KYC Article

100 UK-licensed electronic institutions have been red flagged for potential money laundering risk

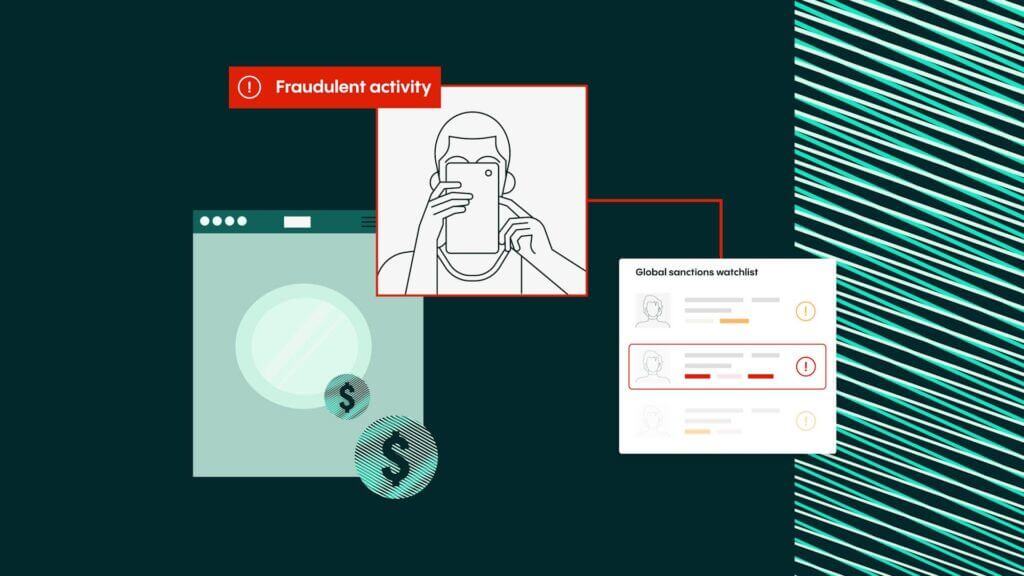

Research from Transparency International UK has revealed more than a third of UK-licensed electronic money institutions have been flagged for potential money laundering. In a December 2021 report, the association claimed that the payments industry could become a “major gateway” for illicit funds from around the world unless it faces stricter enforcement.

Research from Transparency International UK has revealed more than a third of UK-licensed electronic money institutions have been flagged for potential money laundering. In a December 2021 report, the association claimed that the payments industry could become a “major gateway” for illicit funds from around the world unless it faces stricter enforcement.

How are electronic money institutions licensed?

Electronic money institutions are licensed and overseen by the UK’s Financial Conduct Authority. They are allowed to issue payment cards, offer bank accounts, and authorize money transfers. However, unlike traditional banks, electronic money institutions cannot provide loans or mortgages. They are also not covered by the Financial Services Compensation Scheme.

How popular are electronic money institutions?

In the 12 months to June 2021, electronic money institutions processed more than £500bn of financial transactions, according to data from the Financial Conduct Authority.

In their study, Transparency International UK reviewed 261 electronic money institutions that are licensed to operate in the UK. Of these, 100 had potential money laundering red flags raised against them. Although these red flags indicate risk rather than prove wrongdoing, this remains an alarming statistic.

Transparency International UK also found that nearly a third of “suspicious activity reports” in the 19/20 financial year came from the electronic payments sector. On top of this, the association’s review also found that Russian and Ukrainian-language websites were offering to establish anonymous shell companies with accounts at British electronic money institutions. UK-licensed e-money businesses were also being advertised for sale on LinkedIn and other websites for between £600,000 and £1.5m.

What does this mean for the future of electronic money institutions?

As a result of the study, Transparency International UK has called for greater regulation in the sector. The association has also called the role the Financial Conduct Authority has played in supervising the sector into question.

Responding to the report, the Financial Conduct Authority said: “We are focused on tackling financial crime. We have done a substantial amount of work to raise anti-financial crime standards at payment and e-money firms, including placing business restrictions on some. We will continue to take assertive action where firms do not meet the standard we expect.”

Ensure compliance with Veriff

Veriff supports over 12,000 identity documents from across 230+ countries and territories.

