IDV Article

The future of digital trust in Asia: five trends to watch in 2026

Asia’s digital economy is growing rapidly, reshaping banking, shopping, and connections. With surging digital payments and mobile commerce, digital trust is now key for businesses to thrive.

The digital landscape in Asia is expanding at an unprecedented rate. From banking and commerce to daily communication, billions of people now rely on digital platforms. This rapid transformation has made digital trust the most critical asset for businesses, governments, and consumers alike. Understanding the forces shaping this trust is essential for any stakeholder operating in the region—and for anyone preparing for the future of digital trust in asia.

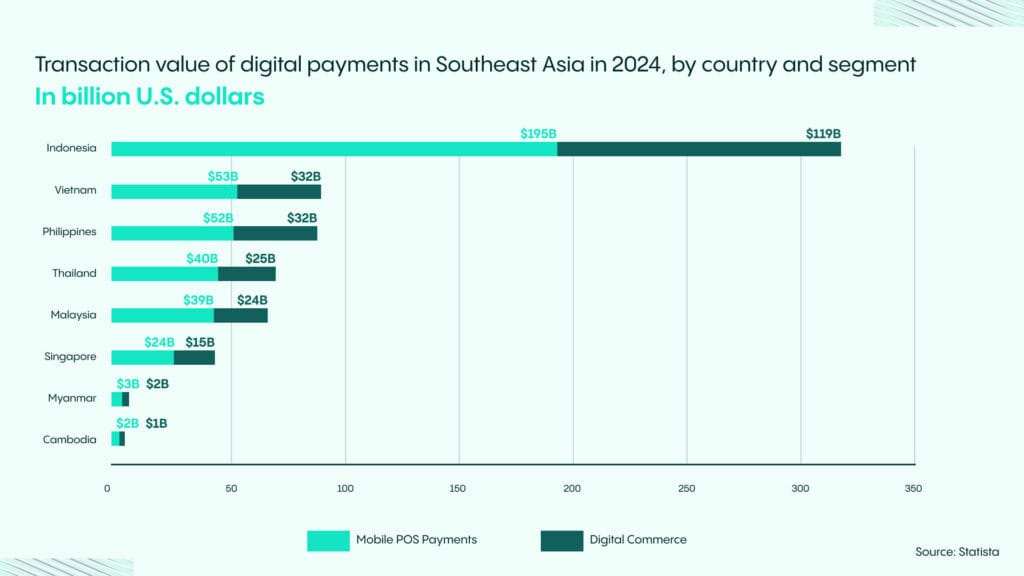

The growth of digital payments highlights this shift. In 2024 alone, Southeast Asia’s digital payment transaction value is massive, with Indonesia leading at over $313 billion. This boom is fueled not only by the rapid expansion of digital commerce and mobile payments but also by the way consumers in the region are reshaping their shopping habits. Hybrid shopping, where users seamlessly blend online and offline experiences, is now a defining feature across the Asia-Pacific. Mobile commerce dominates, with most consumers in markets like Indonesia and Thailand using their phones to discover and complete purchases. Social-driven commerce is also on the rise, and platforms such as Shopee, TikTok, and Instagram have become essential not only for entertainment and connection, but also as entry points for shopping and product discovery.

In Southeast Asia, consumers often begin their purchasing journey online, research products on social media, and validate sellers through reviews and influencer recommendations before making decisions. Live shopping events, influencer-driven campaigns, and instant checkout experiences are normalizing a new, more interactive path to purchase. This highly connected, social, and mobile-first approach further underscores the urgency of building secure and trustworthy digital systems.

This post will explore five pivotal trends that are set to redefine digital trust across Asia, offering insights for executives, investors, and policymakers navigating this dynamic environment.

1. Embedded IDV becomes standard in superapps

Superapps have become the primary gateway to the digital world for millions across Asia. These all-in-one platforms for messaging, payments, shopping, and services are now integrating identity verification (IDV) directly into their ecosystems. This shift from standalone verification processes to embedded, seamless checks is profoundly changing user expectations and security standards.

By integrating IDV, superapps can offer a more secure and frictionless user experience. Onboarding becomes faster, transactions are better protected, and access to sensitive services like lending or investing is streamlined. For users, this means verifying their identity once to gain trusted access across a wide array of services. For businesses on the platform, it reduces fraud and increases customer confidence.

We expect this trend to accelerate in 2026. Superapps will leverage biometric data, document verification, and behavioral analytics to create a continuous and passive authentication environment. The result will be a digital ecosystem where trust is established and maintained with minimal user effort, making embedded IDV a core competitive advantage.

Equally important are the ways social media and live commerce transform how consumers interact with digital payments and brands in Southeast Asia. Social platforms like TikTok, Instagram, and Shopee have emerged as key entry points for product discovery, purchase decisions, and payment activities. Live commerce events—where influencers demonstrate products in real time, and viewers can purchase instantly—foster new transparency and engagement. This highly interactive and social path to purchase not only fuels transaction growth but also increases demands for greater digital trust and robust identity verification, as consumers expect seamless yet secure experiences at every step.

This is especially crucial in markets like Indonesia and the Philippines, where mobile POS payments and digital commerce represent a transaction value of over $313 billion and $83 billion, respectively, showing a deep integration of digital payments into daily life.

