IDV Article

Digital identity in Australia challenge: Why fintechs must strengthen verification

Australia’s fintech and BNPL boom has fueled growth — but at a cost. With $2.03 billion lost to scams in 2024, weak identity controls are now a systemic risk. Strong verification is essential to protect consumers and preserve trust in digital finance

Australia’s fintech and Buy Now, Pay Later (BNPL) sectors have experienced explosive growth, fueled by consumer demand for seamless onboarding and instant credit. But this rapid expansion has exposed a critical vulnerability: identity verification. Digital identity in Australia is now at the center of the solution, as the industry works to balance speed with certainty and reduce exposure to sophisticated fraud, regulatory scrutiny, and the erosion of public trust.

The numbers paint a stark picture. According to the latest data, Australians reported a staggering $2.03 billion in combined scam losses in 2024. While this represents a decrease from the previous year, the volume of financial crime remains alarmingly high. The message is clear: without a robust identity verification framework, the risks will only grow. Fraud rings are exploiting weak Know Your Customer (KYC) controls, and regulators are watching closely. A single high-profile breach could trigger punitive regulations and shake confidence in the entire digital finance ecosystem.

At Veriff, we believe trust is the foundation of innovation. Here’s why building a stronger, standardized verification framework is no longer optional, and how fintechs and BNPL providers can lead the way.

The risk of frictionless onboarding: A system-wide weakness

The fintech promise of instant approvals and frictionless onboarding has been a game-changer for consumers. But in the race to remove barriers, many providers have sacrificed the safeguards that prevent fraud. Lightweight identity checks, minimal data capture, and delayed verification have created systemic gaps that fraudsters are quick to exploit.

The result? Fraud schemes scale rapidly across platforms, leveraging weak signals to create synthetic identities, take over accounts, and orchestrate large-scale attacks. This isn’t just a problem for individual providers; it’s a collective risk that threatens the entire sector.

The 2024 data reveals exactly where these vulnerabilities lie. Investment scams topped the list of financial losses, costing Australians $945 million. This category alone highlights how easily bad actors can manipulate trust in financial systems when verification barriers are low. Furthermore, payment redirection scams ($152.6m) and remote access scams ($106.0m) continue to drain millions from the economy, thriving in environments where identity checks are insufficient or easily bypassed.

Get your free access to the report

Explore the latest insights into digital fraud trends with the Future of Payments Report.

Australia’s challenge isn’t innovation. It’s digital identity.

Fintech innovation thrives on trust: trust that users are who they claim to be, that transactions are legitimate, and that consumer protections are enforceable. Without consistent, reliable identity verification, every new product becomes a faster way to move risk through the system.

For BNPL providers, the stakes are even higher. Their ultra-low-friction onboarding flows, designed to maximize speed and simplicity, rely on trust signals that are easy to spoof. As a result, the sector has outpaced the development of standardized KYC and anti-money laundering (AML) practices, leaving it exposed to financial crime and regulatory intervention.

The demographic data from 2024 underscores the human cost of these gaps. People aged 65 and over reported the highest losses, indicating that fraudsters are aggressively targeting vulnerable populations who may be less familiar with digital security protocols. Additionally, small businesses reported the highest total loss to investment scams, proving that even commercial entities are not immune to sophisticated deception.