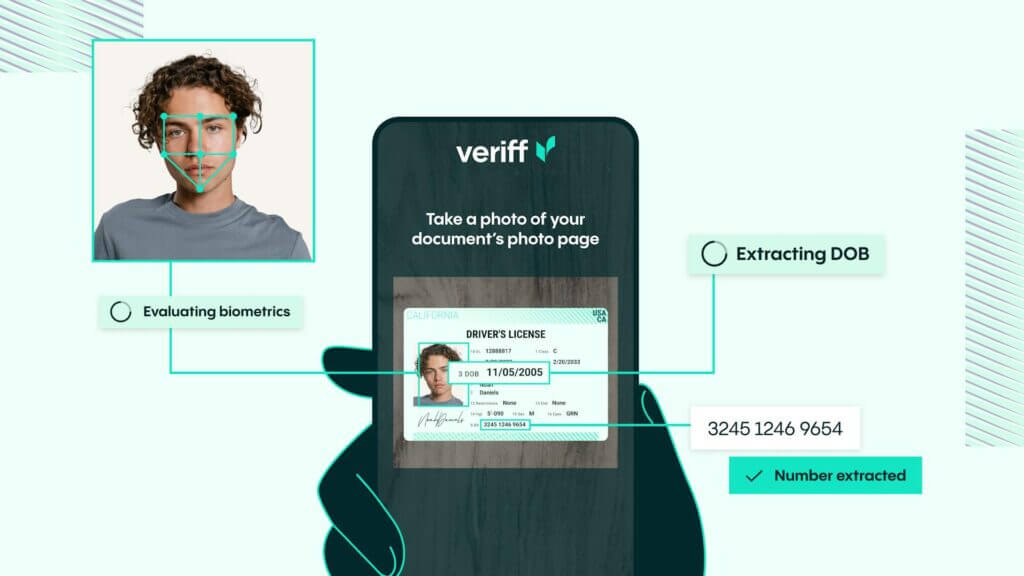

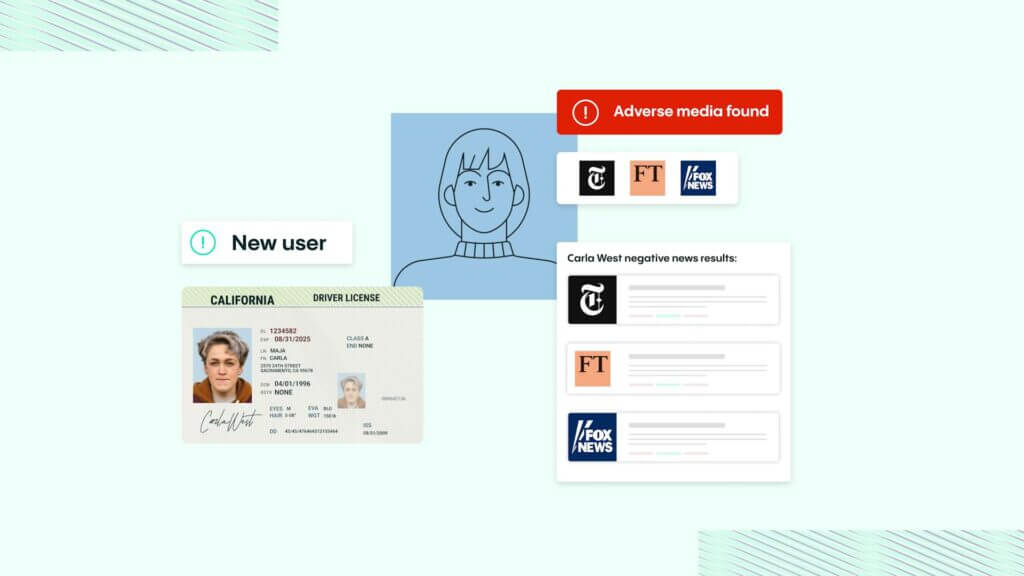

the finance sector, companies are facing the prospect of greater regulation. As a result, if you’re operating in the fintech space, you need to ensure you know exactly who your customers are.

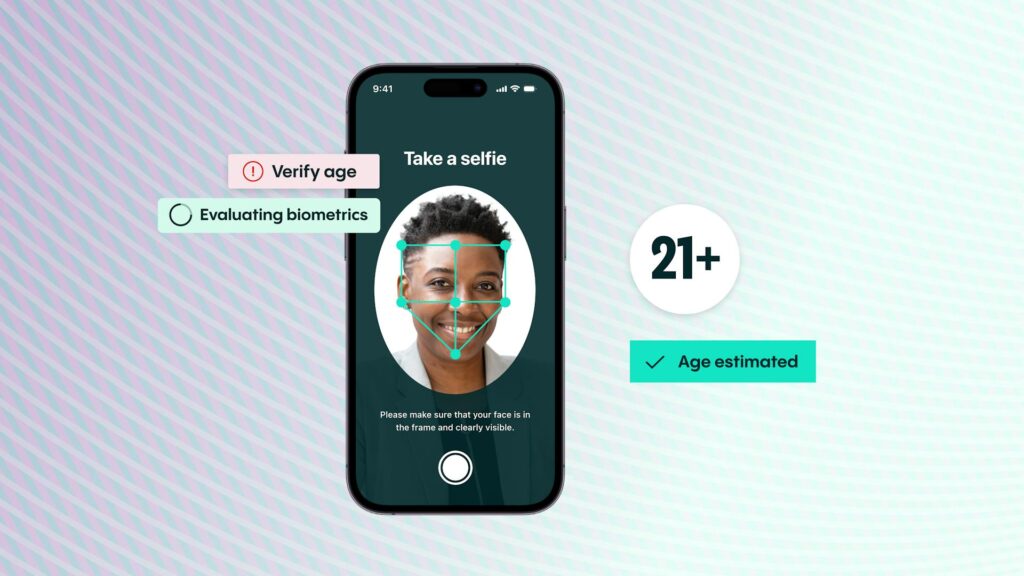

Thankfully, our fintech identity verification tool allows you to ensure KYC compliance. With device analytics and liveness checks, we’ll make sure you know everything you need to, including if your customer is real. Learn more about our online identity verification solution today.