How AML Screening works

Take a look at how AML screening works with Veriff’s Identity Verification solution.

Ensure that your customers are who they say they are and fight identity fraud with Veriff’s powerful identity verification platform. With superior document fraud detection and user experience, you don’t have to compromise between strong fraud prevention and high customer conversion rates.

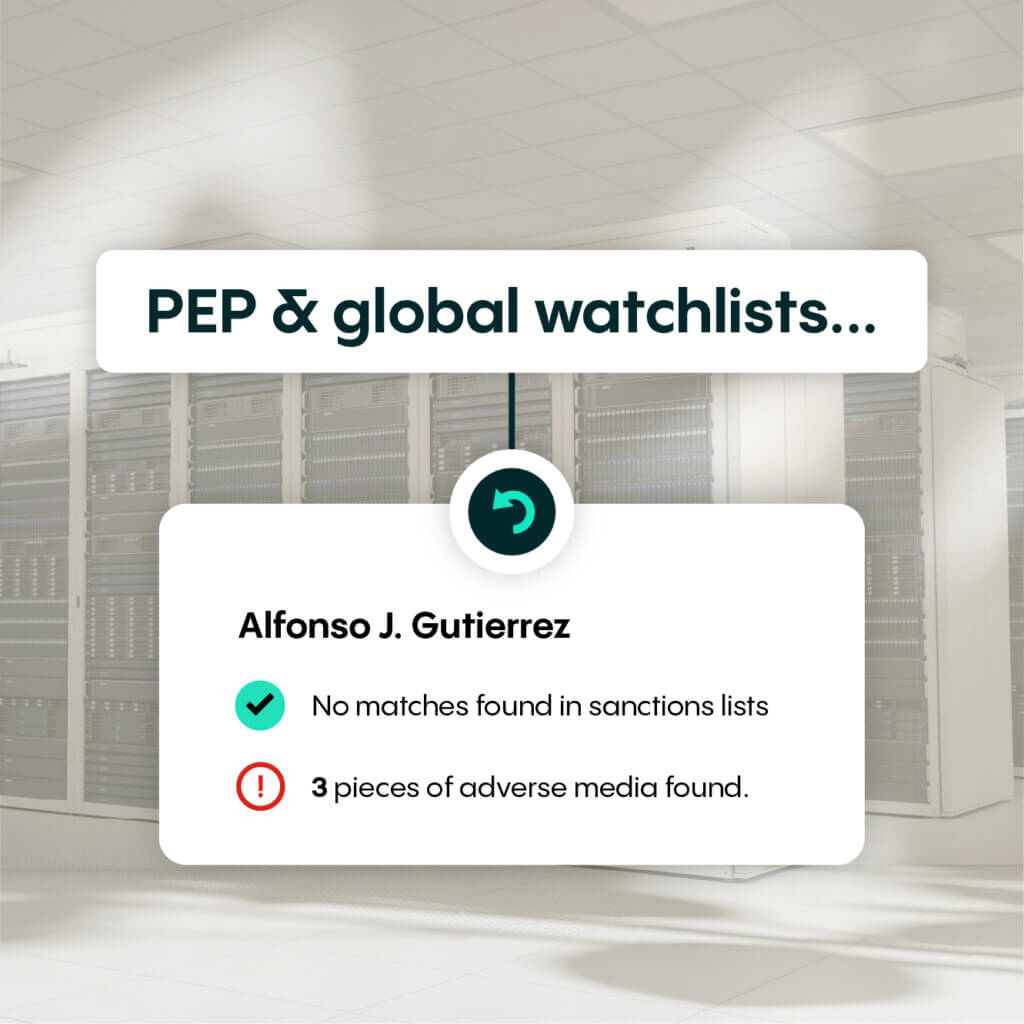

Comply with regulations and fight financial crime by screening users against global PEP and sanctions watchlists. Veriff’s list coverage is updated in real-time, bolstering confidence in your KYC process.

