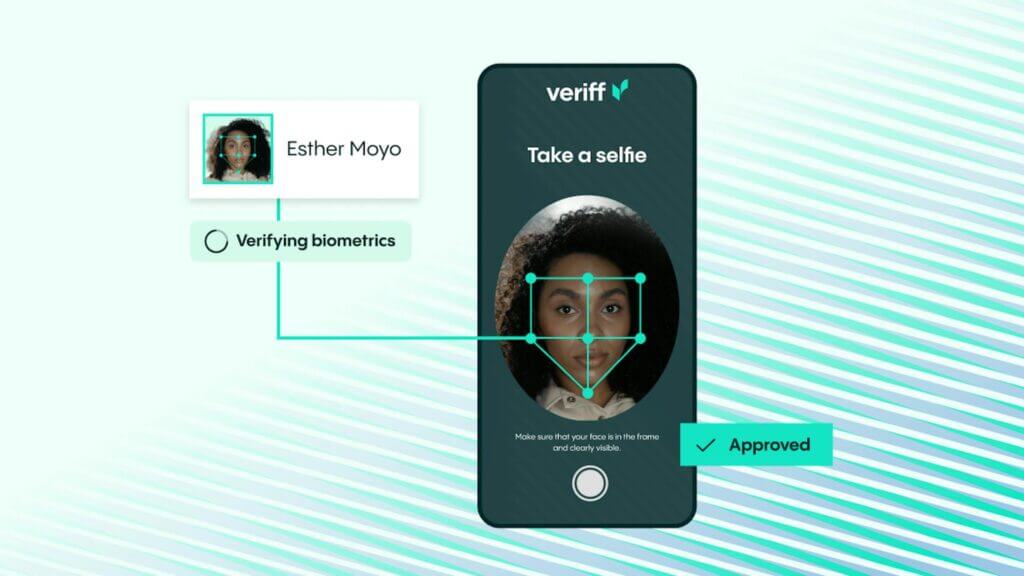

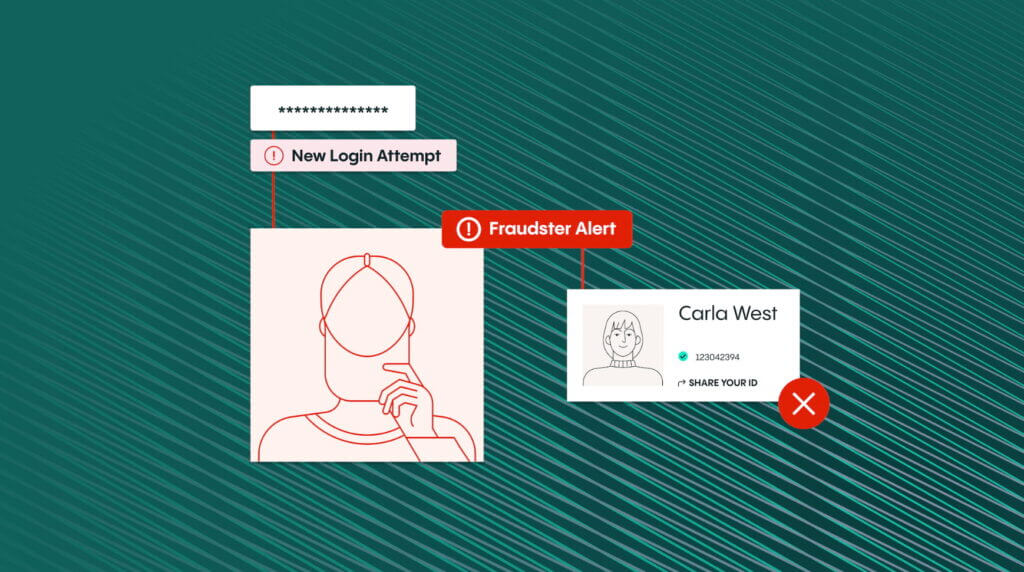

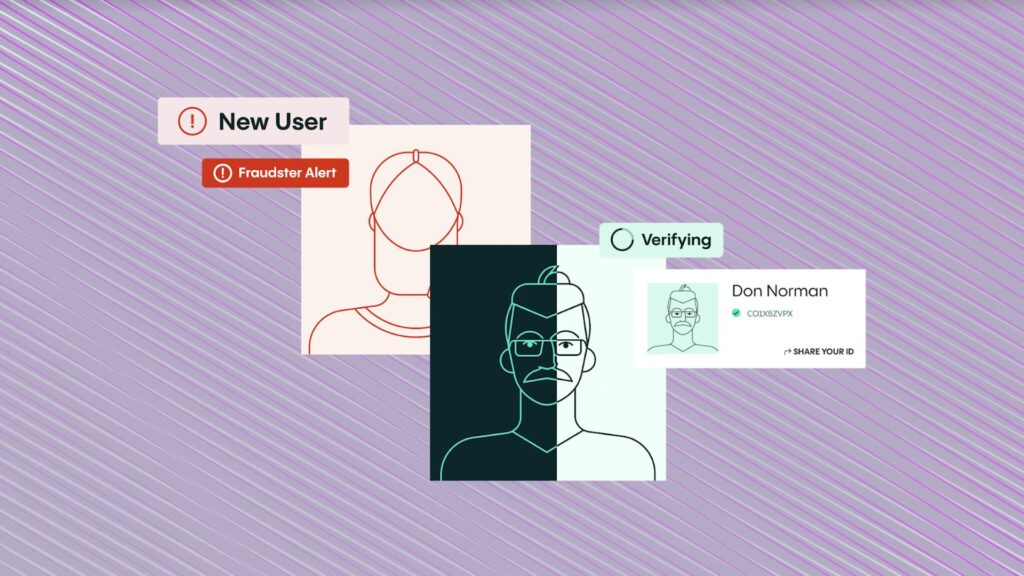

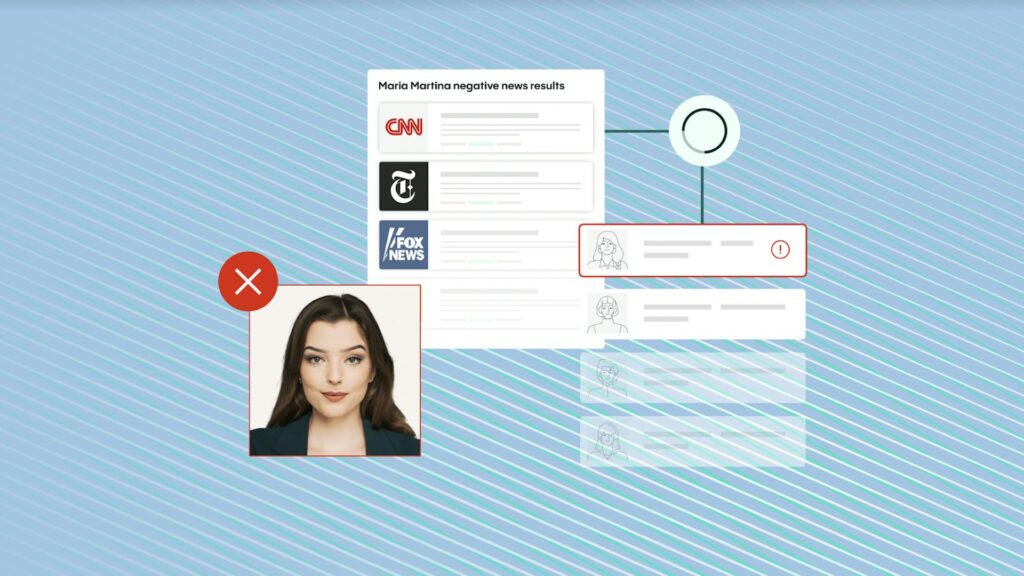

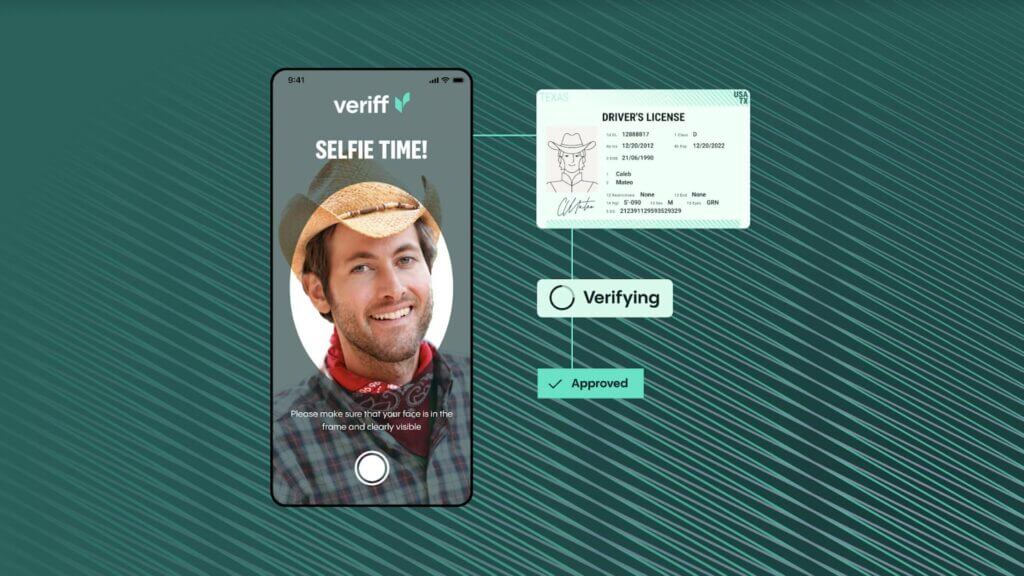

When using biometric authentication for payments, businesses are able to use technology that identifies a user based on their physical characteristics. Once the customer has been identified, the technology authorizes the deduction of funds from a customer’s bank account. Although fingerprint recognition is the most common biometric payment method, other types of biometric data used for the

Using biometric authentication for payments