Fraud Article

From losses to lessons: Assessing the full spectrum of the cost of fraud

Discover the hidden costs of online fraud in our comprehensive article. Unveil the staggering numbers behind fraud losses and explore the emerging threats businesses face. With insights from industry experts, learn how to fortify your defenses against evolving fraud tactics.

Fraud studies of financial services firms show that the overall cost of fraud is high: some believe that many organizations are losing around 7% of their annual turnover because of the crime. However, businesses and customers alike face a number of other threats and costs.

Acts of fraud cost consumers around the world billions of dollars every year, with a growing threat from criminals online and via social media. Freshly unveiled data from the Federal Trade Commission reveals that consumers experienced fraud losses surpassing $10 billion in 2023, a milestone never before reached. This represents a 14% uptick in reported losses compared to the figures from 2022 However, the dangers go beyond financial consequences alone. So what is the true cost of fraud – and how can businesses prevent it?

1. What is fraud?

Fraud occurs when someone uses deceitful tactics to illegally or unethically make a gain at the expense of someone else. The process involves the false representation of facts, whether by withholding information or providing false statements to gain something that would not have been provided without the deception.

Talk to us

Talk to us to learn how Veriff can help your gaming business fight fraud and comply with identity verification requirements.

2. What are the key fraud trends?

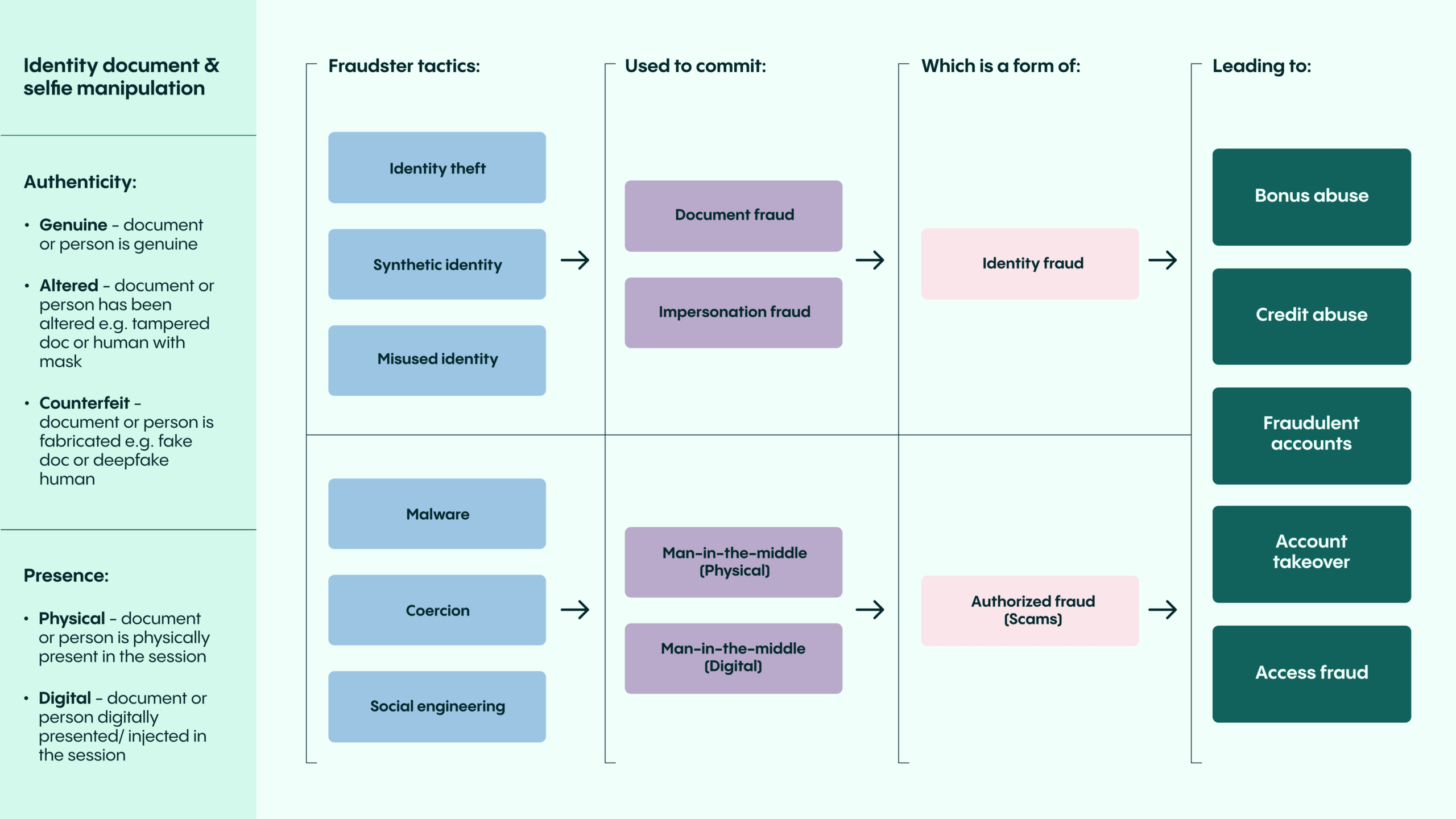

In the world of finance, fraud can take many different forms. Common types of online fraud and tactics include:

- New account fraud/ Application fraud

- Account takeover fraud

- Impersonation fraud

- Phishing scams

- Social engineering

- Authorized push payments

- Deepfakes

- Synthetic fraud and document tampering

3. What is the cost of fraud?

So, how are businesses and individuals affected by fraud? Of course, the precise figures depend on the vertical involved, among other factors. For example, financial institutions could face different challenges to other sectors, such as gaming. But data suggests a serious threat to the bottom line.

Research conducted for PayPal by the Ponemon Institute found that surveyed organizations lost an average of $3.7 million annually due to fraudulent transactions online.

That’s trouble for consumers, too. According to the US Federal Trade Commission (FTC), there were $8.8 billion in total reported losses from fraud in 2022, compared with $6.1 billion in 2021. This is despite fewer fraud reports: 2.4 million in 2022, versus 2.9 million in the previous year.

While imposter scams lead the way, online shopping scams are second on the list. Meanwhile, according to the data by the Federal Trade Commission, losses via social media platforms were a worrying $1.2 billion.

4. The cost of fraud to the business?

The consequences of fraud aren’t purely financial. For example, if you allow a fraudster to access a customer’s account and use it, then your business will also suffer a great deal of reputational damage.

