FILTERS

SEARCH BY KEYWORD

Aug 28, 2024

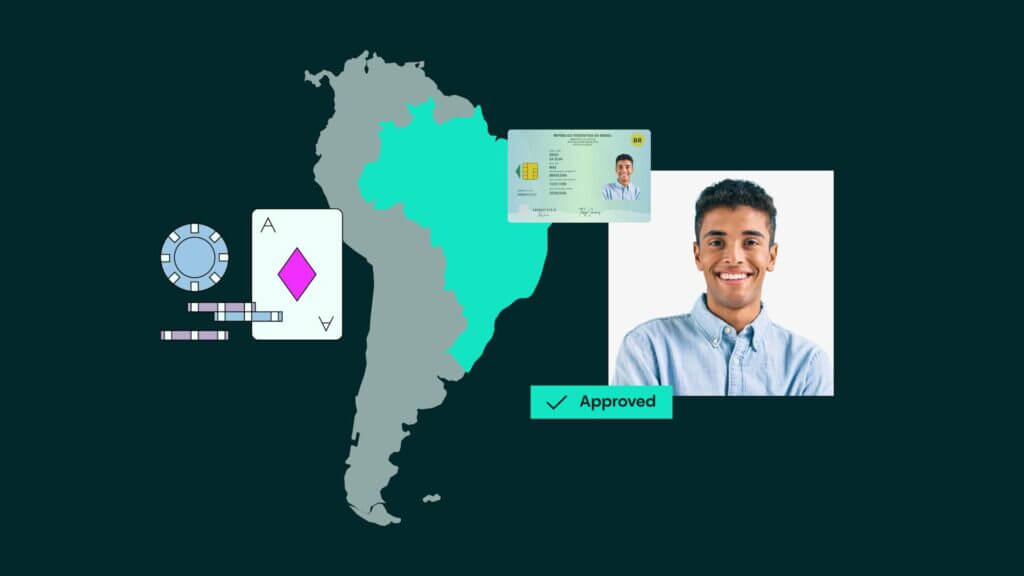

The importance of KYC in gaming: Avoiding pitfalls and leveraging Veriff

KYC learn

View

Sep 6, 2022

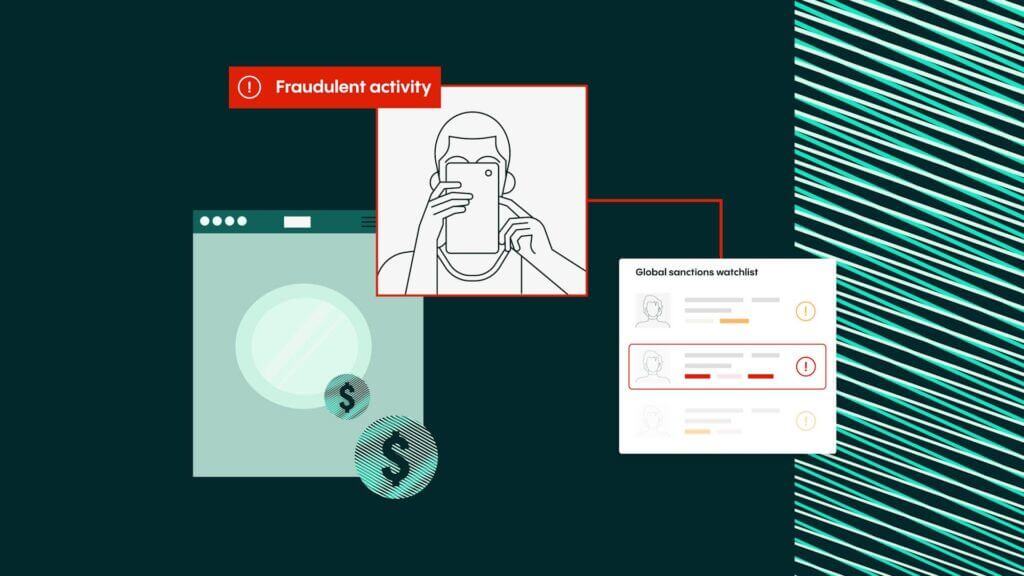

