How IDV works

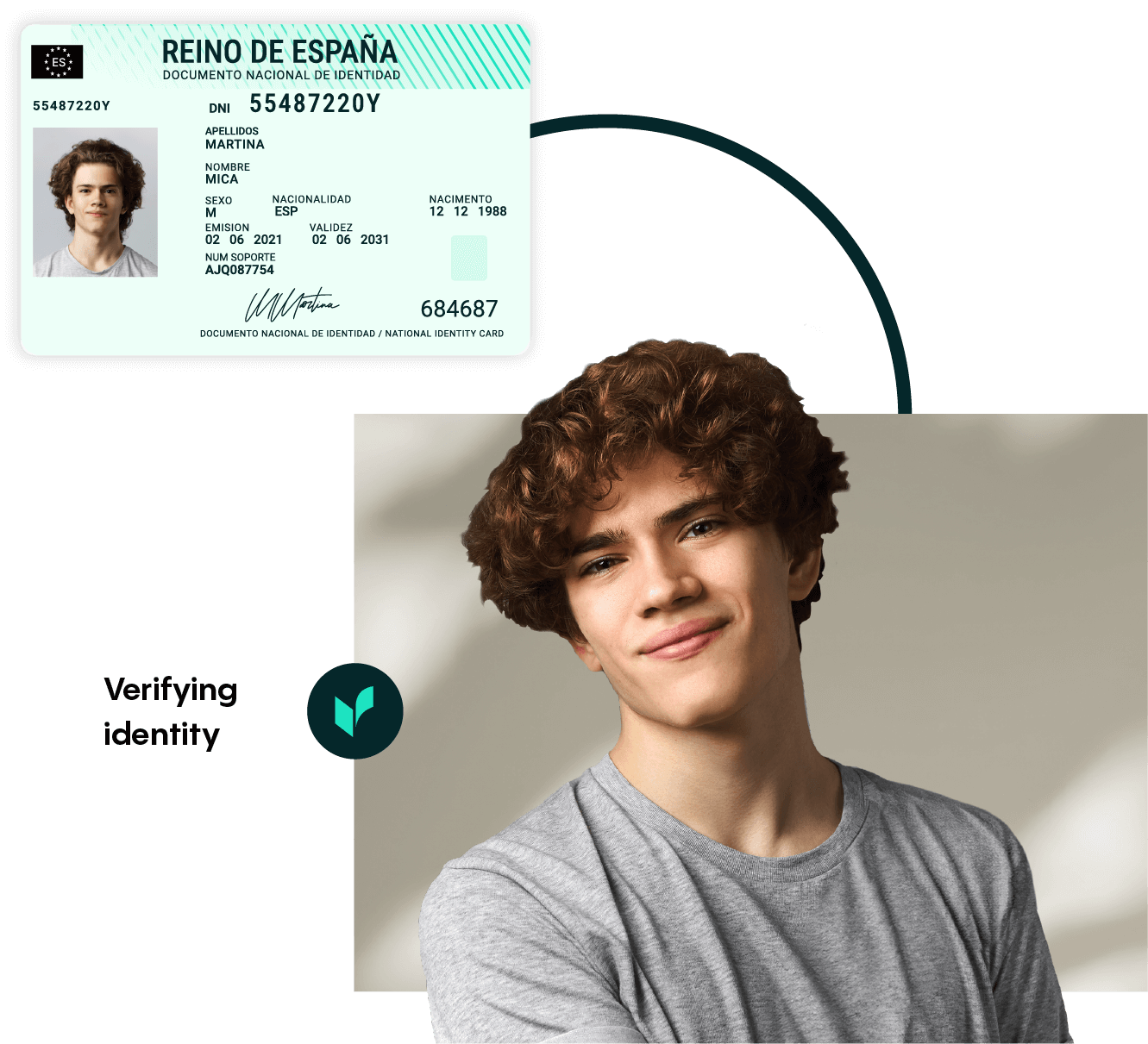

The user is asked to take a photo of their government-issued identity document and a simple selfie. This can be completed on a device and platform of their choice, as Veriff supports iOS, Android™, mobile web, and web SDK or API.

Veriff guides the user through the entire process with real-time feedback and automatically identifies the document type, so the user doesn’t have to manually enter data. This makes the process quicker and minimizes typing errors.

