IDV Article

Real-time deepfake fraud in 2025: Fighting back against AI-driven scams

In 2025, AI-powered scams are evolving fast, with 1 in 20 ID verification failures now linked to deepfakes. Fraudsters are using generative tools to manipulate live video, forge documents, and bypass verification systems. Ira Bondar explores how this threat is reshaping fraud—and what businesses can do to stay ahead.

Online fraud is scaling faster than ever and so are the risks to enterprise reputation, compliance, and customer trust. According to Veriff’s 2025 Identity Fraud Report, global fraud attempts grew by 21% year-over-year, with deepfake attacks now driving 1 in every 20 identity verification (IDV) failures. Deepfakes aren’t just a novelty: they’re a direct threat to business credibility.

Synthetic videos are increasingly exploited by bad actors to engage in different types of fraud, starting with seemingly harmless free trials or bonus abuse and ending with payment fraud. This evolving threat undermines consumer trust and poses significant risks to the integrity of services.

This new reality is reshaping how fraud is executed—and how it must be fought. At the center of this transformation is generative AI, the powerful force that redefines both offense and defense in the world of digital identity. Let’s dive in to learn more.

The fraud game has changed: generative AI is everywhere

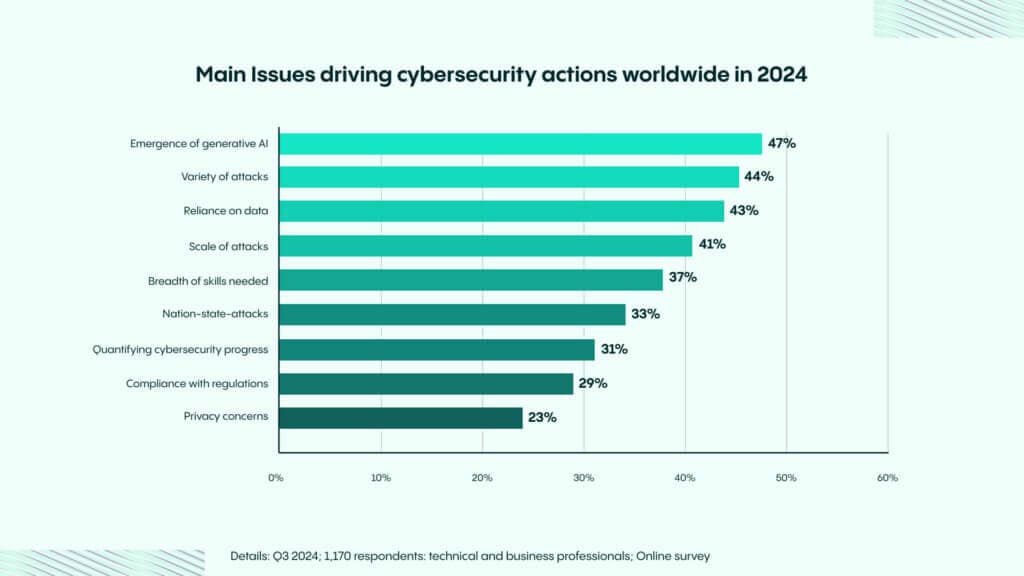

Generative AI has quickly evolved from a creative novelty into a disruptive force across industries. In cybersecurity, it’s a double-edged sword: capable of detecting threats at unprecedented speed but also enabling fraud on a scale never seen before.

Fraudsters are now using AI to forge hyper-realistic identity documents: driver’s licenses, residency cards, even synthetic government IDs that can fool even advanced verification systems. These aren’t your typical manually edited fakes. With tools like GPT-4o and other generative models, creating convincing fake IDs is as easy as typing a prompt, no Photoshop required. As noted in an earlier blog, these sophisticated forgeries are already surfacing online, calling into question the reliability of static and even semi-dynamic identity verification methods. These deepfaked documents mark a dangerous evolution in identity fraud: one that no business can afford to ignore. This democratization of fraud means anyone with access to generative AI can become a threat actor.

The rise of real-time deepfake fraud

Real-time deepfakes go beyond static deception

Unlike pre-rendered synthetic videos, real-time deepfakes allow fraudsters to actively impersonate individuals during live interactions: from romantic scams to bypassing Know Your Customer (KYC) verifications. This evolution marks a dangerous shift as attackers are no longer relying on rehearsed scripts. They’re improvising, manipulating, and adapting in real-time to bypass biometric checks and deceive both humans and automated systems.

Real-world examples show alarming sophistication

Investigative reporting from 404 Media reveals a chilling reality: scammers now use generative AI tools like DeepFaceLive, Magicam, and Amigo AI to alter their face, voice, gender, and race during live video calls. This means a fraudster can mimic a government-issued ID, then instantly match their manipulated appearance on camera, thus deceiving systems that rely on photo-to-selfie comparisons or liveness checks.

In one case, a scammer used deepfake software and a ring light to impersonate an elderly man during a video call, convincing a woman to send money. Behind the real-time avatar was a much younger individual with a completely different appearance.

These aren’t isolated incidents. Cybersecurity firms like SentiLink and Reality Defender confirm that real-time deepfake attacks are now actively targeting onboarding systems in sectors like banking, fintech, and crypto.