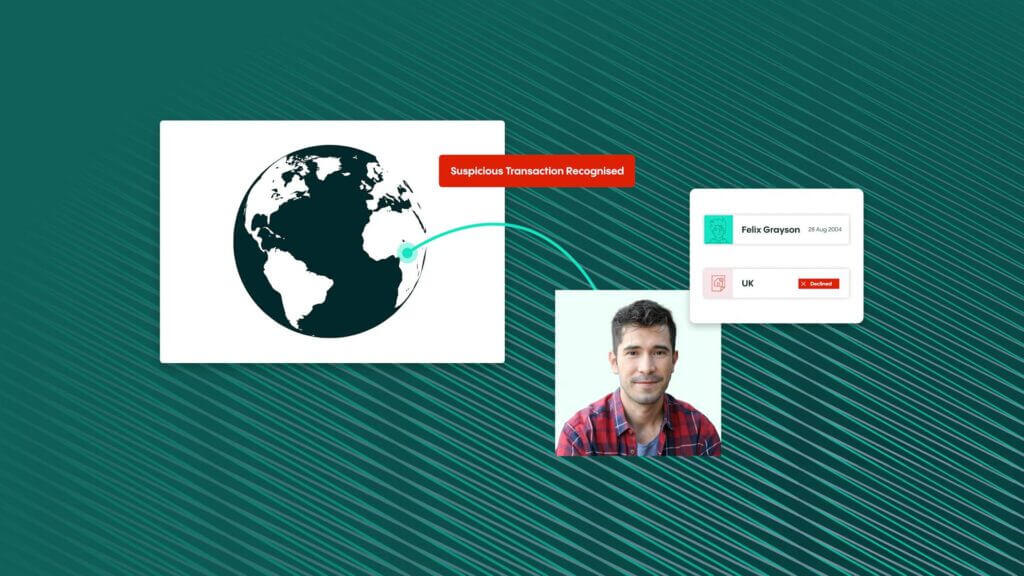

Crypto criminals laundered more than $500 million via cross-chain bridges

KYC learn

ViewSubscribe for insights

What is KYC

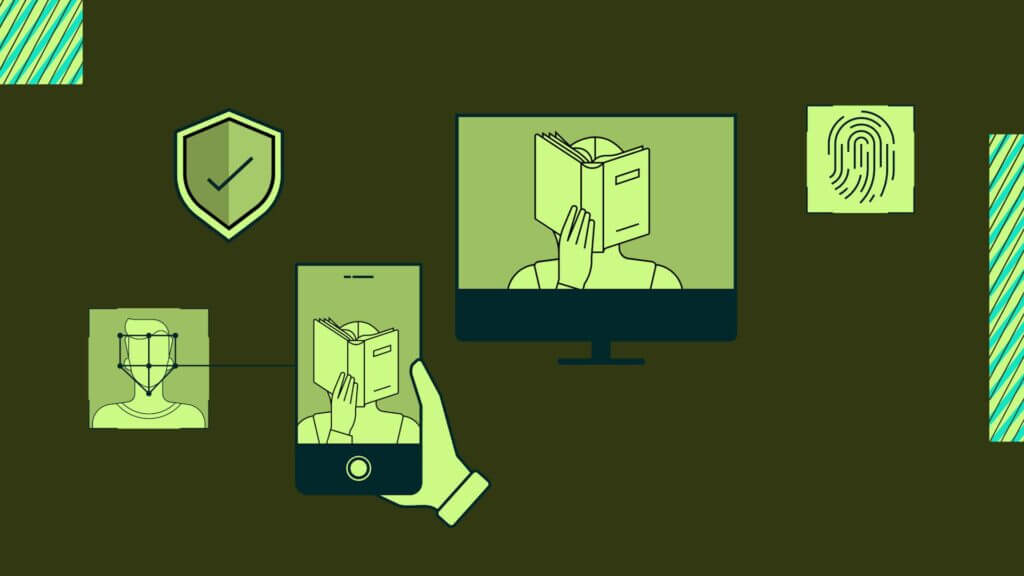