The case for a stronger verification framework

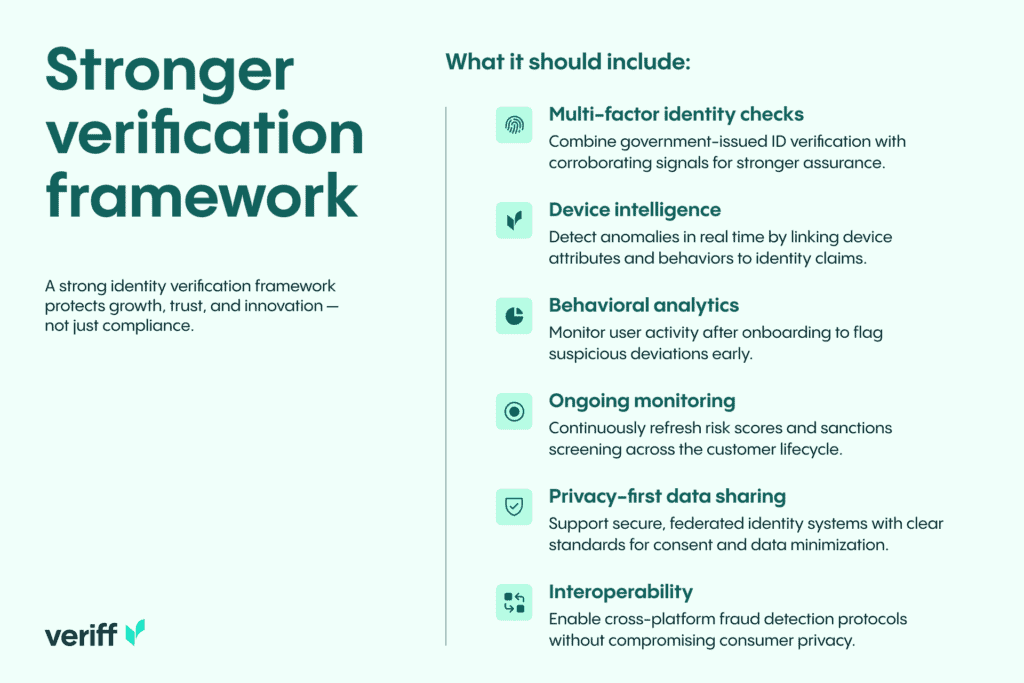

A robust identity verification framework isn’t just about compliance; it’s about protecting growth, trust, and innovation. Here’s what it should include:

- Multi-factor identity checks: Combine government-issued ID verification with corroborating signals for stronger assurance.

- Device intelligence: Detect anomalies in real time by linking device attributes and behaviors to identity assertions.

- Behavioral analytics: Monitor user patterns post-onboarding to flag suspicious deviations.

- Ongoing monitoring: Continuously update risk scores and sanctions checks throughout the customer lifecycle.

- Privacy-first data sharing: Enable secure, federated identity systems with clear standards for data minimization and consent.

- Interoperability: Establish protocols for cross-platform fraud detection without compromising consumer privacy.

When these elements are standardized across the sector, they close gaps, reduce fraud, and create a predictable compliance baseline for regulators and auditors.

Balancing security and customer experience

Tightening identity checks doesn’t have to mean sacrificing user experience. Modern verification technologies, like device intelligence and passive risk signals, enable strong, silent verification for most users while directing only high-risk cases to additional checks. This approach preserves the speed and simplicity consumers expect while ensuring robust fraud prevention.

Operationally, this requires investment in automation, orchestration, and scalable verification workflows. Providers must prioritize evidence sources that are both strong and scalable, like government identity schemes and persistent device signals, while maintaining high-quality manual review for ambiguous cases.

Why acting now is critical

Waiting for a headline-grabbing fraud scandal will only invite rushed, punitive regulation. Acting now allows the industry to co-design a framework with regulators, one that balances security, compliance, and customer experience. This proactive approach not only reduces the risk of enforcement actions, but also preserves consumer trust and positions Australian fintechs for sustainable growth.

With over $2 billion lost to scams in a single year, the urgency is undeniable. For BNPL providers and fintechs, the business case is clear: early investment in scalable verification reduces fraud, protects brand reputation, and supports expansion into global markets where strong KYC is a prerequisite.

Get your free access to the report

Explore the latest insights into digital fraud trends with the Future of Payments Report.

A call to action: Build trust, protect growth

Australia’s fintech and BNPL sectors are at a crossroads. Strengthening identity verification isn’t just a compliance exercise. It’s a strategic imperative. By adopting a consistent, risk-based framework, the industry can reduce fraud, protect consumers, and enable the next wave of responsible innovation.

At Veriff, we’re here to help. Let’s build a verification framework that scales with your growth, without slowing it down.