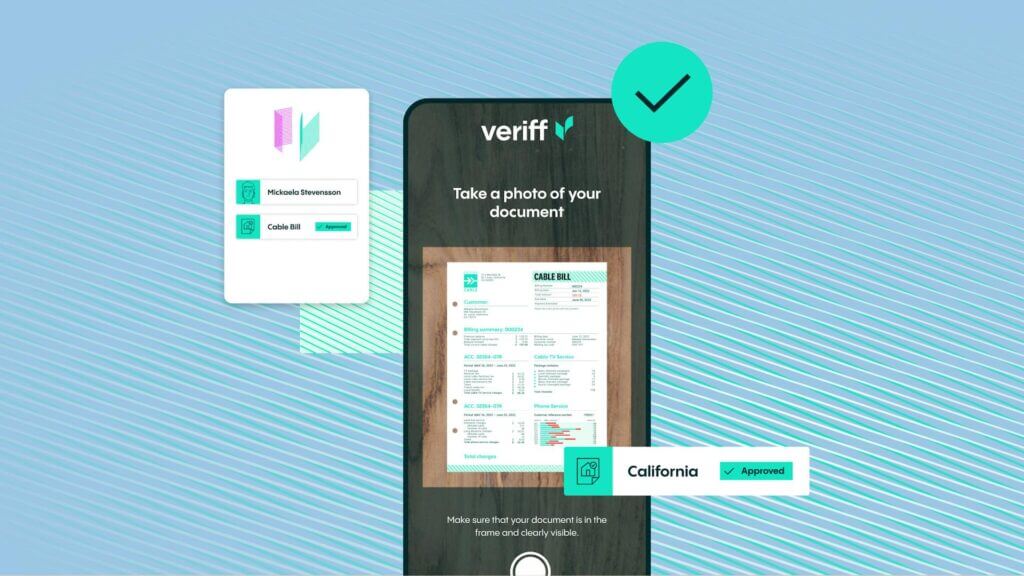

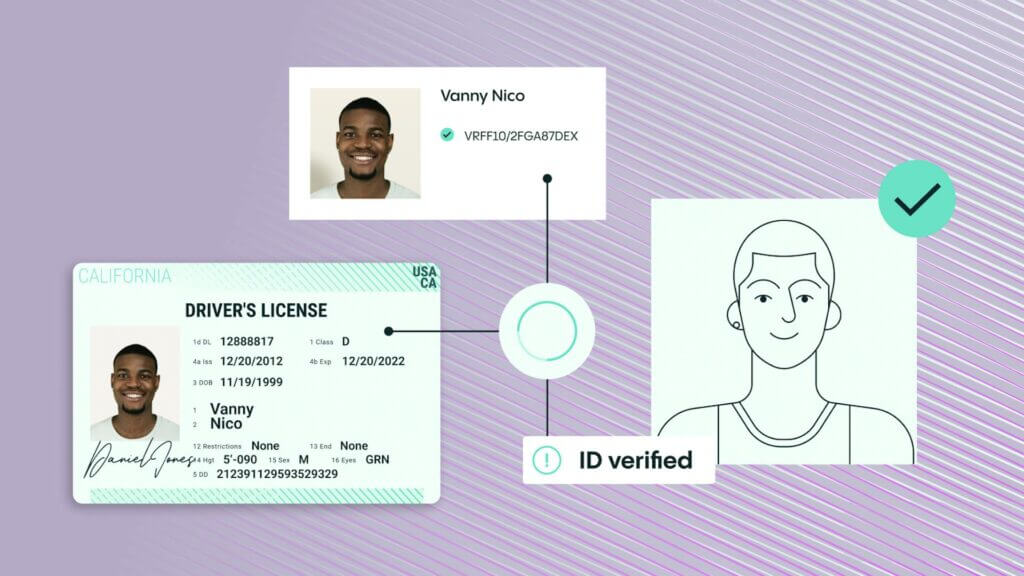

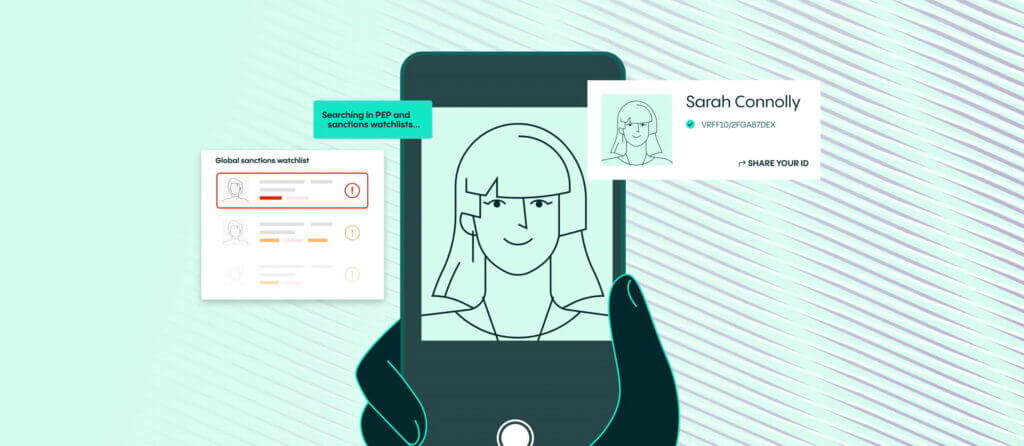

The fully automated process is completed in under 10 seconds, which manually could take hours or even days. Operation is simple – users upload or use the camera on