Blog Post

Veriff launches product accessibility features

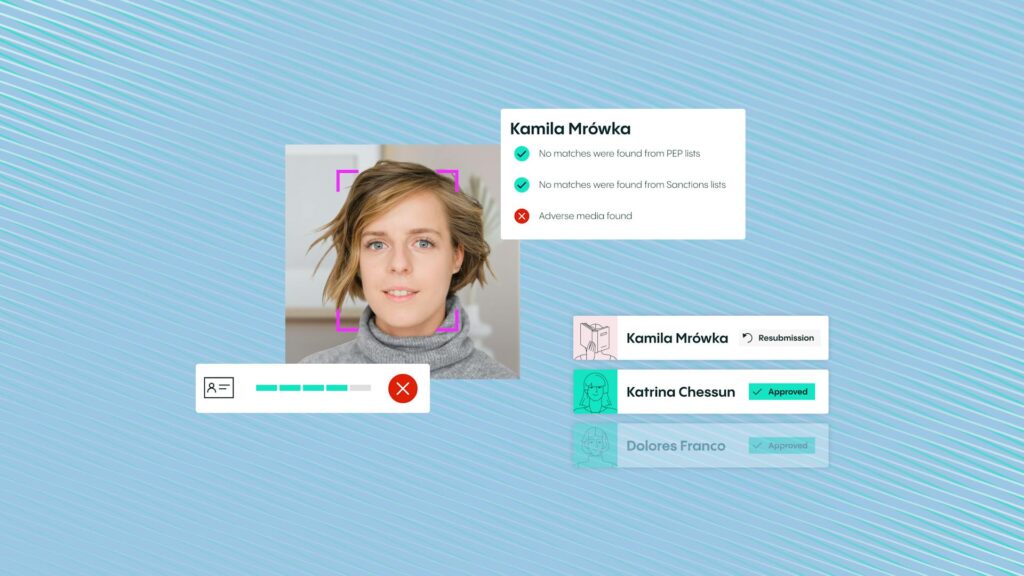

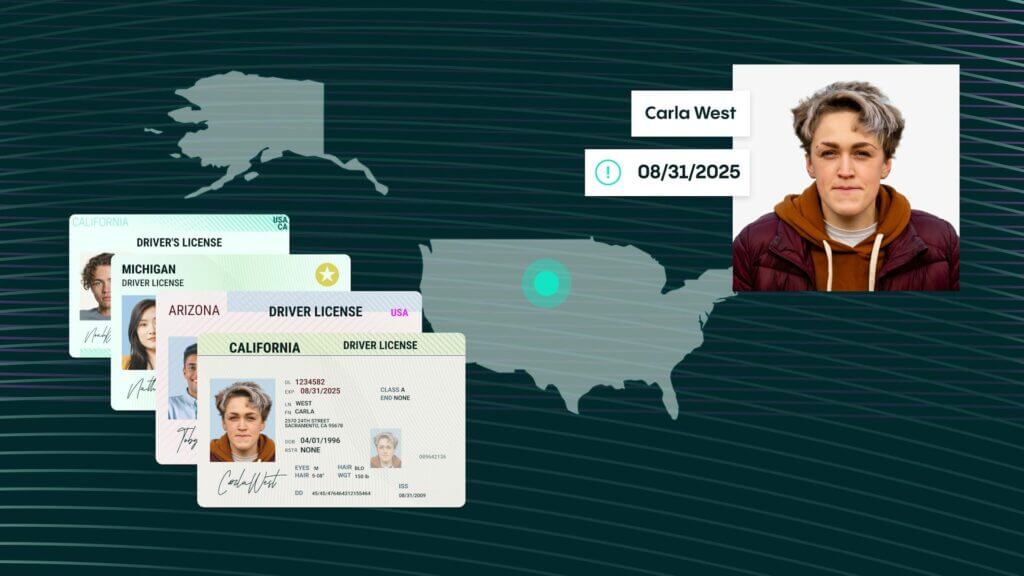

AI-driven online identity verification company Veriff launches a new product accessibility feature that enables remote access to digital products and services.

Veriff’s online verification service is now more accessible for everyone. With improved service accessibility, it is now possible to go through the verification process without using a mouse–just a keyboard and a screen reader.

According to Janer Gorohhov, the COO and co-founder of Veriff, the company is focusing on inclusion when building and designing their product. “We make sure that all people, regardless of their abilities , are included and have equal access to digital services. It’s especially vital now as the COVID crisis accelerated digitalisation and online verification has become an integral part of any digital service.”

With improved service accessibility, Veriff’s website meets the AA standard of Web Content Accessibility Guidelines (WCAG) 2.0. The new accessibility features are available in Veriff’s Software Development Kit (SDK) for Android and web applications, with iOS following shortly.

When testing the service usability, Veriff consulted with the Estonian Blind Union, a member of European Blind Union (EBU). According to the chairman Jakob Rosin, it’s great that more companies are thinking of making digital services available for people with disabilities. “By today, accessibility should be a natural part of any product development and design process. Unfortunately, most digital services and apps are not accessible for people with visual impairments. It’s great to see that thanks to Veriff there are now more services available that people can independently use. When actual visits to a bank office to verify your identity can be annoying for anyone, they are almost impossible for people with disabilities because of poor physical accessibility. I do believe that this demographic could be the most loyal customer segment for any company who is considering their needs when designing products and services,” he added.

According to the WHO, about 15% of the world’s population lives with some form of disability, of whom 2-4% experience significant difficulties in functioning. There are about 300 million visually impaired people living on this planet, and about 39 million of them are blind and would need extra help using digital services.