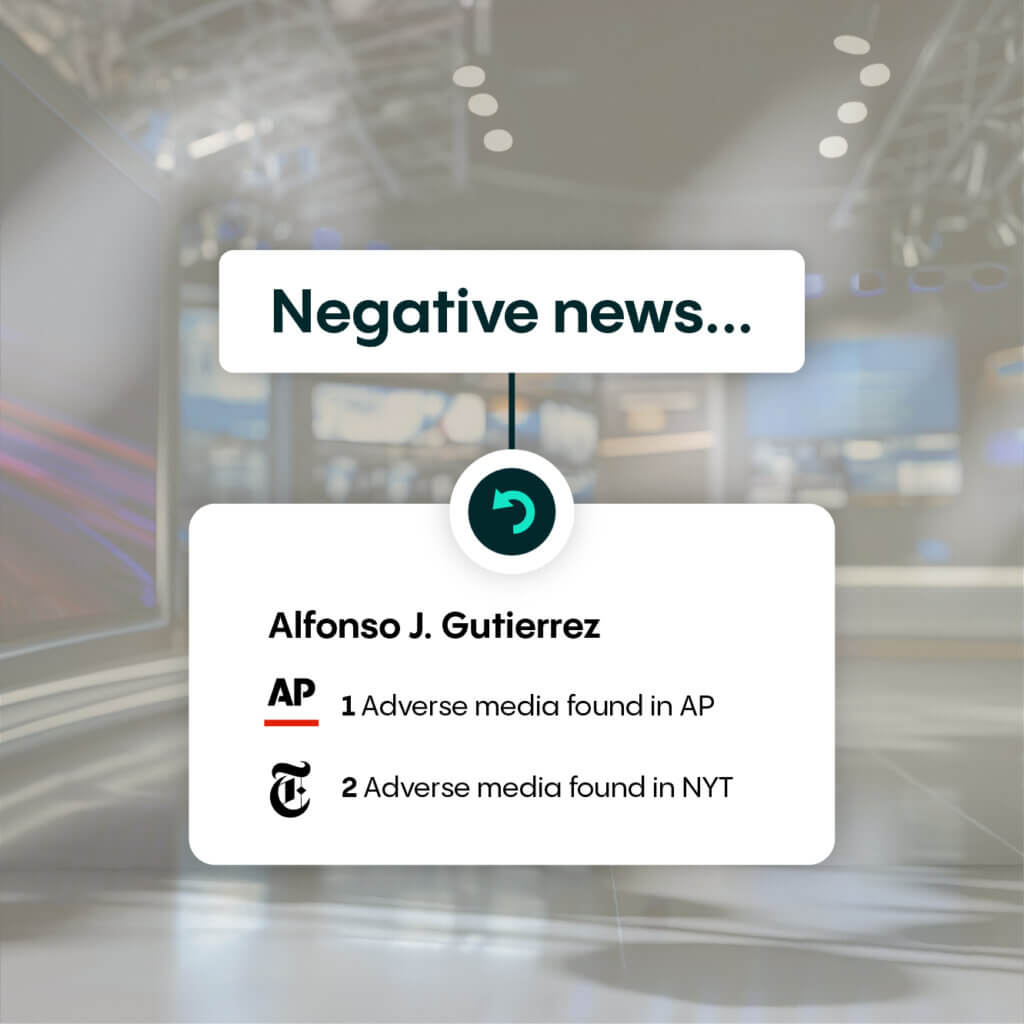

Even peripheral connection to crimes can indicate risk. Veriff screens for negative information and news to help businesses assess the potential risk exposure presented by their customers.