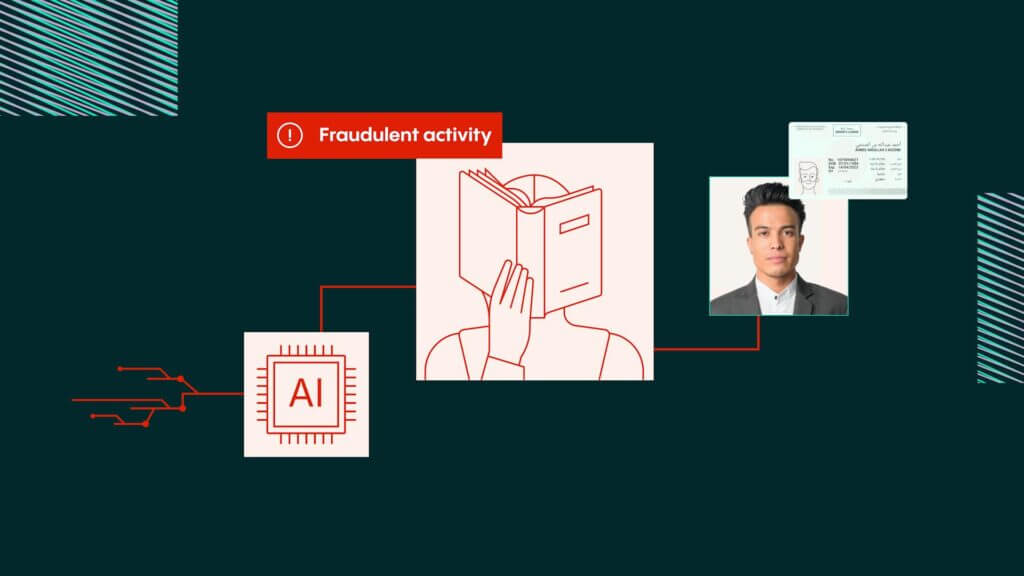

How IDV is transforming KYC

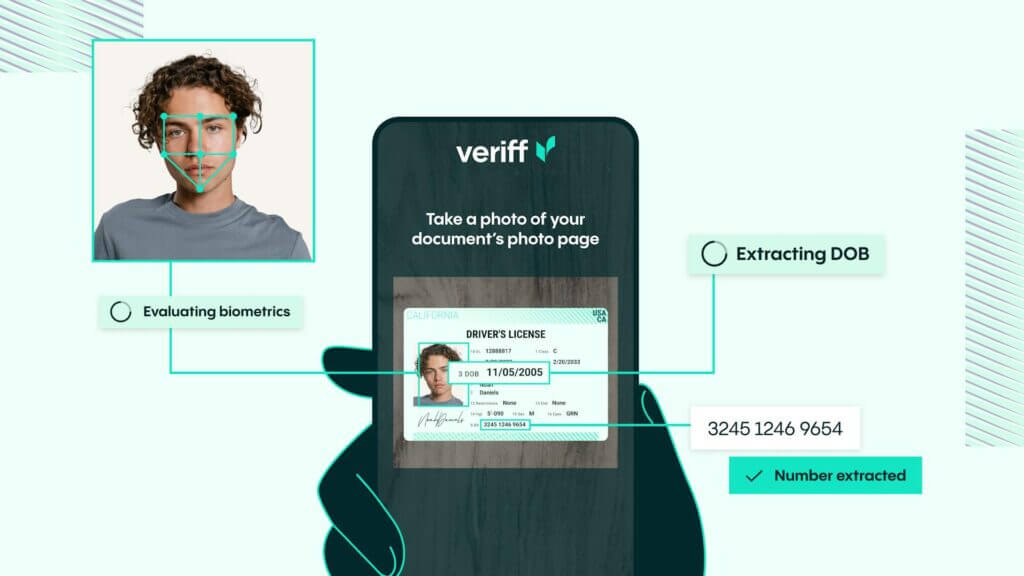

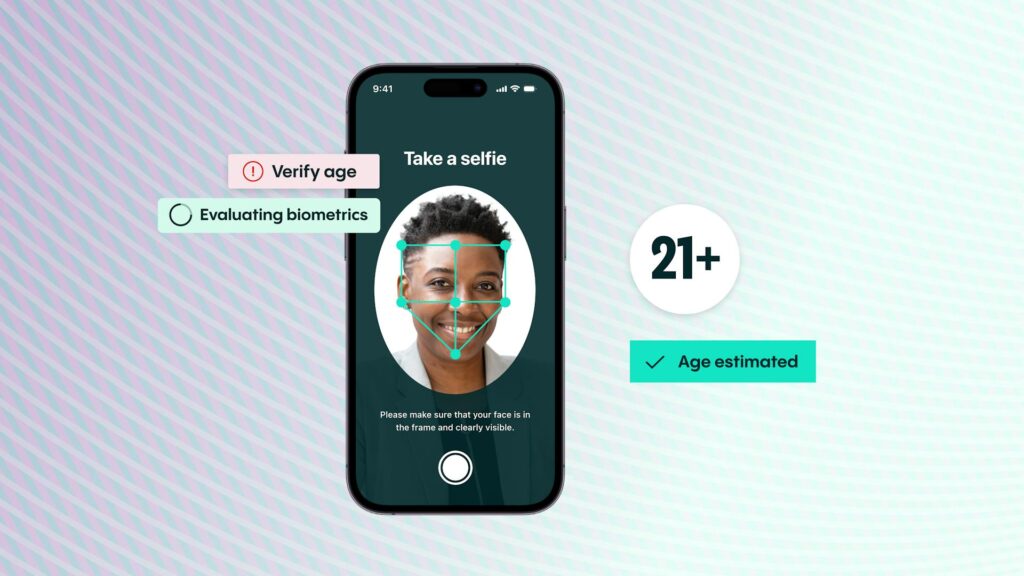

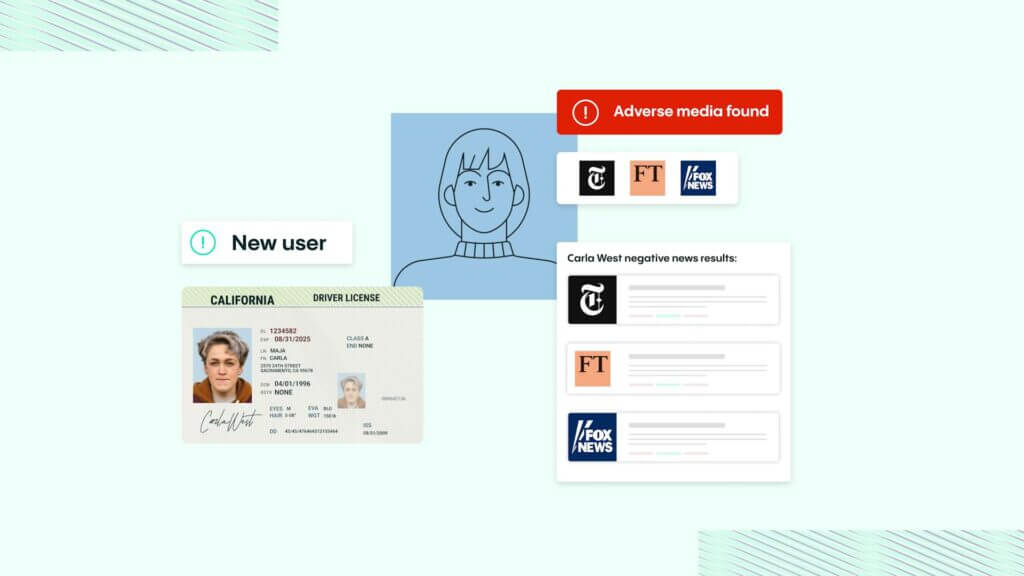

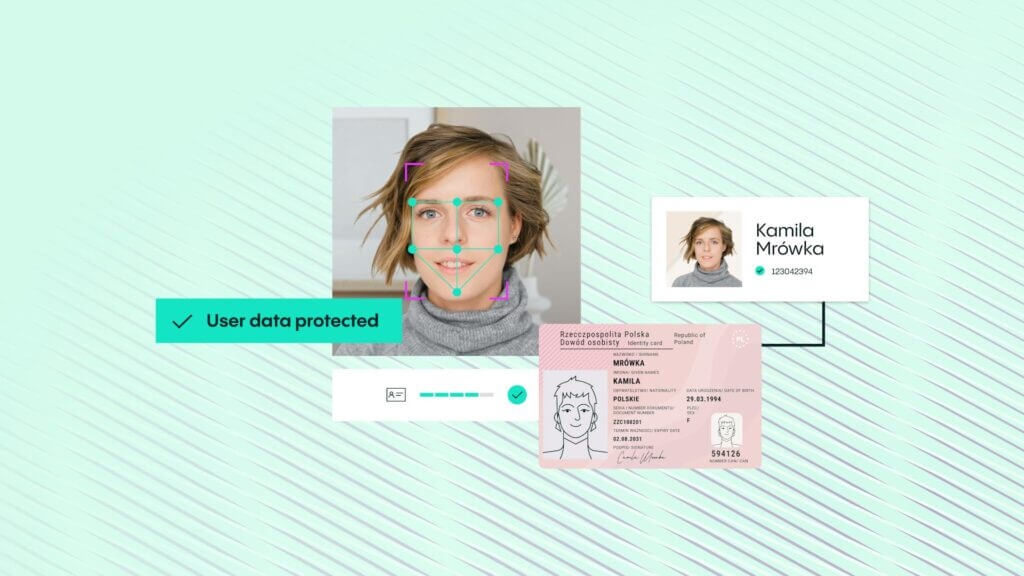

