news

Veriff Identity Fraud Report 2026: Online fraud continues to rise, hitting e-commerce and financial services hardest

Impersonation scams lead as fraudsters shift to more sophisticated tactics.

New York – November 11, 2025 – Online fraud is climbing at a rapid pace, with e-commerce and financial services platforms facing the most significant impact, according to Veriff’s newly released Identity Fraud Report 2026. Impersonation remains the most common type of fraud, as criminals adopt increasingly advanced techniques and move away from methods that are easier to detect.

In late September, European Union authorities opened formal inquiries into Google, Microsoft, Apple, and Booking.com under the Digital Services Act, seeking details on how the companies are preventing fraud on their platforms. The action highlights the scale of the problem: online scams – from deepfake videos of public figures promoting fake investments to fraudulent banking apps and bogus hotel listings – are estimated to cost EU residents more than €4 billion ($4.7 billion) each year.

Veriff’s report found that about one in every 25 online identity verification attempts now involves someone attempting to pose as another person.

“Across industries, online fraud attempts are clearly continuing their sharp upward trajectory, with our latest findings coming on the heels of two consecutive years of 20 percent increases,” says Ira Bondar-Mucci, Fraud Platform Lead at Veriff. “In addition, we’re seeing a clear trend of fraudsters deploying increasingly sophisticated attack methods as they move away from older techniques that are now more conspicuous.”

Online fraud attempts are clearly continuing their sharp upward trajectory, with our latest findings coming on the heels of two consecutive years of 20 percent increases.

Key fraud trends and types

- Impersonation fraud dominance: Highlighting that impersonation fraud is the most common type, accounting for over 85 percent of all online fraud attempts, and noting that AI helps automate this at an industrial scale.

- Emerging attack methods: Discussing the rise of Emulator attacks (simulating legitimate devices to bypass security) and Injection attacks (injecting false/synthetic data into the verification flow).

- Traditional vs. authorized fraud: Noting that document fraud has dropped by 13 percent, while authorized fraud (where the user is tricked into performing a session/providing credentials) remains low.

Impact across industries and niches

- E-commerce marketplace crisis: Highlighting that this niche was the most severely impacted, with a net fraud rate of 19.2 percent (nearly five times the global average) and seeing more than 10 times the global average of authorized fraud.

- Financial services: Detailing that the net fraud rate exceeded 5.5 percent of all online identity verification attempts, with crypto and lending platforms leading the growth with a 38 percent year-over-year increase.

- Other high-risk platforms: Mentioning the massive increases seen in the gig economy and mobility platforms.

- Non-financial targets: Noting that video gaming sites and social media platforms have net fraud rates more than double the global average, and explaining their role as early digital touchpoints for building rapport before a fraudster attempts a financial crime.

Explore key fraud statistics, regulatory shifts, and actionable recommendations from Veriff’s new report.

Geographic and technological shifts

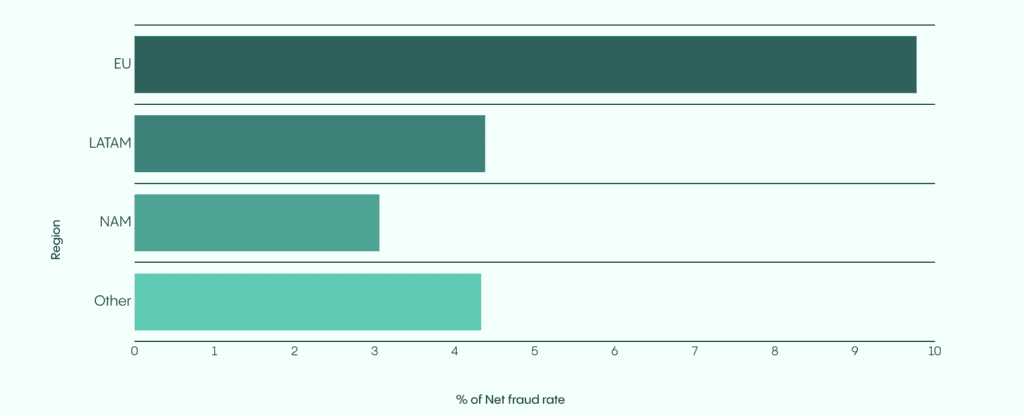

- Regional comparison: Detailing that North America and Latin America rates remained relatively consistent, while the annual mean fraud rate in the EU and UK has increased by nearly 2.3 times, with a cautionary note that this may be due to newly measured activity following greater adoption of anti-fraud solutions.

- AI as an accelerator: Dedicating a point to the growth of AI-powered fraud, noting that digitally presented media was 300 percent more likely to be entirely AI-generated or altered compared to the previous year.

Percentage of all verification attempts that were fraudulent in 2025 by region

“The fraud landscape today shows just how aggressive and adaptable bad actors have become – and no platform can afford to let its guard down,” Ira said. “We welcome the EU’s push under the DSA to hold major tech companies to a higher standard, but strong, modern identity verification must be a priority for every online platform, not just the biggest ones.”

The fraud landscape today shows just how aggressive and adaptable bad actors have become – and no platform can afford to let its guard down.

About Veriff

Veriff is a global identity verification platform helping businesses build trust online. Our AI-native technology combines automation and human expertise to quickly and accurately verify users worldwide with minimal friction. Trusted by leading companies like Blockchain, Bolt, Deel, Monzo, Starship, Trustpilot, and Webull across finance, marketplaces, mobility, gaming, and other industries. Our trust infrastructure helps businesses stay compliant, prevent fraud, protect users, and scale globally, enabling a safer, more transparent internet for everyone.