Fraud Article

California data privacy trends & compliance action points for financial services

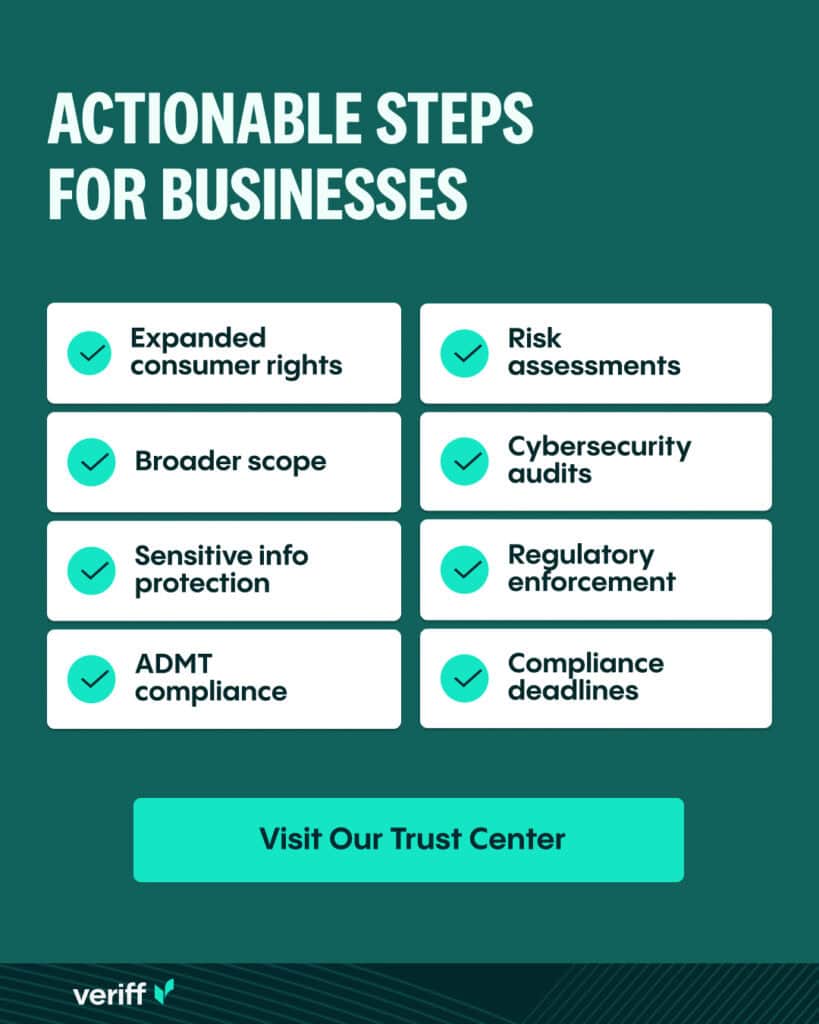

This blog outlines key trends in California’s evolving privacy landscape and offers actionable steps to help your organization safeguard consumer data, maintain compliance, and build trust with clients.

California’s data privacy laws, particularly the California Consumer Privacy Act (CCPA) and its amendment, the California Privacy Rights Act (CPRA), are transforming how businesses, including in the financial services sector, handle personal data.

Financial services (FinServ) firms must be prepared to comply with these regulations, as they manage sensitive consumer data such as account information, credit histories, transaction records but also Social Security numbers and data used for their customer’s authentication.

Here are key trends and practical action points to help financial services organizations stay compliant with these evolving laws.

1. Expanded consumer rights

California residents have the right to:

- Opt out of the sale of their personal information.

- Request corrections to inaccurate personal data.

- Limit the use and disclosure of sensitive information, including financial records and Social Security numbers.

Action Point:

Implement a data request portal where consumers can easily exercise these rights. This portal should allow users to opt out of data sales, request corrections, and limit data usage.