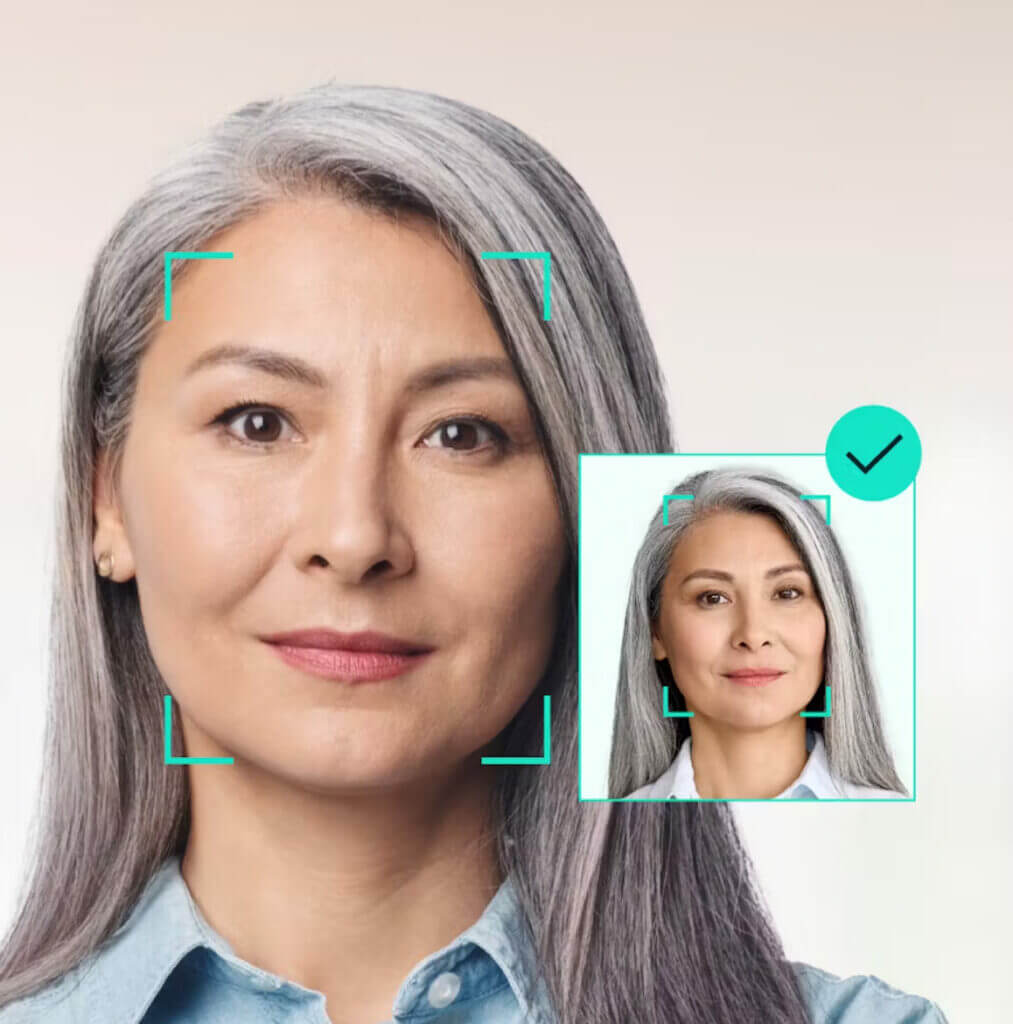

The user is asked to take a simple selfie and Veriff’s Assisted Image Capture lets them know immediately if there’s something wrong with the image. We quickly detect liveness and realness without asking users to move unnaturally or follow complex instructions.

The data is securely sent to Veriff and our AI-powered identity verification technology provides a decision in a matter of seconds based on the identity checks your business requires.

Get genuine users onboarded faster while fighting identity fraud.

verified on the first try

second verification

documents supported

languages & dialects

IDV that works for you

We understand that every organization has a unique view of how to balance speed, conversion, and fraud mitigation during the identity verification process. That’s why we offer the following options:

| FULL AUTO | HYBRID |

|---|---|

| Veriff Full Auto IDV is an AI-based solution best suited for businesses seeking a cost-effective identity verification option. Full Auto provides rapid response times, making it perfect for businesses that require swift verification. Full auto is ideal for you if you prioritize: | Veriff Hybrid IDV is a highly automated AI-based solution supported by trained verification specialists. It is designed for businesses that need to balance speed with accuracy. Hybrid is ideal for you if you prioritize: |

|

|

Customers around the world trust Veriff

Featured resources

Get the Veriff Identity Fraud Report 2025

Our 2025 report shares the insights our expert fraud team has discovered on the front line of fighting fraud — giving you the tools to protect your business and keep you ahead of the fraudsters.

Get started

Our identity verification experts are ready to help build you a solution that

gets more honest customers onboarded faster, and more securely, than ever before