On top of this, you may also be fined by regulators for not keeping a customer’s data safe. It’s therefore vital that your business follows the correct reporting requirements, such as FCA fraud reporting PSD2 in the UK and Federal Trade Commission (FTC) reporting requirements in the US.

Finally, you must consider that other teams in your organization will also come under strain due to fraud. For instance, hacks and security issues must be investigated by your IT team, while your customer support team will likely be overwhelmed by customer journey-related requests. Meanwhile, your finance team must fight costly chargebacks on top of doing their usual tasks.

5. To the customer

When faced with the distressing realization of being a victim of fraud, customers are primarily concerned about the possibility of recovering their funds and ensuring their safety from future occurrences. Of course, a customer´s main concern when they find that they’ve been a victim of fraud is whether they can get any of their money back through chargebacks. However, customers also face other threats.

For example, if their account has been compromised, a hacker has also gained access to this customer’s sensitive and private information. Using this information, they can attempt to hack into the customer’s other accounts. The customer must, therefore, attempt to secure each account they own and ensure no others have been compromised. This can be a stressful and time-consuming process.

6. How has the pandemic affected fraud and cybercrime?

During the pandemic, many financial services and lending companies moved their operations online. Although this increased convenience for customers, it also provided fraudsters with an opportunity to exploit weaknesses in new systems.

This uptick in digital processes has directly led to an increase in fraud. When compared with pre-pandemic rates, the rate of identity fraud cases has increased by 41%.

7. What are the emerging fraud threats for 2024?

The ways in which fraudsters are attacking businesses are constantly evolving. From account takeover to synthetic identity fraud, and replay attacks to advanced biometric fraud, fraudsters continue reinvent their approach.

In the coming years, it’s widely expected that the level of threat posed by fraudsters will continue to rise. Based on findings from an Experian study, approximately 70% of businesses have observed a rise in fraud losses in recent times. At the same time, more than half of consumers perceive themselves as increasingly vulnerable to fraud compared to a year ago.

Here are three of the main fraud threats you need to know for 2024:

Generative AI

The widespread adoption of generative AI has empowered fraudsters to accelerate their illicit activities. fraudsters are increasingly utilizing generative AI to produce convincing deepfake content, including emails, voice recordings, and videos, as well as creating fraudulent websites and orchestrating online attacks. Moreover, there’s a growing concern that generative AI will be employed for social engineering schemes, fabricating “proof of life” scenarios using stolen identities on social media. Companies may need to implement advanced, multilayered fraud prevention solutions that leverage AI technologies to counter these evolving threats.

