watch how Veriff Veriff identity verification works.

Veriff’s case studies show the real-world impact: startups and small businesses using Veriff report faster onboarding, significant fraud reduction, and the ability to handle rapid user growth without expanding their compliance team. With Veriff, your business can enhance user experience, reduce fraud, and remain fully compliant at any stage of growth.

Self-serve IDV isn’t just a compliance tool—it’s a growth enabler. For startups and small businesses, it delivers trust, speed, and scalability in one package.