Trust starts with the global leader in identity verification

Veriff verifies identities by analyzing 1,000+ signals per session, stopping fraud while enabling global digital growth

Trust without

compromise

Protect your organization while accelerating growth. Secure users without killing conversion, and meet every compliance standard with speed and accuracy.

Performance at scale

230+

Countries and territories covered95%

Pass rate6s

Fast decision times12.5K+

Government documents coveredAI-powered architecture,

built for trust

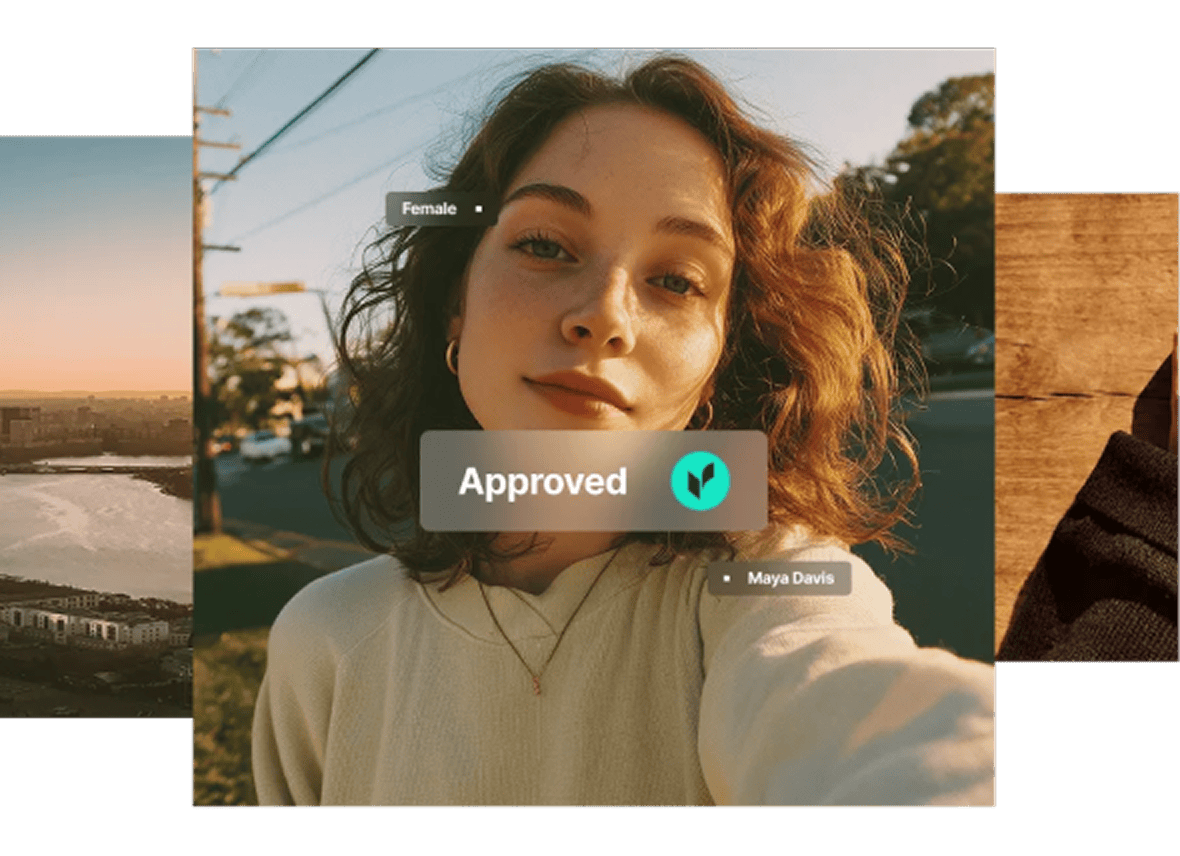

Identity Verification

AI-powered identity and document checks to confirm users worldwide, supporting millions of IDs while reducing fraud, compliance risk, and onboarding friction.

Biometric Verification

Facial biometrics and passive liveness detect users in seconds, matching them to IDs or templates for secure, frictionless authentication.

Fraud Prevention

Machine learning and behavioral signals detect impersonation and anomalies in real time, stopping fraud while validating real customers.

Know Your Business

Validate businesses worldwide with access to global registries and corporate records, reducing fraud, ensuring compliance, and streamlining onboarding at scale.

Reduce Fraud

Neutralize threats before they scale

Give your business an intelligent shield that is continuously learning. Learns fast so you can grow faster. With document forensics, liveness cues, and behavioral signals built into your workflow, you can instantly block deepfakes and coordinated attacks in real-time.

Ship fast

Integration without friction

With clean APIs, pre-built SDKs, and comprehensive documentation for seamless integration, your team gets a smooth path from sandbox to production. Plus, we’re here to support you every step of the way.

Boost Conversion

Turn barriers into bridges

Transform identity verification into a seamless user experience—with automated, real-time feedback loops high-intent customers are guided through the process in seconds, not minutes.

Ensure Compliance

Global standards. Local assurance.

By automating KYC and AML checks across 230+ countries, we simplify global regulatory hurdles so you can stay audit-ready and compliant without adding manual overhead or slowing your momentum.

Global reach for local compliance

Scale with confidence with a platform that respects local compliance and risk

requirements in 230+ countries and territories, 48+ languages, and across

all major regulatory frameworks.

Click on a country to see the supported documents