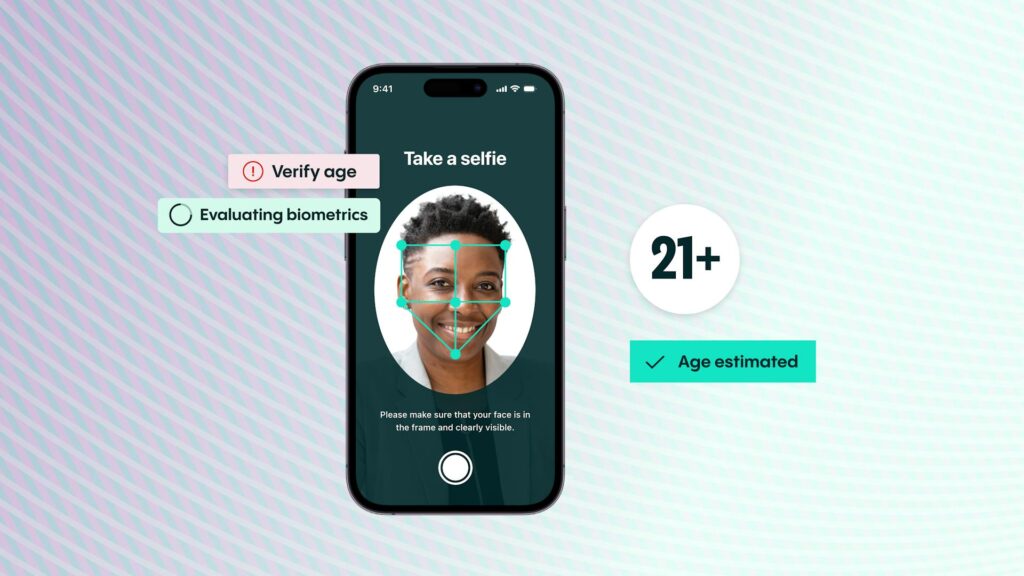

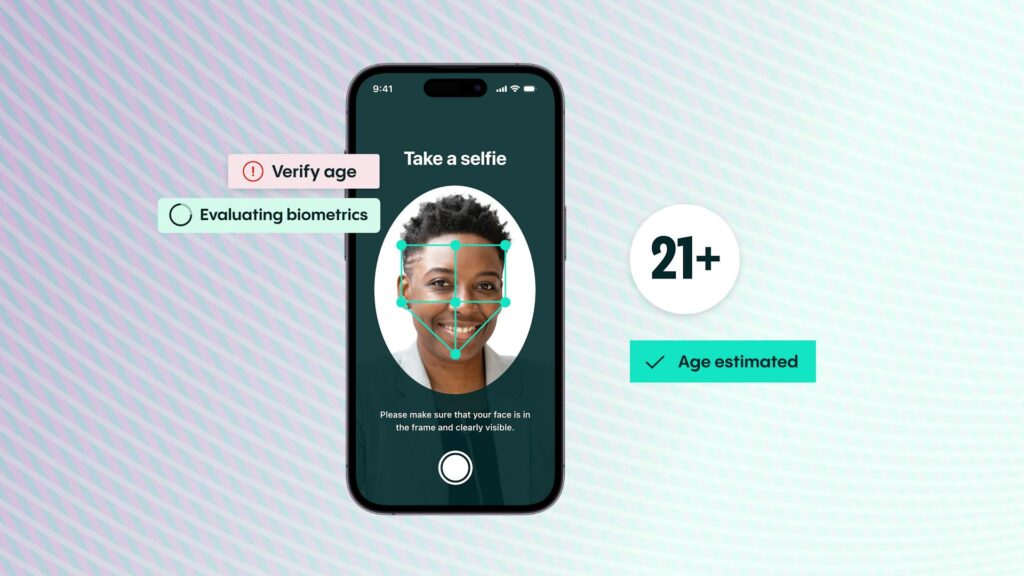

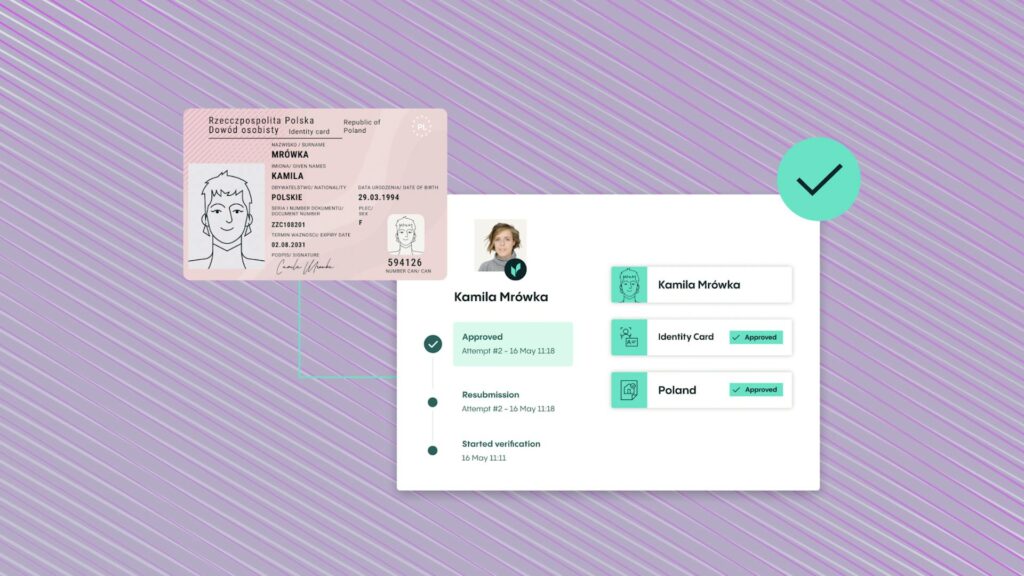

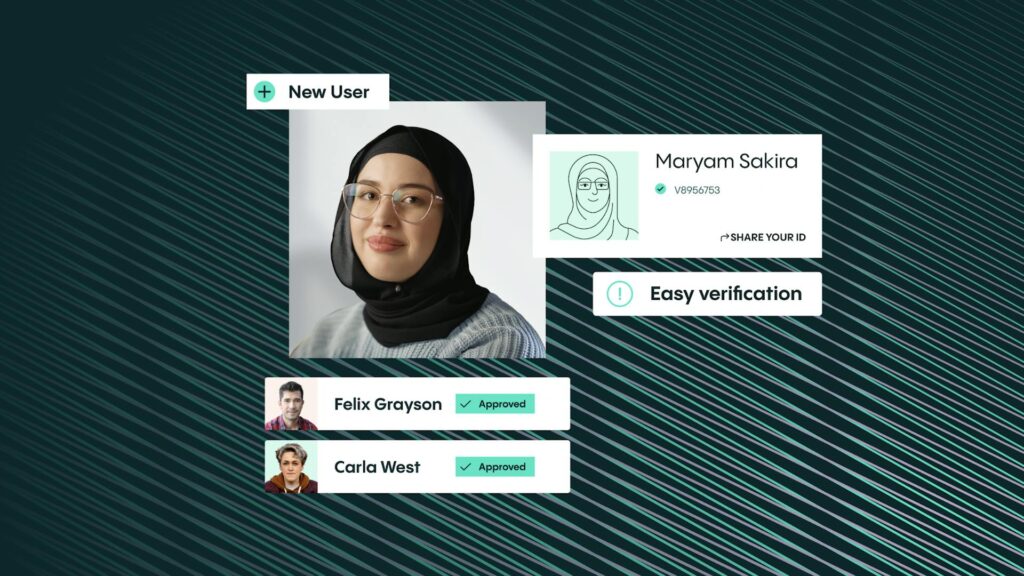

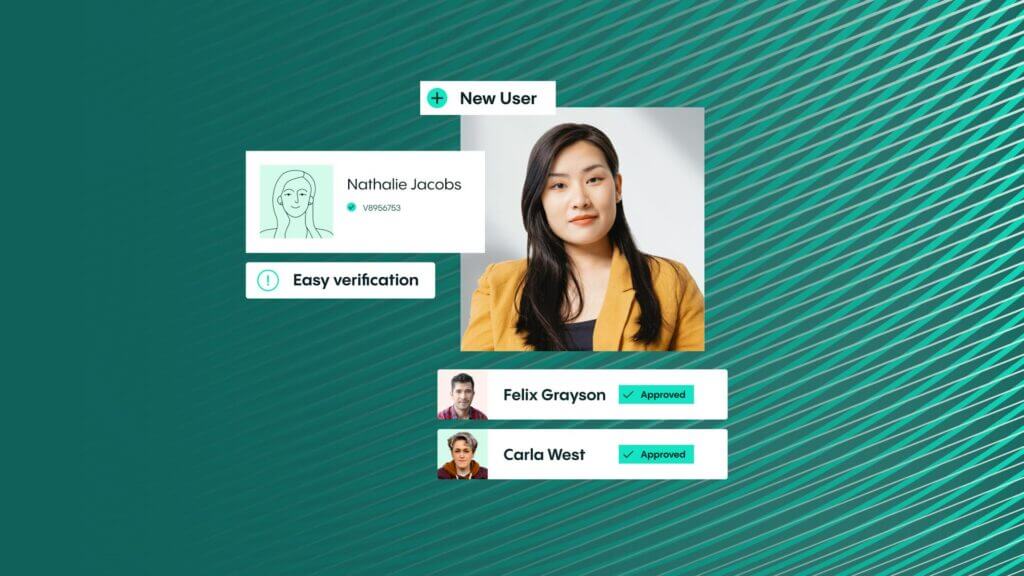

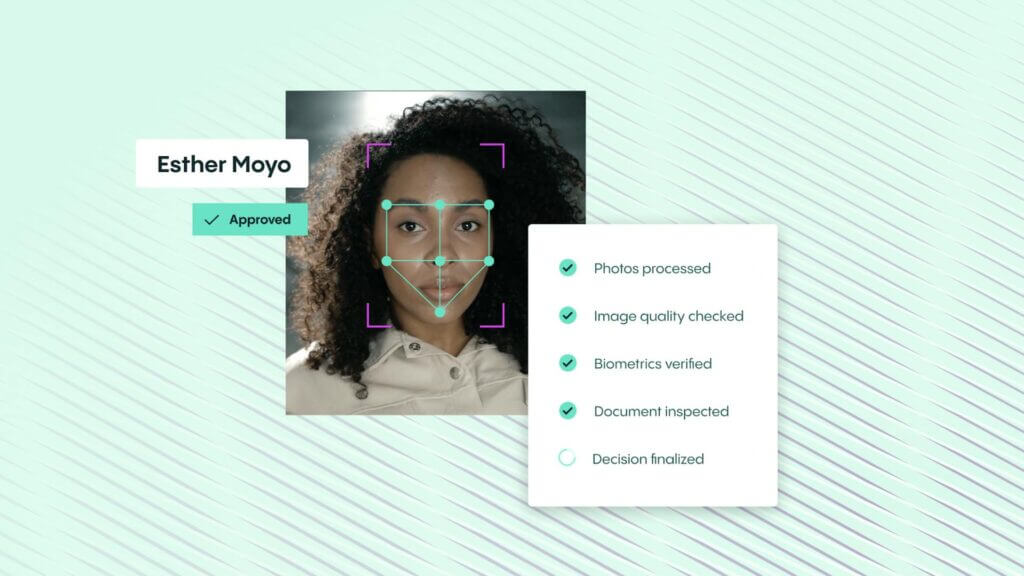