Rise of Synthetic Identities

During the pandemic, fraudsters created synthetic identities, which remained dormant initially but now pose a heightened risk. Experian forecasts that these dormant synthetic identities, equipped with a few years of history, will enable fraudsters to evade detection more effectively. Consequently, there’s a looming threat of fraudsters exploiting these accounts to siphon funds, necessitating closer collaboration between businesses and fraud-prevention partners to identify and mitigate synthetic identity fraud.

Authorized fraud

These are scams where a user is deceived into authorizing a transaction: for example, the fraudster might pretend to represent your financial institution to trick you into making a verification attempt. It saw a dramatic – and worrying – rise over the year, with a 40% expansion in the fourth quarter. In total, it made up about 1.15% of attempted verifications. Common examples include elderly people being tricked into sharing financial information to remove a virus from their computer.

Get the global picture of the current fraud landscape drawn from our cross-industry work across all regions over the last year. With the most insightful data, opinions, and analysis from our world-renowned fraud experts and tips to help you stay ahead of the fraudsters in 2024, the Veriff Fraud Report 2024 is a must-read.

8. How can Veriff help prevent fraud?

As the methods employed by criminals become more sophisticated, businesses must take every possible precaution in the fight against fraud. One of the best approaches is to employ the use of technology.

Here at Veriff, we’ve created a number of powerful solutions that can help businesses fight successful fraud and ensure regulatory compliance. For example, our online identity verification solution can help you verify users and ensure each customer is exactly who they claim to be. We check the user’s facial biometrics, along with their document, for any signs of tampering or manipulation and their device and network information.

Additionally, our biometric authentication solution can help your business to provide an instant, easy-to-use, and secure authentication method. Biometrics are a vital tool in the fight against fraud, using a person’s physical characteristics – such as a facial scan – to confirm they are who they claim to be.

Biometrics can help you secure customer accounts and prevent account takeover, by ensuring a person is the legitimate account holder. Identities can be verified in as little as one second, and the solution is 100% automated.

Technology is key to the fight against fraud. Veriff embraces cutting-edge advances in different technologies to protect organizations and their customers. Our Fraud Protect product uses machine learning-powered checks, advanced fraud network mitigation strategies, and a team of highly trained experts to help protect against fraudsters.

Meanwhile, our Fraud Intelligence suite provides enriched insights and a consolidated RiskScore, providing detailed insights during the identity verification process and enabling actionable, risk-related intelligence and insights.

9. Veriff and Vantage: uncovering the true cost of fraud

Vantage Recreational Finance is a financial solutions company founded in 2012, serving the US domestic marine and recreational vehicle (RV) industry. Vantage facilitates safe and convenient purchases by connecting consumers with suitable lenders based on their financial profiles. It aims to make the process comfortable with low rates, extended terms, and fast credit decisions. However, Vantage faced a significant challenge when fraudsters targeted the company using stolen identities, highlighting the industry’s vulnerability to fraud.

To address this issue, Vantage sought a low-friction customer identity verification solution. They chose Veriff, impressed by its seamless integration into their operations and the positive feedback from their senior team members who tested the solution. Veriff’s implementation proved successful, effectively preventing fraud exceeding $750,000 and safeguarding Vantage’s reputation. The integration also streamlined the verification process, enhancing customer confidence and protecting everyone’s interests.

10. What other best practices can I implement to protect myself from becoming a victim of fraud?

Verifying a customer’s identity before you allow them to access their account or place an order is the best way to prevent fraud. However, there are also other best practices that you should look to follow.

For example, rather than using passwords and one-time passcodes for security purposes, you should instead employ advanced biometric security solutions alongside advanced techniques such as background video recording. This way, you can enhance security without compromising the customer experience.

You should also consider how mobile ID checks could help you authenticate your customer and identify potential future risks. Plus, you should ensure that your fraud prevention, cybersecurity, and compliance teams work collaboratively to build your fraud prevention program. This will ensure your processes suit all needs and requirements.

It’s important to be open and honest with your customers about the security methods you employ and how their data is used and stored (and why). Finally, you should encourage customers to keep their data secure. In doing so, you should inform them about best practice methods for keeping sensitive data safe and why this is so important.

Fraud losses can be protected by different fraud protection agencies.

Talk to us

The cost of fraud is high for customers and businesses alike. If you’d like to secure your systems and ensure that only verified users can access their accounts, then speak with the digital identity experts at Veriff today.