their device to take a picture of a document – credit card statements, driver licenses, and utility or phone bills – that includes their physical address.

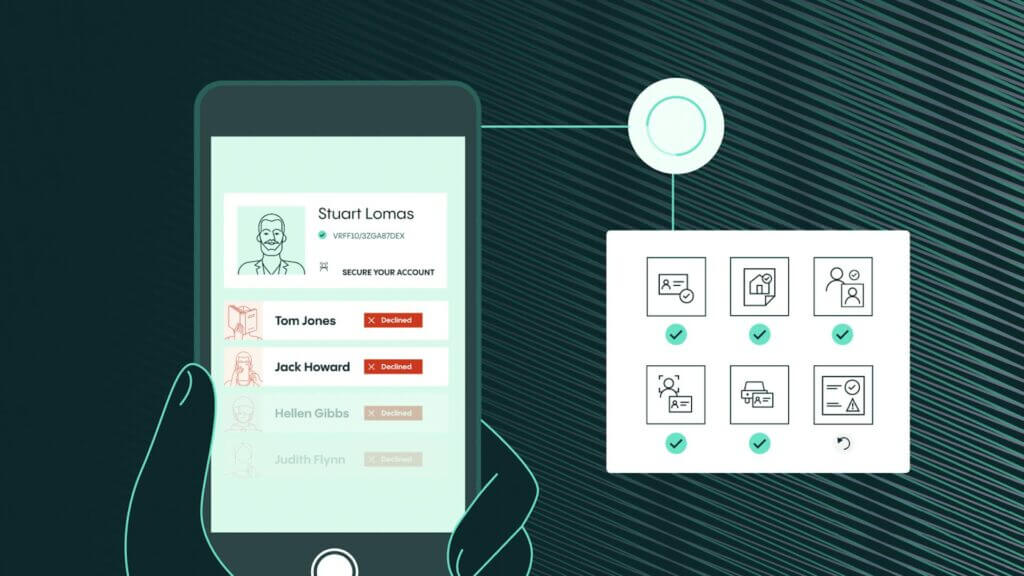

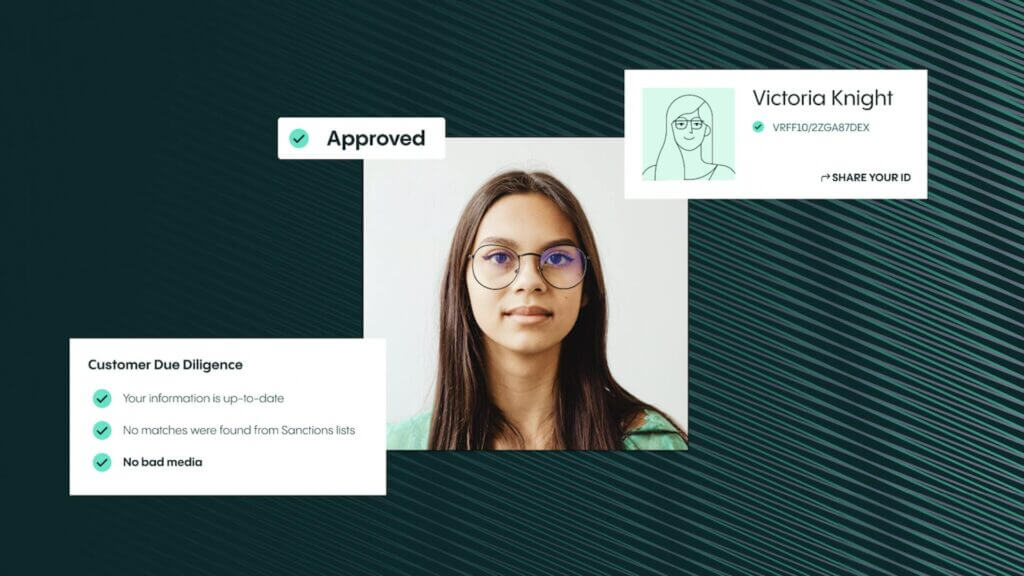

Veriff launches enhanced Proof of Address offering