IDV Article

How the One Big Beautiful Bill Act is changing remittance verification

Big news for global transfers: The ‘One Big Beautiful Bill Act’ drops a 1% tax on U.S. remittance transfers starting Jan 1, 2026. A tiny percentage? Not for an industry moving billions—expect billions in new taxes and tighter regulations. This changes everything.

The One Big Beautiful Bill Act, signed into law in 2025, is set to transform the U.S. remittance industry. Beginning January 1, 2026, one of the most impactful provisions, Section 70604, introduces a 1% excise tax on remittance transfers sent outside the United States, with limited exceptions.

While a 1 percent remittance tax on cash transfers might sound minor, it could result in billions of dollars in new annual taxes, putting intense financial and operational pressure on remittance providers.

So, what does this mean for the remittance industry—and why will companies need advanced identity verification tools, such as those offered by Veriff?

In this article, we’ll break down the One Big Beautiful Bill Act remittance tax, its impact on remittance providers, and how identity verification technology can help companies remain compliant and trusted.

What is the remittance tax under the One Big Beautiful Bill Act?

According to the IRS, a 1% excise tax will apply to certain outbound remittance transfers after December 31, 2025. This includes:

- Cash transfers through money service businesses

- Money orders

- Cashier’s checks

- Other similar physical monetary instruments

The IRS remittance excise tax applies to transfers of $15 or more, meaning even small remittances will fall under the new rule.

What is exempt from the remittance tax?

Certain electronic and digital transfers are exempt from the IRS remittance tax, including:

- Wire transfers from U.S. bank accounts

- Credit and debit card transactions

- Electronic transfers from financial institutions

- Cryptocurrency transfers

In general, funds sent electronically through regulated financial institutions under the Bank Secrecy Act (BSA) are exempt. Otherwise, the remittance tax 2026 USA applies.

Who is affected by the tax?

The law is broad, impacting anyone sending money abroad, including:

- U.S. citizens

- Green card holders

- Visa holders

- Non-resident aliens

This marks a significant shift in compliance expectations for remittance companies.

The One Big Beautiful Bill Act isn’t just changing how money moves—it’s redefining what compliance means. In this new era, trust will belong to the companies that verify smarter and adapt faster.

Why this law is a game-changer for remittance companies

Traditionally, remittance providers—like Western Union, MoneyGram, and Remitly—focused on anti-money laundering (AML) and counter-terrorist financing (CTF requirements. They verified identities using documents such as:

- Foreign passports

- National ID cards

- U.S. driver’s licenses

How much is at stake?

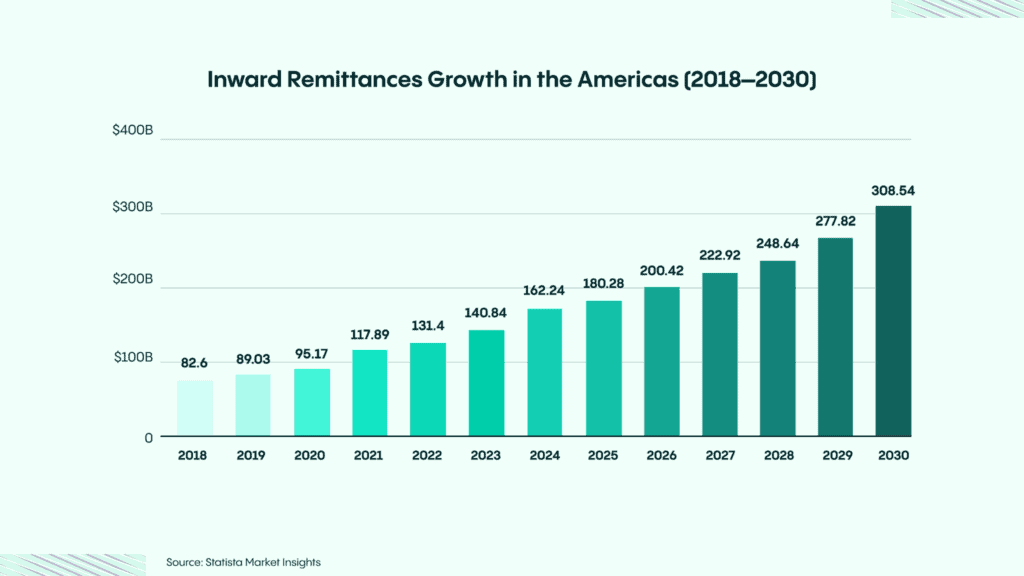

The financial implications are enormous. According to Statista (2025), the Americas remittance market is projected to reach $180.28 billion in transaction value that year.

For example, The Economic Times estimates that Indian-origin residents in the U.S. could collectively pay up to $1.6 billion annually in remittance taxes if current transfer volumes persist.

This impact extends to millions of immigrants, expats, and foreign workers, many of whom rely on cash-based remittance services—the main target of the 1 percent remittance tax on cash transfers.

Penalty relief is temporary

The IRS has announced penalty relief for the first three quarters of 2026 as providers adapt. However, full enforcement will begin in Q4 2026.

This gives remittance companies less than a year to upgrade systems, train teams, and integrate with identity verification platforms like Veriff.

Why Identity Verification providers like Veriff are more essential than ever

To stay compliant and competitive under the remittance compliance 2026 framework, remittance companies must adopt advanced verification solutions that go beyond traditional AML checks.

They need systems that can:

- Instantly verify government-issued IDs

- Confirm U.S. citizenship or nationality status

- Securely store verification documentation

- Support Know Your Customer (KYC) and Enhanced Due Diligence (EDD) processes

That’s where Veriff identity verification for remittance comes in. By offering AI-powered identity verification, Veriff enables remittance providers to automate compliance, reduce manual errors, and build customer trust.

Failure to implement these solutions could lead to misapplied taxes or non-compliance penalties once the relief period ends.

What should remittance companies do next?

To prepare for compliance and minimize exposure:

- Evaluate onboarding workflows – Identify where citizenship or tax status data needs to be collected.

- Partner with a verification provider – Tools like Veriff automate both identity and citizenship verification.

- Educate customers – Many may not know about the new remittance tax 2026 USA or how to avoid it.

- Prepare for audits – Maintain secure, well-organized documentation for IRS review.

The bottom line

The One Big Beautiful Bill Act is reshaping the remittance landscape. The 1% remittance excise tax is more than a fiscal policy—it’s a regulatory catalyst forcing modernization across the industry.

Companies that invest in compliance technology and identity verification systems will not only remain compliant but also gain a competitive edge in building trust and efficiency.

For Veriff and similar providers, this moment represents a defining opportunity to become indispensable partners in the next era of remittance compliance.