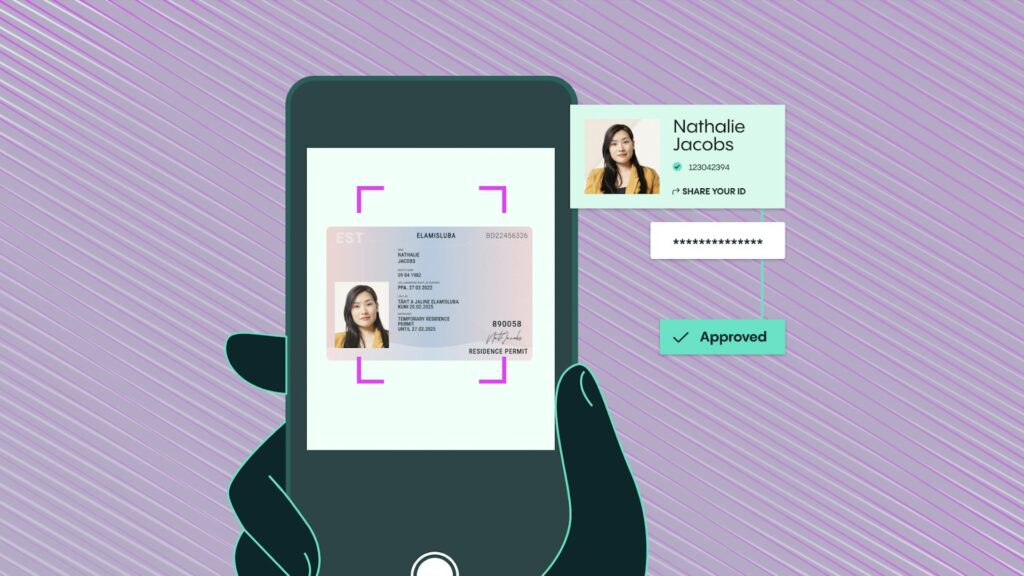

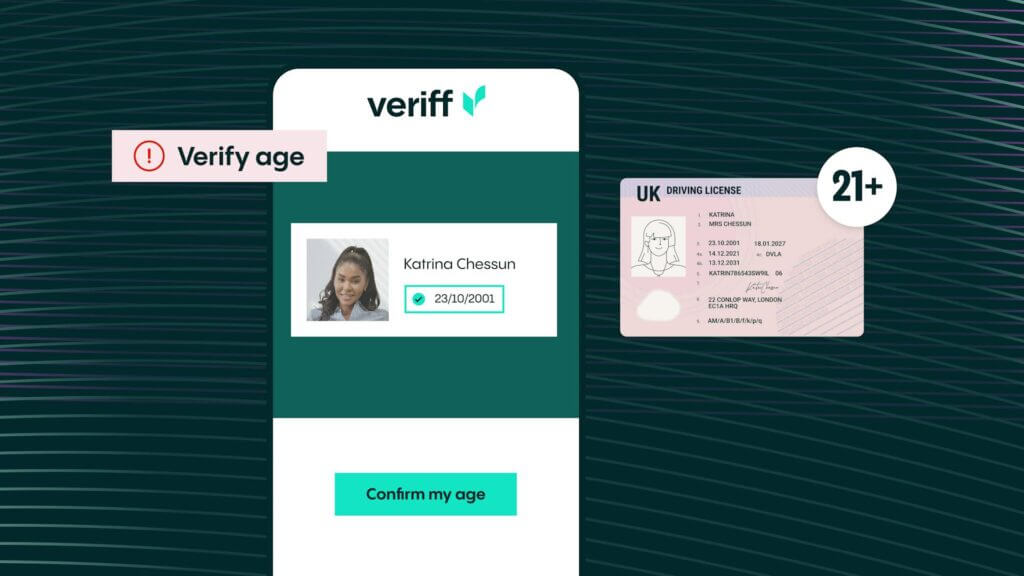

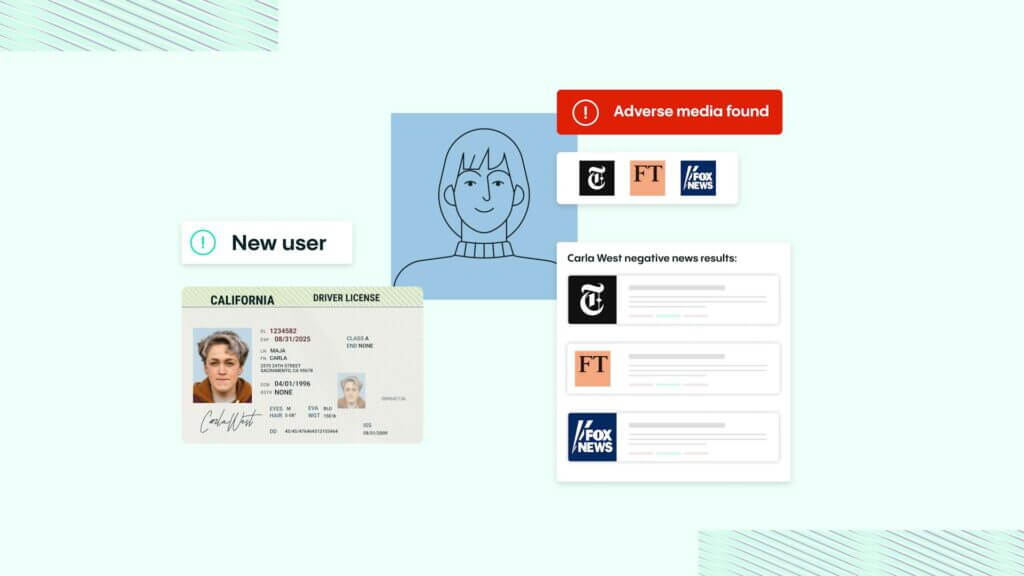

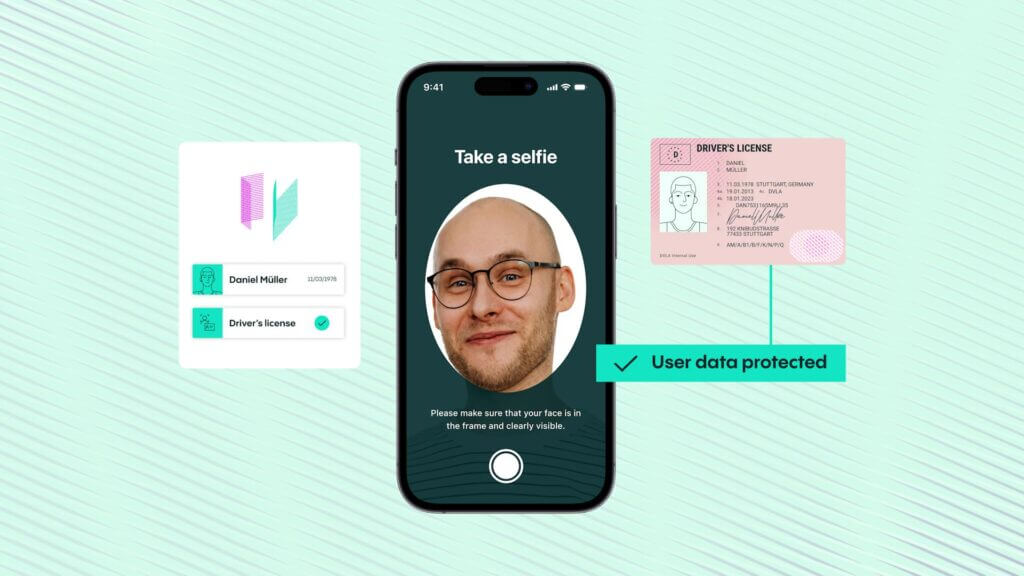

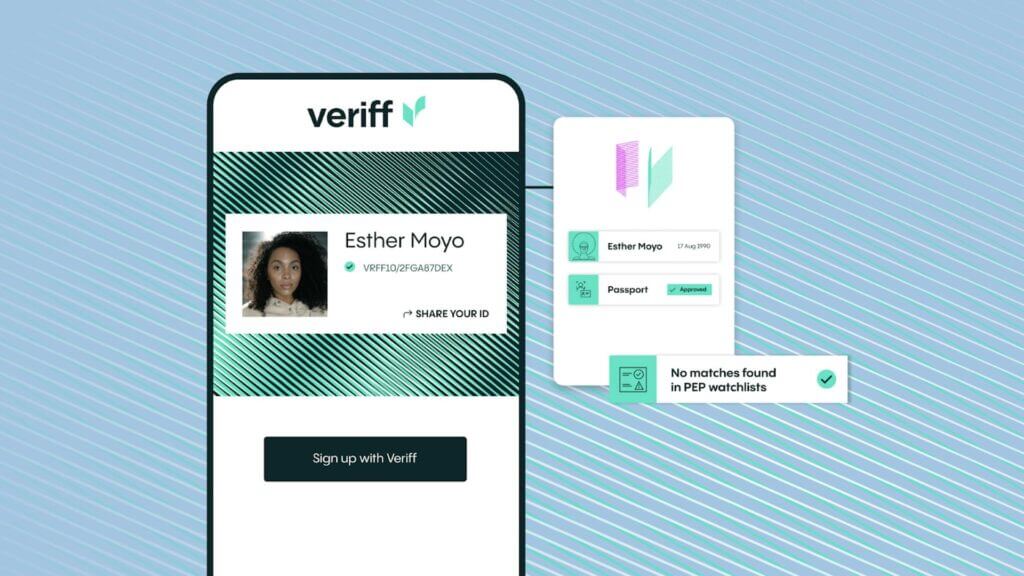

