IDV Article

How to onboard a customer? Building a high-value user base with seamless identity verification

Acquisition isn’t just about sign-ups; it’s about trust, speed, and security from the first click. Seamless onboarding boosts activation by 40%, while friction drives away 63% of users. For businesses with strict IDV and KYC rules, this is both a challenge and an opportunity. With the right strategy, onboarding becomes a competitive edge.

Customer acquisition isn’t just about getting users through the door, it’s about making those first moments memorable, efficient, and secure. Onboarding is the time when your platform begins building trust, setting expectations, and laying the foundation for long-term engagement. A seamless onboarding experience can boost activation rates by up to 40%, while friction-laden processes can push your churn rate through the roof, up to 63% of potential users drop out due to unclear steps or excessive data requests.

For industries navigating strict identity verification (IDV) and Know Your Customer (KYC) regulations, onboarding isn’t only pivotal, it’s also complex. Yet, complexity need not mean frustration. With the right strategy and tools, businesses can achieve higher compliance and conversion—making secure onboarding a business asset, not just a legal necessity.

In this comprehensive guide, you’ll discover:

- How identity verification drives conversions while minimizing fraud and risk

- Strategies to personalize onboarding for different user types and risk tiers

- Proven, actionable tactics to streamline the journey and reduce customer drop-offs

- Real-world data and best-in-class examples to inspire your onboarding makeover

Whether you’re building a new process or refining an existing workflow, these insights will help you transform onboarding into a competitive edge.

Why a thoughtful onboarding strategy matters

Many companies make the mistake of treating onboarding as a final checkbox in the acquisition funnel. In reality, it’s your first—and most important, opportunity to build retention. Nearly 80% of users say the onboarding experience is a primary factor in deciding whether to stick with a service. Strong correlations exist between onboarding and long-term value: customers who have a smooth onboarding are up to 2.5 times more likely to remain active after 12 months.

In high-stakes industries like finance and fintech, a poor onboarding flow is a direct pipeline to abandonment. Cumbersome onboarding drives abandonment rates as high as 68%, representing billions in lost annual revenue, especially when you consider that it can cost 5–25 times more to acquire a new customer than to retain an existing one.

Conversely, organizations with streamlined digital onboarding see customer acquisition rates increase up to 60%. The benefits don’t stop there: reducing onboarding friction directly impacts activation and engagement. InnerTrends reports the average SaaS product activation rate is just 37.5%, while teams that invest in onboarding optimization can push this over 50%.

Key Takeaway: Optimizing onboarding means you’re not just maximizing conversions—you’re actively reducing risk, improving user satisfaction, and fueling growth.