The implications: Verification is no longer about what’s shown — but what’s real

Identity verification methods that rely solely on visual checks, such as basic photo-matching or passive liveness detection, are increasingly vulnerable to today’s AI-driven fraud tactics. While these approaches are still valuable, they are no longer sufficient on their own. Even trained human reviewers can be deceived when faced with hyper-realistic fakes and convincing behavioral cues during video interactions. This evolving threat landscape calls for more advanced, multi-layered identity verification strategies that integrate AI and dynamic risk assessment.

This is why Veriff’s multi-layered approach is built not just on static checks, but also on behavioral biometrics, device analytics, and live anomaly detection. Our FaceCheck Liveness feature, for example, uses movement cues and contextual signals that are extremely difficult for AI-generated personas to replicate in real-time.

Fighting real-time fraud with real-time defenses

To address this new fraud frontier, Veriff’s future-proof framework includes:

- AI-powered liveness detection trained on adversarial samples

- Behavioral anomaly detection to flag unusual user-device interaction patterns

- Fraud detection using link analysis (Crosslinks) to identify repeat attackers using synthetic identities

- Human-in-the-loop systems for critical decisions, especially in high-risk cases

As these threats evolve, we evolve faster. Our data shows a 46% YoY increase in adversary-in-the-middle attacks — many of them real-time deepfakes — which we now proactively detect and flag before they reach your customers.

Strategic takeaway for enterprises

If your fraud strategy still targets outdated threats like forged documents, static images, or isolated biometric mismatches, it’s already falling behind. Today’s real-time deepfakes demand real-time defense, adaptive systems, and infrastructure built with regulations in mind.

Don’t get fooled by what you see.

Talk to our fraud prevention team about how to stay ahead of real-time deepfakes — and read the full Veriff Identity Fraud Report 2025 for case studies and technical insights.

Where fraud hits hardest: Lessons from the frontline

Veriff CEO Kaarel Kotkas highlights the importance of education and AI-driven strategies in combating the growing threat of deepfakes. These manipulated images, videos, or audio clips can depict business leaders making false statements or engaging in harmful acts, damaging reputations, and deceiving consumers. To counter this, companies must educate employees and customers on recognizing deepfakes while adopting a multilayered defense approach. Leveraging AI and biometrics is essential to detect manipulated content and identify fraudsters behind it.

Veriff’s identity verification solutions have delivered measurable results for clients worldwide. For example, Webull significantly reduced fraud and chargebacks by integrating biometric screening into its onboarding process. In Latin America, Kueski successfully combined seamless user experiences with scalable fraud prevention. Veriff’s technology has also enabled fintechs in the region to efficiently onboard unbanked populations, even in areas with low smartphone penetration.

As Salvador Briseño from Kueski remarked, “We needed a partner that could offer robust fraud prevention without compromising user experience. Veriff struck the perfect balance.”

Crown Agents Bank streamlined its onboarding process by transitioning from manual KYC to 90% digital onboarding. Sam Murrant, Head of Financial Crime Risk & MLRO, stated, “Veriff has been critical to our digital-first strategy. The time savings have been a game changer.”

In the Philippines, JTI strengthened age verification to restrict youth access while achieving a 223% increase in customer conversions. These success stories underscore how digital identity verification drives compliance, supports business growth, and fosters financial inclusion globally.

These aren’t just results—they’re validations of Veriff’s enterprise-grade scalability and fraud accuracy.

Building a future-proof fraud defense framework

As AI capabilities grow, fraud-as-a-service will become more sophisticated. Veriff is investing in a future-proof model to stay ahead:

- AI-powered liveness detection

- Biometric and behavioral anomaly mapping

- CrossLinks + RiskScore = 360º fraud visibility

- Fraud Protect Suite: Integrates ML insights and expert oversight

This ensures alignment with your board’s strategic imperatives—from regulatory readiness to growth enablement.

Executive takeaway: Trust is a competitive advantage

Regulators are judging your enterprise, investors, and users on how effectively you manage digital identity risks. Deepfakes and AI-generated fraud are not temporary threats. They’re the new normal. In this evolving digital economy, trust has become the ultimate currency.

At Veriff, we believe trust is not optional, it’s foundational. The most innovative and forward-thinking organizations treat trust as infrastructure: not just verifying identity but reinforcing confidence at every touchpoint, from onboarding to authentication.

Veriff helps you meet this challenge head-on. Our AI-powered, regulation-aligned, and reputation-safe identity verification systems are designed to scale with your growth. Whether you’re combating fraud, fulfilling compliance requirements, or expanding globally, Veriff provides the technology and insight to ensure that your users are real, reliable, and secure.

“We are building the infrastructure for trust online—so you can focus on growth, not fraud.”

— Ira Bondar, Fraud Platform Lead, Veriff

By choosing Veriff, you’re not just investing in a product: you’re joining a movement to restore trust in a digital world that’s lost its way. You’re signaling to the world that your business prioritizes integrity, safety, and long-term relationships over short-term gains.

Veriff recognized in industry analysis for leading deepfake detection capabilities

Veriff’s position at the forefront of real-time deepfake defense is further validated by Acuity Market Intelligence’s latest publication, the Biometric Digital Identity Deepfake and Synthetic Identity Prism Report. In this in-depth, independent evaluation of the Identity Proofing & Verification (IDV) landscape, Veriff ranked among the highest-performing vendors, our inclusion demonstrates the credibility and maturity of Veriff’s AI-powered fraud prevention technologies. Our strong performance across multiple evaluation pillars highlights our leadership in detecting synthetic identities, preventing deepfake abuse, and delivering scalable, enterprise-grade IDV solutions. You can download the full report here to explore how Veriff compares in-depth.