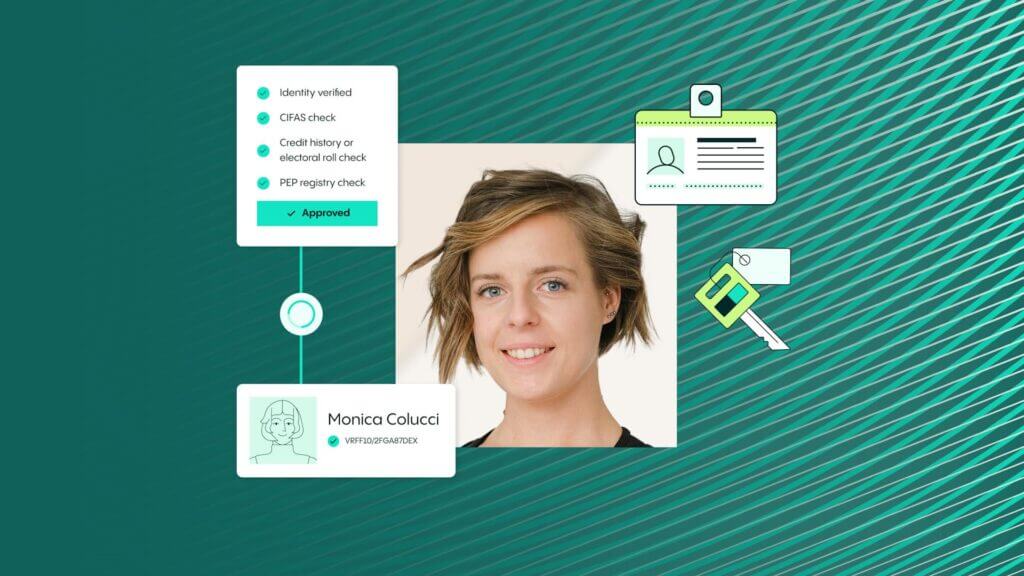

KYC can be a cumbersome manual process for businesses, adding friction to the user experience, resulting in customer dropouts and slow onboarding that can hamper potential revenue. However, identity verification (IDV) is transforming KYC processes for the better; customers can complete KYC checks when and where they want, using a device of their choice, requiring just a government-approved ID and a selfie.