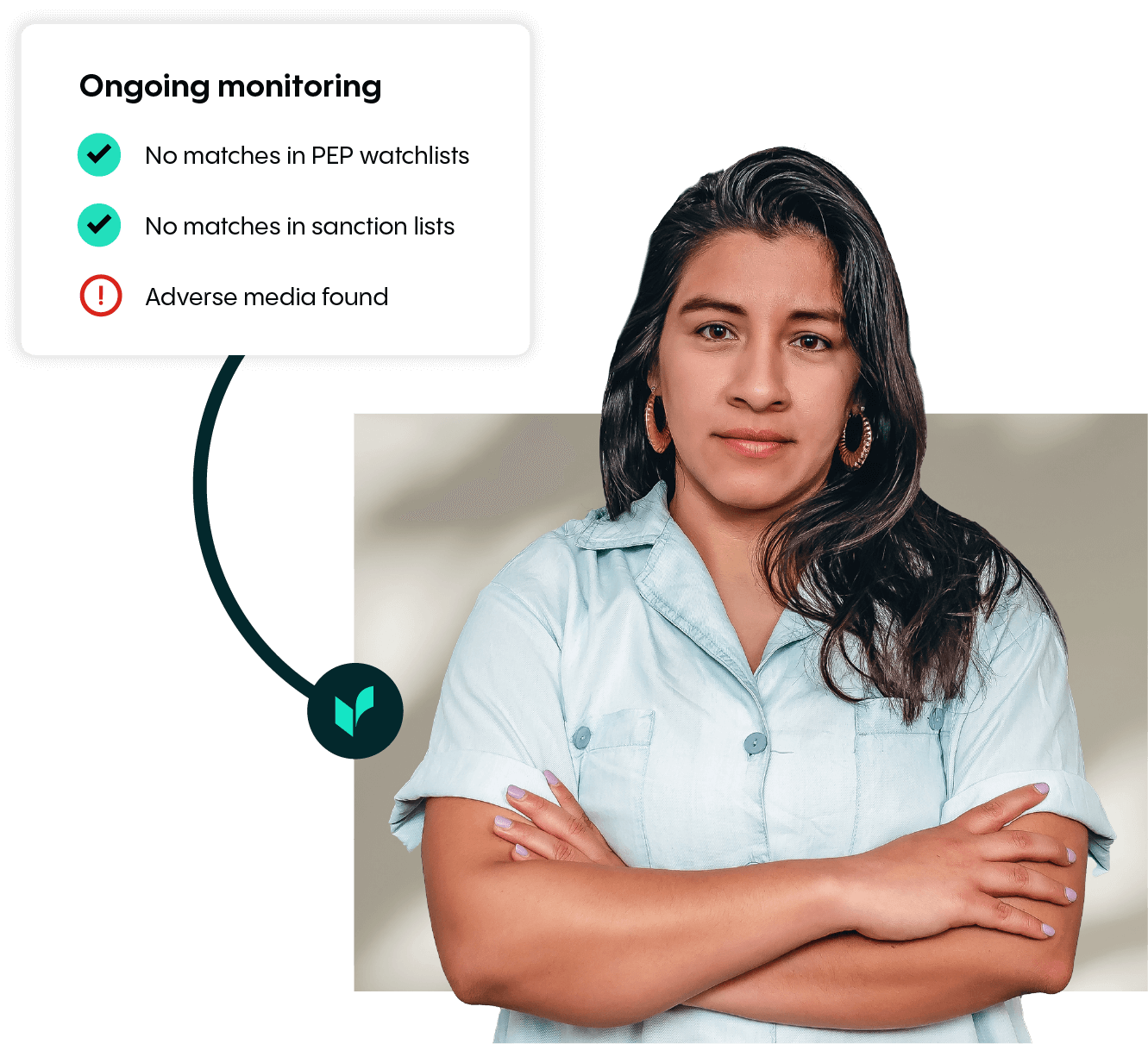

Political and regulatory environments change very quickly. With real-time data, continuously screen customer lists with Veriff’s ongoing monitoring of PEP watchlists, global sanctions lists, and adverse media. Automated screening notifies you if something changes with your existing or previously onboarded customers.

Customers around the world trust Veriff

Featured resources

Get the Veriff Identity Fraud Report 2025

Our 2025 report shares the insights our expert fraud team has discovered on the front line of fighting fraud — giving you the tools to protect your business and keep you ahead of the fraudsters.

Don’t compromise

Automate your AML screening with Veriff and create a user journey that gets you more genuine customers.

Get in touch to get started.