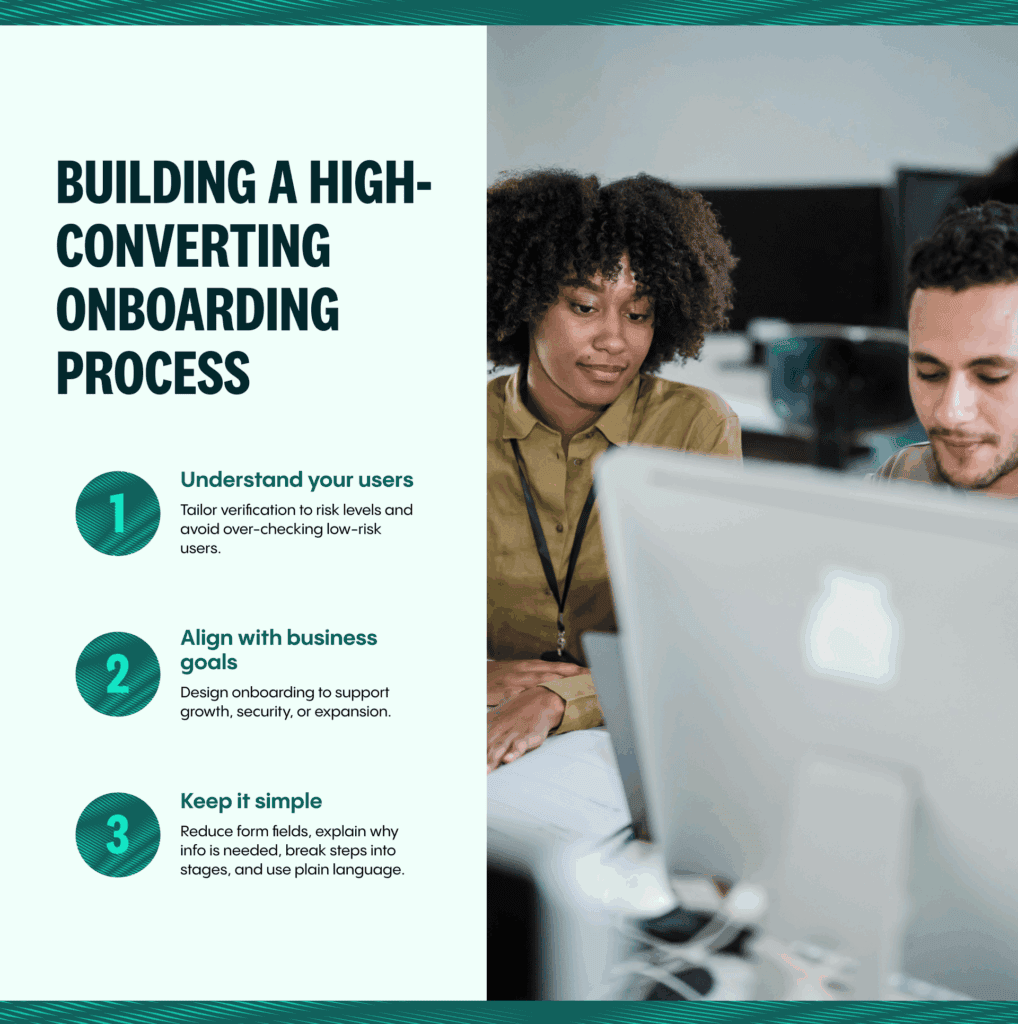

Building a high-converting onboarding process

One-size-fits-all onboarding rarely delivers results in a world of diverse users and regulatory environments. Companies that segment users by risk and tailor onboarding requirements boost completion rates by up to 40%, without opening the door to fraud.

1. Understand your business and audience

A successful onboarding strategy starts with understanding both your regulatory obligations and your users’ preferences.

- Risk-based segmentation: For example, fewer than 5% of new banking customers are genuinely high-risk. Imposing exhaustive checks on every user means sacrificing 95% of your conversions unnecessarily. When UK challenger bank Monzo introduced progressive KYC, requiring only essential data upfront and asking for more verification only when users transferred larger amounts, its onboarding completion rate jumped by over 30%.

- User-centric design: Are your users tech-first Millennials, or older, less tech-savvy professionals? Mobile-friendly onboarding increases completion by as much as 29%, particularly among younger demographics (Gainsight). Cross-border platforms like Legitify have succeeded by supporting document verification in multiple languages and formats, seeing abandonment rates drop by up to 40% across global segments.

Tip: Survey users or analyze your drop-off points to identify what’s working—and which hurdles need to be removed.

2. Align onboarding with your go-to-market strategy

Your onboarding flow should reflect your product positioning and business priorities:

- Growth-focused products: If your priority is rapid growth, implement progressive onboarding or tiered verification. According to Userpilot, companies deploying progressive onboarding had up to 50% more users reaching activation milestones than those requiring all info up front.

- Security-driven brands: In fintech and crypto, 81% of consumers said visible security checks boosted their willingness to complete signup and transact.

- Case in point: Online casino operator Gana777 improved conversion rates by moving from a manual, slow process to automated ID verification—reducing average account approval from days to less than a minute and boosting successful signups by over 40%.

Action: Define your KPIs before tuning your onboarding. Is your objective activation, compliance, or retention? Map steps accordingly.

3. Simplify and clarify every step

Every action or field is a chance for friction. According to the Baymard Institute, complex sign-up flows increase abandonment by up to 30%.

- Audit and eliminate: Remove non-essential fields. Veriff found that adding simple tooltips explaining why each piece of data is needed cut abandonment rates by 20%.

- Break it down: Data from HelpScout shows splitting onboarding into logical steps, each with a visible progress indicator, increases completion by 12%.

- Automate when possible: Using document scanning and autofill can accelerate completion by 70%. EMD, a digital music distributor, slashed its ID verification time from 2–3 days to under one minute by adopting automated verification.

- Plain language always: Jargon confuses and repels. Platforms using clear, friendly language on sign-up screens saw an 18% improvement in completion (InnerTrends).

Pro tip: Regularly test and iterate on your flow. Watch real users complete onboarding to uncover hidden friction.