FAQ

What is the KYC Education Center and why is it important?

The KYC Education Center is a comprehensive library of Know Your Customer (KYC) articles. This hub is essential for businesses that need to comply with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. Here are the three most important pieces of information about the KYC Education Center:

- The KYC Education Center provides access to up-to-date information on AML and CTF regulations, which is crucial for businesses that need to ensure compliance.

- The KYC Education Center offers a comprehensive library of KYC articles, including identity verification, proof of address, and other relevant information.

- The KYC Education Center is designed to be user-friendly and easy to navigate, making it a convenient resource for businesses of all sizes.

What types of businesses can benefit from using the KYC Education Center?

Any business that needs to comply with AML and CTF regulations can benefit from using the KYC Education Center. This includes financial services institutions, such as banks and insurance companies, as well as non-financial services institutions, such as law firms and accounting firms.

What are the benefits of using the KYC Education Center?

Using the KYC Education Center offers several benefits for businesses that need to comply with AML and CTF regulations. Here are the three most important benefits of using the KYC Education Center:

- Save time and resources: the KYC Education Center provides access to a comprehensive library of KYC articles.

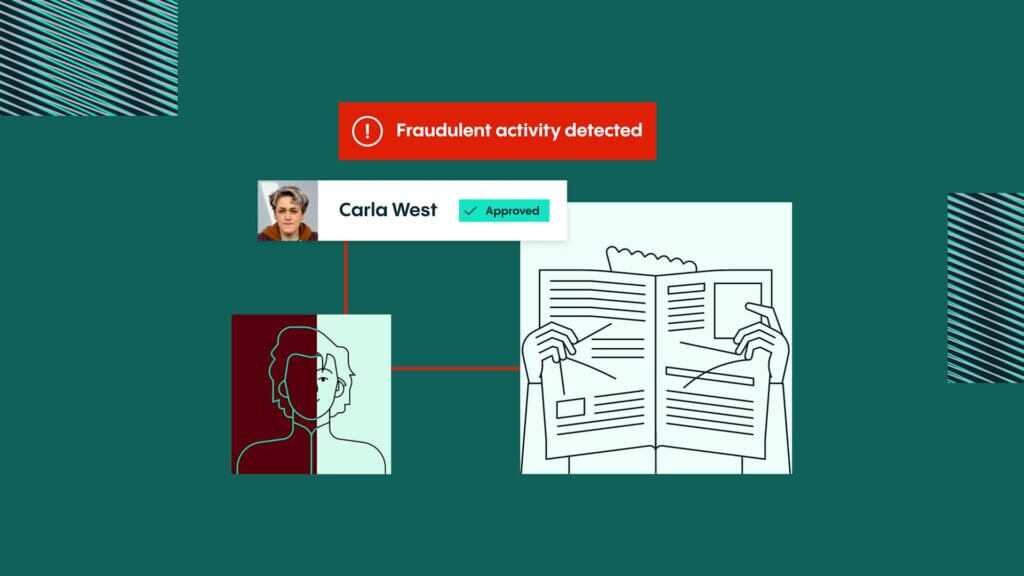

- Ensure compliance: the KYC Education Center provides up-to-date information on AML and CTF regulations, which helps businesses ensure compliance and avoid potential fines or legal issues.

- Improve customer experience: by streamlining the KYC process, businesses can provide a faster and more efficient customer experience, which can help improve customer satisfaction and retention.

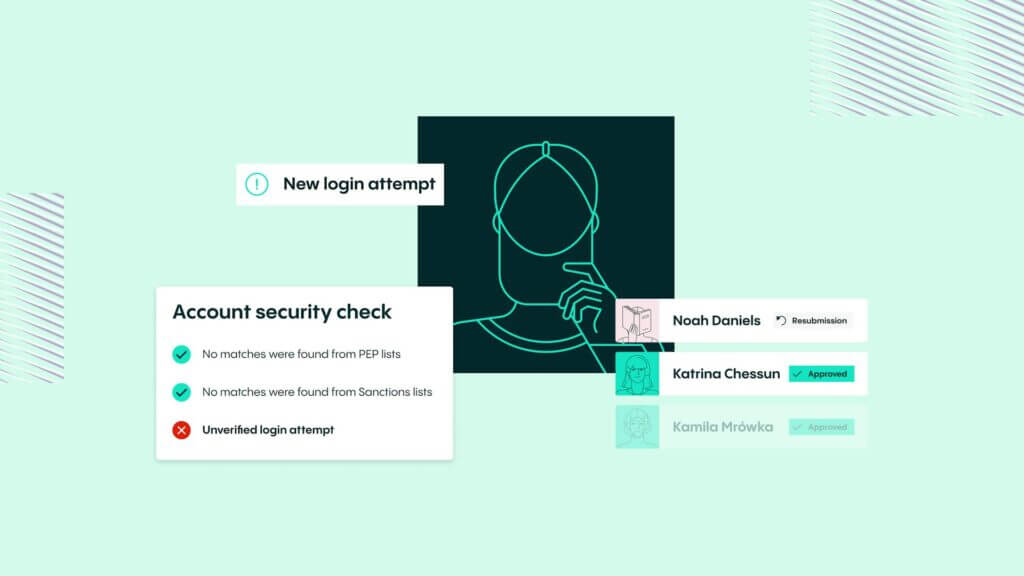

How does the KYC Education Center ensure the security of its platform?

The KYC Education Center takes the security of its platform and its users’ data very seriously. Here are the three most important ways that the KYC Education Center ensures the security of its platform:

- Encryption: the KYC Education Center uses encryption technology to protect users’ data and prevent unauthorized access.

- Secure storage: the KYC Education Center stores all user data in secure, encrypted servers that are located in highly secure data centers.

- Regular audits: the KYC Education Center undergoes regular security audits to ensure that its platform and user data are secure.

Talk to us

Our identity verification experts are ready to help you optimize your processes, onboard more genuine customers faster, and keep bad actors out.