Ensure requests are “verifiable,” confirming the consumer making the request is the one whose data is being processed.

2. Broader scope for businesses

Businesses subject to these laws include those with:

- Over $25 million in annual revenue.

- Selling or sharing the personal data of 100,000 or more California residents.

- Deriving more than 50% of their annual revenue from selling consumer data.

Action Point:

Audit your data collection and sharing practices. Track the volume of personal information your business handles to determine if it falls under CCPA/CPRA requirements.

Remember, California regulates both selling (for monetary or other valuable consideration) and sharing (even without monetary exchange). Ensure third-party data processor relationships are compliant.

3. Sensitive personal information and data protection

CCPA explicitly defines sensitive data to include mail, email, text messages, Social Security numbers, identification documents, and financial account data. Financial services firms, which handle large amounts of such sensitive information, must ensure its protection.

Action Point:

Enhance your data security measures, keeping California’s broad scope of sensitive data in mind. Invest in encryption, anonymization, and data minimization techniques to safeguard consumer data.

Limit the use of sensitive data unless essential for business operations, and ensure consumers can control how their sensitive data is used.

4. Automated Decision-Making Technology (ADMT)

The CPPA has introduced stricter regulations on the use of ADMT, particularly when it replaces or significantly influences human judgment. Businesses must:

- Allow consumers to opt out of ADMT usage for significant decisions.

- Ensure human reviewers can understand, evaluate, and override ADMT outputs.

Action Point:

Audit your use of ADMT to ensure compliance. Implement clear opt-out mechanisms and train personnel to manage ADMT processes effectively.

5. Mandatory risk assessments

Businesses engaging in activities like selling or sharing personal information, processing sensitive data, or using ADMT must conduct detailed risk assessments. These assessments should:

- Identify risks associated with data processing activities.

- Document and address compliance gaps.

Action Point:

Develop a robust framework for conducting and documenting risk assessments. Regularly review and update these assessments to align with evolving regulations.

6. Annual cybersecurity audits

The CPPA now requires annual cybersecurity audits conducted by qualified professionals. These audits must:

- Assess compliance with data security measures, including encryption, access controls, and incident response.

- Provide detailed reports and remediation plans for any identified gaps.

Action Point:

Engage qualified auditors to evaluate your cybersecurity program. Maintain detailed records of audits and remediation efforts for at least five years.

7. Regulatory enforcement

California is unique in its regulatory approach, with both the California Attorney General and the California Privacy Protection Agency (CPPA) enforcing privacy laws. Non-compliance can result in significant penalties.

Action Point:

Conduct regular compliance assessments to ensure adherence to CCPA and CPRA. Respond promptly to consumer requests and continuously improve privacy practices.

Consider appointing a Data Protection Officer (DPO) or a dedicated data privacy team to manage compliance efforts effectively.

8. Compliance deadlines

- ADMT compliance: January 1, 2027.

- Risk assessments: December 31, 2027.

- Cybersecurity audits: Staggered deadlines based on annual revenue, starting April 1, 2028.

Conclusion: Preparing for continuous evolution

For financial services firms, compliance with the CCPA and CPRA is not just about ticking boxes—it’s about ensuring data transparency, enhancing consumer trust, and staying ahead of regulatory changes. With the California Privacy Protection Agency taking a lead in enforcement, it’s essential to implement these practical steps now to avoid penalties and ensure seamless data privacy compliance.

For further information, explore these resources:

- California CCPA overview

- California CPRA overview

- Bloomberg Law insights on California privacy laws

- ADP’s guide to the California Privacy Rights Act

By taking action now, financial service companies can safeguard sensitive information, build trust with consumers, and maintain compliance with California’s data privacy laws.

Stay Ahead of Data Privacy Compliance!

With evolving data privacy regulations, financial service providers must stay informed and compliant. Read our latest blog on U.S. Data Privacy Protection to learn how to protect consumer information and stay legal.