Fraud Article

Beyond borders: How APAC marketplaces can conquer cross-border fraud

Borders define countries — but they shouldn’t define opportunity. In today’s digital economy, businesses expand faster than ever, reaching customers across continents in seconds. Yet with global growth comes complexity: regulations, fraud risks, and identity challenges that don’t stop at the border. Here’s how companies can navigate it all with confidence.

The Asia-Pacific (APAC) region has emerged as a global powerhouse for digital marketplaces. Millions of buyers and sellers connect across borders in dynamic, fast-growing economies every day. From Singapore to Sydney and Tokyo to Jakarta, the APAC cross-border marketplace landscape is as diverse as its people. However, with this unprecedented growth comes a significant shadow: the rising tide of cross-border fraud.

As your platform expands throughout APAC, you face a delicate balance. You must drive seamless onboarding to capture new opportunities while simultaneously protecting your marketplace from sophisticated fraudsters who capitalize on regional complexities.

Fragmented regulations, highly varied identity document types, and evolving fraud tactics can create friction. These obstacles slow down growth and threaten your platform’s reputation. In this post, we examine the unique cross-border fraud challenges for APAC marketplaces. We will look at the hard data behind rising threats, from bot attacks to synthetic identities, and show how adaptive trust infrastructure helps platforms thrive across every market.

Get your free access to the report

Explore the latest insights into digital fraud trends with the Future of Payments Report.

The unique challenges of cross-border fraud in APAC

Expanding across APAC isn’t just about supporting multiple languages or payment methods. Each country brings its own risks and requirements, stretching your operations and testing your platform’s integrity.

Navigating a complex regulatory patchwork

Regulations in APAC are far from uniform. Marketplaces must navigate a maze of local laws that change frequently.

- Singapore: Robust data protection under the PDPA requires strict handling of user data.

- Australia: Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) requirements demand rigorous checks.

- India: Stringent KYC mandates (like Aadhaar verification) are non-negotiable for many digital services.

Keeping pace with changing regulations in China, Indonesia, Vietnam, and beyond is daunting. Non-compliance leads to serious business risks and hefty fines. You need a system that adapts to these nuances, balancing compliance with the smooth user experiences your customers expect.

Verifying identities across borders

APAC boasts a staggering variety of identity documents. You might encounter Aadhaar cards in India, MyKad in Malaysia, National ID cards in Thailand, and passports from across the region.

Furthermore, many countries still have significant unbanked populations. This complicates reliable user verification because traditional credit bureau data is often missing. Rigid or manual verification systems struggle to keep up with this diversity. The result is often high drop-off rates and frustration for legitimate users. In a region where your next power-user could come from anywhere, inability to verify diverse IDs is a direct threat to revenue.

Facing APAC-specific fraud patterns: The data

Fraudsters in APAC are both inventive and adaptive. They use regional nuances to their advantage, employing scams that range from account takeovers to large-scale automated attacks. Recent data paints a concerning picture of the threat landscape.

The rise of synthetic identities

One of the most alarming trends is the explosion of synthetic fraud. According to FutureCISO, the APAC region has seen a 142% surge in synthetic data fraud. This isn’t just about stolen IDs; it involves fraudsters combining real and fake information to create entirely new, non-existent identities. These “Frankenstein” IDs are used to onboard onto platforms, build credit or trust scores, and then vanish after defrauding the marketplace.

Scams and mule accounts

Trust is the currency of any marketplace, but it is under attack. A recent FICO survey reveals that 7 in 10 APAC bank leaders now consider scams and mule accounts their dominant fraud concern.

Fraud rings often recruit “mules”, sometimes unwitting individuals, to create legitimate-looking accounts that are actually controlled by criminals. These accounts act as conduits for laundering money from illegal goods sold on your platform.

Complex cross-border schemes

The complexity of scams is also escalating. Chainalysis has reported on the rise of “pig butchering” scams—long-con investment frauds often run by syndicates in Southeast Asia. These schemes rely on building deep trust with victims over time before draining their assets.

For marketplaces, this highlights the risk of social engineering. Fraudsters are not just hacking accounts; they are manipulating users. Cross-border e-commerce heightens the risk, as fraud rings operate via loopholes found in less mature regulatory environments or exploit differences between local and international standards.