2. The rise of regional data sovereignty laws

Data is the lifeblood of the digital economy, and Asian governments are increasingly asserting control over how it is stored, processed, and shared. Inspired by regulations such as Europe’s GDPR, countries across the region are enacting stringent data sovereignty and data localization laws. These policies mandate that citizen data must be stored within a country’s physical borders, posing a major challenge for multinational corporations.

Concerns over national security, citizen privacy, and economic protectionism drive this legislative wave. For businesses, navigating this fragmented regulatory landscape is becoming a primary operational hurdle. Companies must now invest in local data centers, re-architect their cloud infrastructure, and develop compliance strategies that vary from country to country. Failure to comply can lead to substantial fines and reputational damage.

Looking ahead, organizations must adopt a “multi-local” strategy. This involves building flexible and resilient data management frameworks that can adapt to different national requirements. The era of a one-size-fits-all approach to data governance in Asia is over.

3. Decentralized identity gains traction

The concept of a self-sovereign, decentralized identity is moving from theory to practice. In this model, individuals, not corporations or governments, control their own digital identities. Using blockchain and other distributed ledger technologies, users can manage their own credentials and share only the necessary information for a specific transaction without relying on a central authority.

While still in its early stages, decentralized identity offers a compelling solution to many trust issues plaguing the digital world. It can reduce large-scale data breaches, give users greater control over their personal information, and simplify identity verification across different platforms. For example, a user could prove they are over 18 without revealing their exact birth date.

By 2026, we anticipate more pilot programs and niche applications of decentralized identity, particularly in sectors where privacy and security are paramount, such as healthcare and finance. While widespread adoption will take time, its foundational principles will start to influence how businesses and governments think about identity management.

4. The intensifying AI-driven fraud arms race

As the technologies for verifying identity become more sophisticated, so do the methods used by fraudsters. The next frontier in this ongoing battle is artificial intelligence. Malicious actors are now leveraging AI to create highly convincing deepfakes, synthetic identities, and automated bots to carry out fraud at a massive scale. These attacks are harder to detect and can bypass traditional security measures.

The stakes are incredibly high, especially when considering the volume of money moving through digital channels. With countries like Vietnam and Thailand processing over $85 billion and $64 billion in digital payments, the financial incentive for fraudsters is immense. The sheer scale of mobile point-of-sale transactions makes these platforms a prime target for sophisticated, AI-driven attacks.

At the same time, AI is proving crucial in not only combating fraud but also building consumer trust across e-commerce markets in Asia-Pacific. Research shows nearly half of APAC consumers are already satisfied with AI-powered product recommendations, suggesting that intelligently implemented AI can enhance both the security and personal relevance of online shopping journeys. From personalized suggestions to real-time threat monitoring, AI-driven features help platforms deliver safer, more transparent, and more satisfying experiences. For businesses, leveraging AI is becoming a necessity, not just to outpace fraudsters but to meet rising consumer expectations for security, personalization, and seamless service within rapidly evolving digital ecosystems.

In response, organizations are deploying their own AI-powered defenses. Machine learning algorithms can now analyze vast datasets in real-time to detect anomalous patterns, identify sophisticated fraud rings, and predict emerging threats. This AI arms race creates a dynamic and rapidly evolving security environment where the advantage can shift in an instant. Staying ahead requires continuous investment in advanced AI and machine learning capabilities.

5. Privacy-enhancing technologies (PETs) emerge

Balancing data utility with user privacy is one of the most significant challenges in the digital age. Privacy-Enhancing Technologies (PETs) offer a path forward by enabling organizations to derive insights from data without exposing sensitive personal information. Technologies like homomorphic encryption, zero-knowledge proofs, and federated learning allow data analysis on encrypted or distributed datasets.

For example, a group of hospitals could collaborate to train a medical diagnostic AI model on their combined patient data, without any hospital having to share its raw, sensitive patient records. This allows valuable collaboration while preserving strict privacy and compliance. This is particularly relevant for markets with high per-capita digital spending, like Singapore, where consumer expectations for privacy are sophisticated.

As data regulations tighten and consumer awareness of privacy grows, the demand for PETs will increase significantly. By 2026, we expect PETs to become a key component of enterprise data strategies in Asia. They will enable businesses to unlock the value of their data for analytics and AI while building trust with customers and navigating complex regulatory requirements.

Consumer trends in APAC clearly show that trust is a top priority, especially when it comes to sharing personal information online. A significant share of shoppers across the region express concerns about privacy, data collection, and how their information is used in digital transactions, particularly within social and mobile commerce. PETs therefore, play a critical role in addressing these risks, supporting consumer confidence by providing greater transparency and assurance around data use. Brands and platforms that prioritize these technologies are better positioned to earn and retain customer trust in an environment where privacy expectations and regulatory scrutiny continue to rise.

Conclusion: Navigating the new landscape of trust

The future of digital trust in Asia will be shaped by the interplay of technology, regulation, and user expectations. The trends we’ve discussed: embedded IDV, data sovereignty, decentralized identity, the AI arms race, and PETs, are not isolated phenomena. They are interconnected forces that will require a holistic and forward-looking strategy from all stakeholders.

The massive flow of digital payments across Southeast Asia is a clear indicator that trust is no longer an abstract concept, but a tangible economic driver. For executives and investors, these trends signal where to direct resources and what capabilities to build. For policymakers, they highlight the need for balanced regulations that foster innovation while protecting citizens. Success in Asia’s digital future will depend on the ability to build, maintain, and adapt trust in a complex and rapidly changing environment. The time to prepare for 2026 is now.