Fraud Article

AI tax scams: A growing threat in 2026

Last month, with the 2026 tax season on the horizon, there was a noticeable surge in tax-related fraud perpetrated by AI-powered cybercriminals.

Tax season often brings a mix of urgency and stress—conditions that fraudsters actively exploit through ai tax scams. And the scale of the threat is no longer theoretical. According to the IRS Criminal Investigation (IRS-CI) Fiscal Year 2025 Annual Report, investigators identified $10.59 billion in financial crimes, a 15.7% increase year over year, with tax fraud alone surging by more than 111%. These figures underscore just how aggressively criminals are targeting taxpayers and financial systems alike.

As we move into 2026, artificial intelligence (AI) has pushed tax rebate scams to unprecedented levels. Today’s fraud schemes are faster, more adaptive, and far more convincing, leveraging AI to generate realistic communications, impersonate trusted institutions, and scale attacks across thousands of victims at once. The IRS-CI itself reported a nearly 60% increase in cases with a cyber component, highlighting how digital and financial crimes are rapidly converging.

Understanding how these scams operate is the first step in protecting yourself and your organization. This article explores the mechanics of AI-driven tax fraud, highlights key warning signs, and examines advanced, intelligence-led solutions designed to help you stay secure in an era where financial crime is evolving faster than ever.

What are AI-powered tax rebate scams?

While tax rebate scams are not new, the integration of AI has made them significantly more dangerous. Fraudsters now use AI to impersonate tax authorities like the IRS in the United States or HMRC in the UK, tricking victims into sharing personal data such as Social Security numbers or bank account details under the guise of a tax refund or rebate.

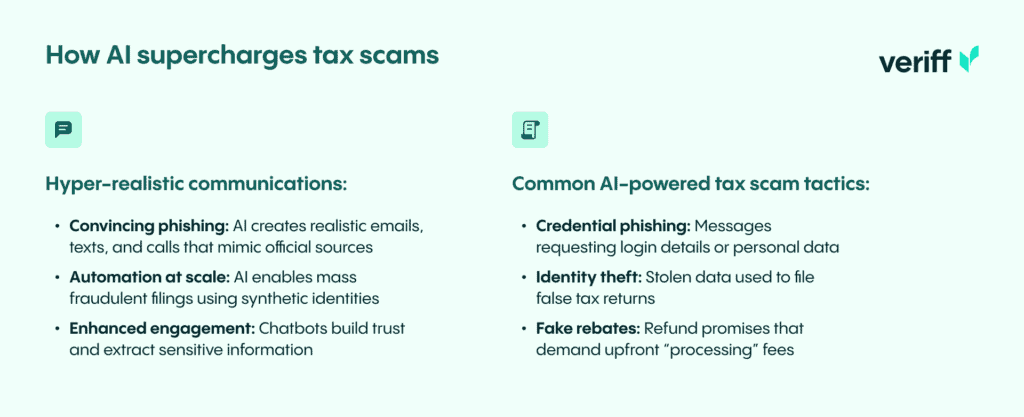

AI enhances these scams in several ways:

- Hyper-realistic communications: Generative AI creates phishing emails, text messages, and even voice calls that closely mimic official correspondence, complete with authentic logos, language, and formatting.

- Automation at scale: AI enables scammers to generate synthetic identities and automate fraudulent tax filings, allowing them to target thousands of victims with minimal effort.

- Enhanced engagement: AI-powered chatbots interact with victims in real time, answering questions and building trust to extract sensitive information more effectively.

These scams manifest in various forms, including phishing for credentials, identity theft to file fake returns, and fraudulent tax rebate offers requiring upfront fees.

Regional threats: The US and UK

Tax authorities in both the United States and the United Kingdom are actively warning citizens about the surge in fraudulent activity, particularly around tax filing deadlines.

United States

The IRS has reported a sharp increase in AI-driven scams. Fraudsters use tactics like fake IRS notices and AI-generated voice phishing to create urgency and manipulate victims. The IRS emphasizes that it will never initiate contact via email, text, or social media to request personal or financial information. Any such unsolicited communication is a major red flag.

United Kingdom

HMRC faces similar challenges, especially around the January 31 Self Assessment deadline. Between November 2023 and October 2024, HMRC received nearly 150,000 scam reports, with about half related to fake tax rebate claims. Scammers often use phishing emails and texts, threatening penalties to pressure individuals into acting quickly.