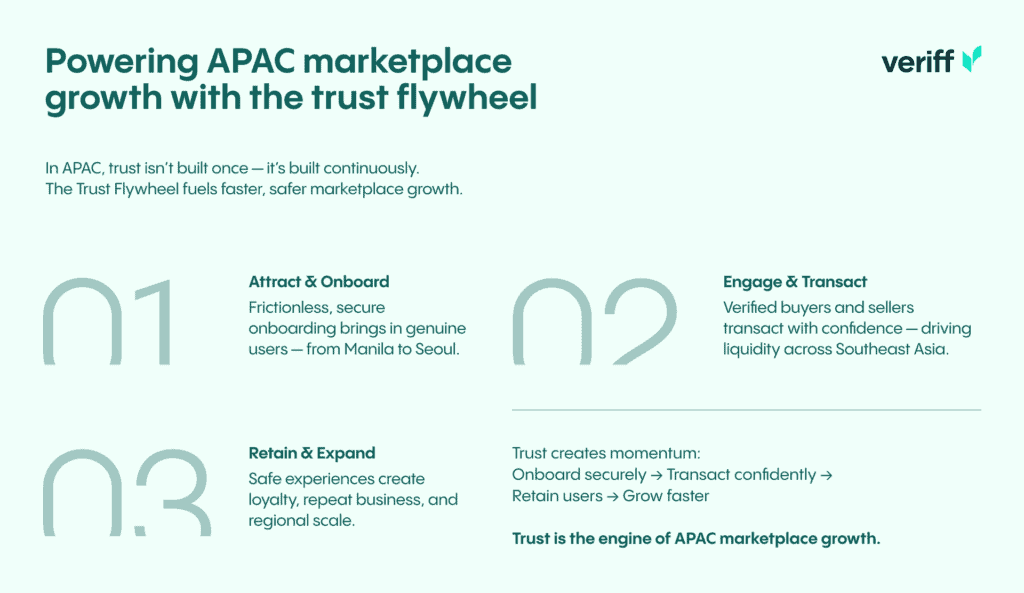

Powering APAC Marketplace Growth with the Trust Flywheel

To succeed across APAC, trust-building must be continuous, not a one-off event. This is where the concept of a “Trust Flywheel” becomes essential. By embedding trust, speed, and safety into every step of the user journey, APAC marketplaces can create the momentum needed for growth and sustainability.

Attract & Onboard

Your goal is to draw in diverse earners and spenders, from freelancers in Manila to cross-border buyers in Seoul. However, you cannot sacrifice security for speed. Frictionless and secure onboarding maximizes conversion, welcoming genuine users fast, no matter which APAC country they call home.

Engage & Transact

Users need confidence when sending remittances from Vietnam, booking homestays in Bali, or trading goods throughout Southeast Asia. Verified users interact with trust. When buyers know sellers are verified, transactions flow, and marketplace liquidity grows.

Retain & Expand

A safe environment drives repeat business. When APAC users feel protected from scams like those mentioned above, they are more likely to stay, transact frequently, and become advocates. This loyalty helps your platform expand from local to regional and, ultimately, global scales.

Users need confidence when sending remittances from Vietnam, booking homestays in Bali, or trading goods throughout Southeast Asia. Verified users interact with trust. When buyers know sellers are verified, transactions flow, and marketplace liquidity grows.

Building progressive trust with adaptive infrastructure

In APAC’s fast-changing environment, trust-building is a journey. APAC marketplaces must flex with the region’s demands: rapid onboarding upfront, followed by advanced checks at key lifecycle moments. This is progressive trust, confidence that deepens as users engage further.

Veriff’s unified, AI-powered solution is tailor-made for these needs. Instead of point solutions cobbled together for each country, you get a single platform to protect both sides of the marketplace and accelerate regional growth.

Adaptive workflows for diversity

Veriff’s adaptive workflows detect and offer the best verification method based on who the user is and where they are based. Consider these scenarios:

- A gig worker onboarding from Thailand.

- A luxury goods seller based in Singapore.

- A new buyer registering from Australia.

Whether matching a cross-border selfie to a Japanese residence card or verifying an Indonesian passport, the process remains seamless. This supports APAC’s world-leading digital adoption rates without opening the door to fraudsters.

Get your free access to the report

Explore the latest insights into digital fraud trends with the Future of Payments Report.

Next-gen defense for unique regional threats

To handle APAC’s sophisticated fraud landscape, you need defenses that evolve faster than the attackers.

Combatting bot attacks

Automated attacks are a massive issue in the region. Research from Akamai indicates that financial services in APAC faced 10.5 billion AI bot attacks recently. These bots attempt to effect account takeovers, scrape data, or spam listings. Veriff analyzes thousands of behavioral and device signals to distinguish between a legitimate human user and a bot script.

Deepfake detection

With the rise of generative AI, deepfakes are becoming a standard tool for criminals. Veriff’s AI catches the latest generative attacks, crucial as APAC becomes a global hub for tech-savvy fraudsters.

CrossLinking for organized crime

To spot repeat offenders and organized fraud rings, you need to see connections others miss. CrossLinking technology identifies accounts sharing devices or behavioral patterns, which is vital for stopping the mule accounts identified in the FICO survey.

Continuous trust and lifecycle integrity

Onboarding is just the beginning. APAC users expect seamless experiences but with high security throughout their journey.

- Biometric Authentication: Securely re-verify users at cash-out, booking, or high-value transaction moments. This is ideal for APAC e-wallets and digital travel services where account integrity is paramount.

- Continuous Authentication: Ensure only verified account holders, not account takeovers or bots, remain active. This tackles problems common in large, multilingual APAC marketplaces where manual review is impossible at scale.

- Re-verification: Trigger extra checks in response to suspicious activity, from spam listings to unusual device changes.

With this comprehensive lifecycle approach, your APAC marketplace shifts from chasing fraudsters to building proactive, resilient trust.

Accelerate your APAC growth — Securely

Cross-border fraud is one of the biggest challenges for APAC digital marketplaces. But it is also the key to unlocking explosive growth if managed right. The data from Chargebacks911 and others shows a clear trend: fraud is increasing, but so is the opportunity for platforms that can secure their perimeter.

By moving beyond fragmented point solutions and adopting an end-to-end trust and verification platform, you gain:

- Enhanced compliance across APAC’s regulatory mosaic.

- Seamless onboarding for users from anywhere in the region.

- Operational efficiency and scalable growth.

- Powerful defense against emerging threats like synthetic IDs and AI bots.

Veriff’s partnership with digital leaders demonstrates a commitment to secure, borderless growth in even the most complex markets.

Get your free access to the report

Explore the latest insights into digital fraud trends with the Future of Payments Report.