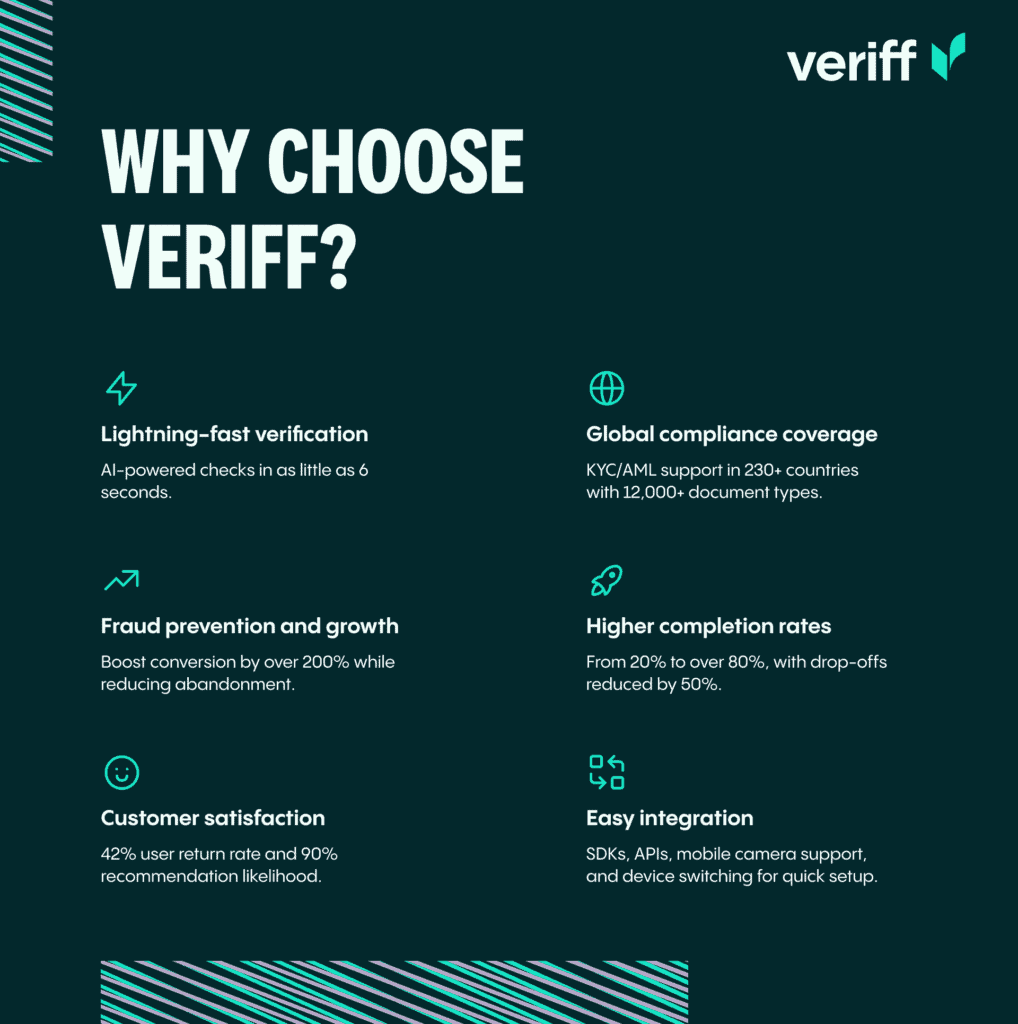

How Veriff transforms customer onboarding

The right technology provides both the guardrails for compliance and the frictionless experience users demand.

- Lightning-fast verification: Veriff’s AI-driven platform automates ID checks in as little as 6 seconds. This is over 10x faster than manual review processes, dramatically reducing the window where users may get distracted and drop off.

- Global compliance coverage: Veriff helps platforms stay compliant with KYC/AML regulations in 190+ countries, allowing brands to confidently scale across borders and support over 11,000 types of identity documents.

- Razor-sharp fraud prevention: One fintech saw fraud rates fall below 1% post-Veriff integration, protecting both financials and reputation.

- Higher completion and activation: Across industries, clients have seen onboarding completion rates leap from 20% to over 80%, and reduction in drop-off rates by up to 50% (Veriff customer data).

- Customer satisfaction and support: Companies using Veriff often report up to 42% customer return rates after a frictionless experience, and a 90% likelihood of users recommending the service after a strong onboarding.

- Seamless workflow integration: SDKs, APIs, mobile camera compatibility, and device switching let you integrate world-class onboarding without starting from scratch.

- ROI in action: Juancho Te Presta, a leading fintech in Latin America, reduced incomplete verifications by almost half and eliminated nearly all fraud by integrating Veriff—including video analysis for added transparency.

Actionable insights: Next steps for optimizing your flow

- Gather user feedback: Incorporate real-time surveys or analytics to pinpoint frustrations and confusion.

- A/B test incrementally: Experiment with removing or rearranging steps, and measure impact on conversion.

- Educate your users: Brief, human explanations for data requests or verification steps can build trust and minimize resistance.

- Mobile optimize: With 78% of users starting onboarding on mobile devices (Gartner), ensure your workflow is mobile-first.

- Monitor and adapt: Analyze onboarding funnels monthly to detect shifts in drop-off and tune your approach accordingly.

Onboarding as your competitive edge

A best-in-class onboarding experience does more than check legal boxes—it sets the tone for a loyal, engaged user base and positions your company for scalable growth. By understanding your audience, segmenting risk, simplifying processes, and deploying technology like Veriff, you can confidently bring more high-value, genuine customers onto your platform.

Remember, the onboarding experience is your brand’s handshake with every new customer—make sure it’s a strong one.

In summary, seamless and secure onboarding is the cornerstone of customer retention and business growth. By prioritizing a frictionless experience, you not only increase activation rates but also build lasting trust with your users, turning first-time signups into long-term advocates for your brand.

Ready to streamline your onboarding and boost conversion? Download the Veriff Onboarding Tool Kit and start building frictionless, compliant user journeys today.