How to identify and prevent tax-related fraud

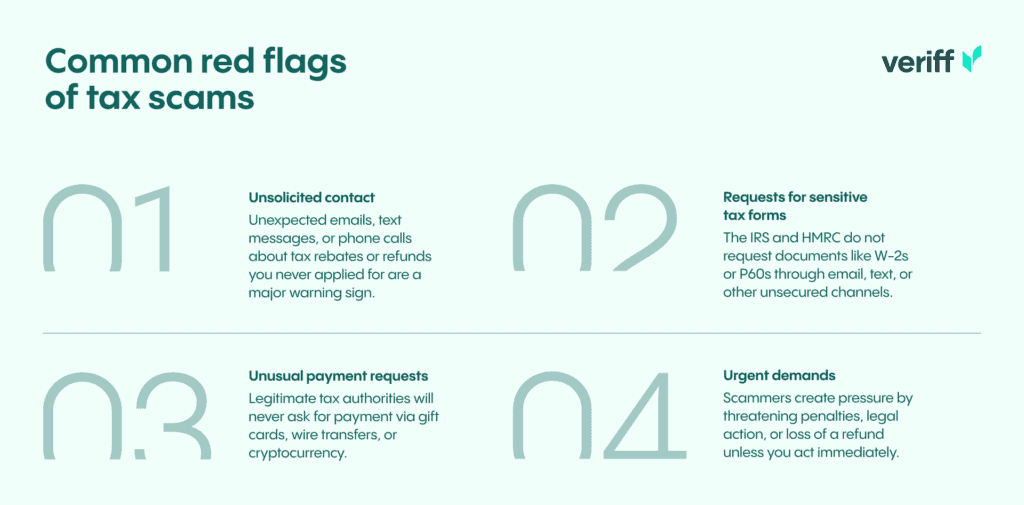

Awareness is your first line of defense. Both individuals and businesses should be vigilant for common red flags that signal a potential scam.

Common red flags

- Unsolicited contact: Be cautious of unexpected emails, texts, or calls about tax rebates or refunds you didn’t apply for.

- Urgent demands: Scammers often pressure victims to act immediately, threatening legal action or loss of a refund.

- Unusual payment methods: Legitimate tax agencies will never request payment via gift cards, wire transfers, or cryptocurrency.

- Requests for tax forms: Agencies like the IRS and HMRC do not request sensitive forms like W-2s or P60s through unsecured channels.

For businesses, particularly financial institutions, the challenge is twofold: protecting customers while ensuring regulatory compliance. The sophistication of AI-driven scams requires more than manual oversight—it demands advanced technological solutions.

The role of advanced fraud prevention

Combating AI-driven fraud requires equally advanced tools. Identity verification (IDV) platforms like Veriff provide critical support in this fight. As a trusted partner for fintech, crypto, and financial services companies, Veriff offers a robust infrastructure to establish trust in the digital world.

How Veriff helps combat tax scams

- Phishing scams: Veriff’s biometric authentication adds a powerful layer of security. Even if scammers obtain a password and multi-factor authentication code, they are stopped when the system requires a live biometric match.

- Identity theft: Veriff cross-references historical data associated with an identity to detect misuse, ensuring the person presenting an identity document is its true owner.

- Fake rebate offers: Veriff’s velocity abuse detection identifies and shuts down multi-accounting attempts, limiting the number of fraudulent claims from a single source.

By deploying these capabilities, businesses can safeguard their systems, protect their customers, and maintain trust in an increasingly risky environment.

Get your free access to the report

Explore the latest insights into digital fraud trends with the Future of Payments Report.

How Veriff can help?

Navigating the future of fraud prevention with advanced biometric solutions

In an era where digital advancements rapidly evolve, the threat landscape shifts with equal velocity, presenting intricate challenges in online security and fraud prevention. Veriff stands at the forefront of combating these threats through innovative real-time remote biometric identification solutions, leveraging the cutting-edge capabilities of artificial intelligence (AI) and machine learning.

The AI-driven approach to biometric identification

Our commitment to enhancing the security framework for businesses and organizations worldwide is underscored by our continuous development in AI and machine learning technologies. These advancements significantly amplify our identification processes’ speed, safety, and efficiency. Operating on a global scale requires a deep understanding of the varied legal environments, and our robust legal teams are adept at navigating these complexities.

Combatting deepfakes and AI-generated media

With the emergence of deepfake technology and AI-generated media, the risk of impersonation fraud has escalated. Veriff addresses this burgeoning threat with a comprehensive strategy that includes our advanced FaceCheck Liveness technology. This solution utilizes sophisticated algorithms designed to validate genuine human presence without necessitating any user action, effectively mitigating the risk of digital manipulation.

Further enhancing our security measures, DocCheck and DeviceCheck play pivotal roles in authenticating documents and analyzing data points from devices, respectively. These checks are essential in detecting anomalies that may indicate fraudulent activities, such as synthetic identities and multi-accounting.

Real-time fraud detection with CrossLinks

Our CrossLinks technology underscores our capability to uncover and combat complex fraud patterns in real time. By analyzing connections between different verification sessions, CrossLinks can identify potential fraud rings and synthetic identities, significantly bolstering our fraud detection mechanisms.

Introducing Fraud Protect and Fraud Intelligence

The introduction of our Fraud Protect package marks a significant milestone in our mission to safeguard organizations from various facets of online fraud. It is designed to protect businesses during the IDV process while minimizing friction for genuine users, and includes various checks ensuring we onboard trustworthy users. It also includes Velocity Abuse Prevention, which is tailored to deter velocity abuse and multi-accounting, thus maintaining the integrity of processes such as electoral voting.

Our RiskScore, integrated in Veriff’s Fraud Intelligence, offers a comprehensive insight into risks associated with users, allowing organizations to incorporate valuable risk intelligence into their decision-making processes. This advanced approach empowers organizations to build sophisticated counter-fraud strategies and conduct thorough investigations when necessary.