Fraud Article

AI-generated fakes are surging — here’s how risk and fraud leaders can stay ahead

ChatGPT’s latest image tool gives anyone the ability to create a fake identity document that is good enough to pass many KYC checks. This means having video-based identity document checks are more vital than ever.

Fake IDs have leveled up. And so must businesses in all sectors..

In less than two minutes, someone with no design skills and a simple AI prompt can now create a fake government-issued ID that’s convincing enough to pass traditional KYC checks. Static photo-based verification? That’s yesterday’s defense — and today’s vulnerability.

As a leader responsible for fraud, risk, onboarding, or compliance, this isn’t just an industry trend. It’s your frontline challenge.

The fraud game has changed

Document forgery has always been a risk — but AI has made it instant, scalable, and shockingly simple. From counterfeiting and tampering to simulation techniques, fraudsters now exploit new tools to create ultra-realistic identity documents that fool legacy systems.

For example, ChatGPT’s native image generation tool, GPT-4o, which was opened for users across the world last week has already been used to create fake driving licences, residency cards, Indian Aadhaar cards and many others – as has evidenced by the flood of these being posted to social media..

It all means you’re not just fighting fraudsters. You’re racing against machine intelligence.

Picture-based IDV alone isn’t enough

We’re officially past the tipping point. With tools like GPT-4o, anyone can now generate realistic-looking ID documents — in under two minutes, with zero coding or design skills. A synthetic Aadhaar card, shared recently online, was produced using only AI prompts. No Photoshop. No templates. Just pure machine intelligence.

This isn’t sci-fi anymore — it’s real, and it’s here.

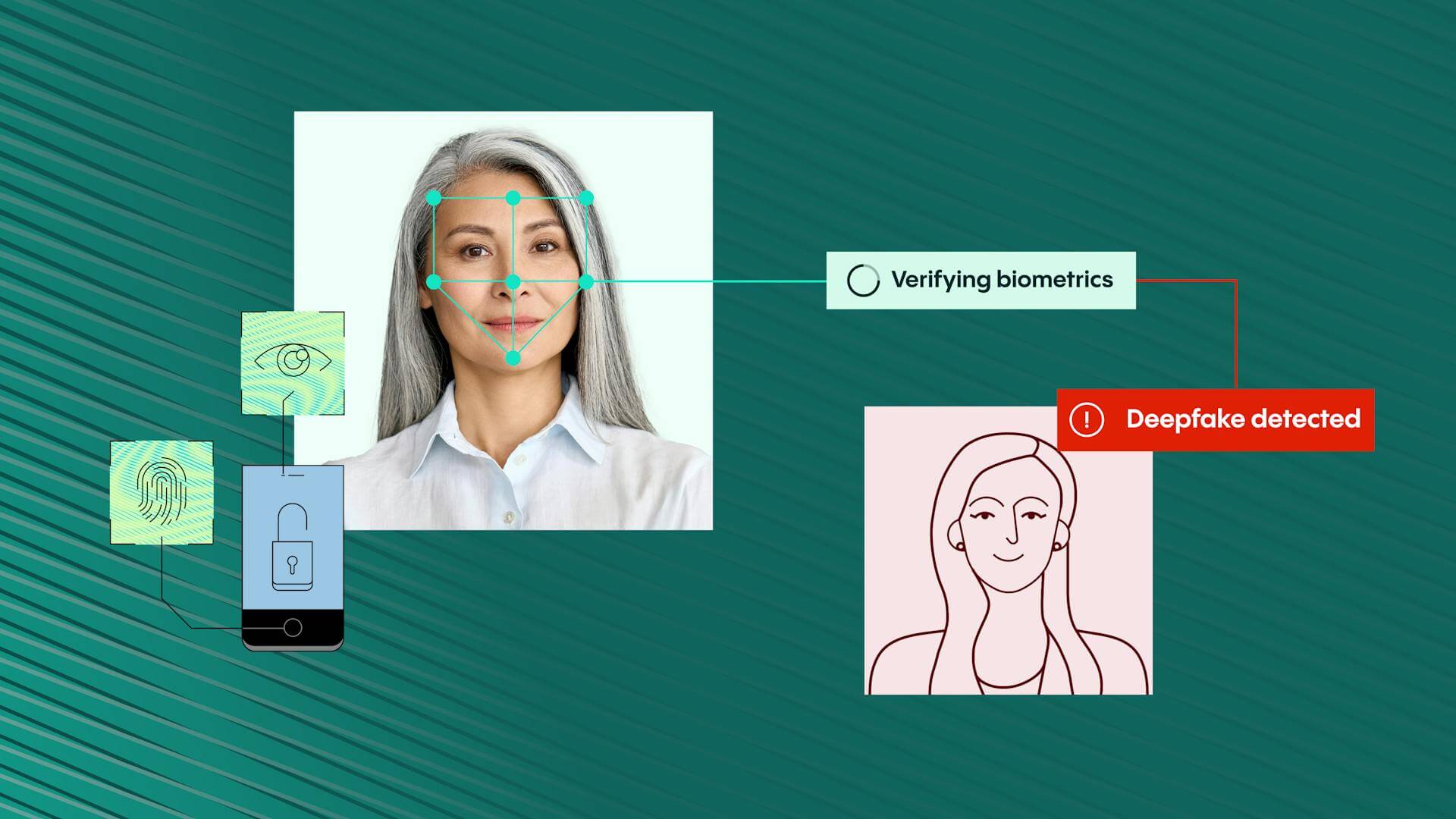

As generative AI expert Akshar Jain noted in a recent LinkedIn post, “Verification systems that rely on ‘just a photo’ are officially outdated.” We couldn’t agree more. Picture-based identity verification (IDV) isn’t dead, but it is at a crossroads. The emergence of generative AI has exposed the vulnerabilities of outdated, single-layer verification systems, forcing the industry to confront a stark reality: that static photo checks alone can’t keep up.

The speed at which hyper-realistic fake identity documents are being created is evolving faster than many companies’ ability to detect them. These documents often contain fake information that can be difficult to distinguish from genuine data. Picture-based KYC — which once felt like the pinnacle of innovation — is now dangerously close to becoming outdated.

What smart risk leaders do differently

Here’s how forward-thinking fraud and risk leaders we work with are responding:

1. Double down on multi-layered verification

Your fraud stack needs more than visuals. It needs:

- Biometric face matching + liveness detection

- Cryptographically signed documents

- Official data cross-checks (e.g. DMV, SSN databases)

- Fraud pattern analysis using AI and machine learning

This isn’t about adding friction. It’s about ensuring trust without compromise.

2. Leverage AI — Don’t just fear it

Yes, AI creates fakes. But it also detects them.

Use AI to:

- Spot document anomalies

- Identify synthetic patterns

- Flag suspicious behaviors in real time

- Analyze fraud signals across devices, networks, and behavior.

Guardrails are key. But so is action.

3. Make the case for smarter regulation & data access

Push for:

- Access to real-time verification APIs (Aadhaar, SSN, etc.)

- Standardized frameworks to detect AI-generated content

- Clarity on legal boundaries around synthetic ID usage

If your stakeholders hesitate, remind them: Fraud is not just a risk. It’s a revenue and reputational threat.

4. Educate your org relentlessly

Many internal teams still think static image checks are “good enough.” Your job is to change that. Use:

- Real examples of AI-generated forgeries

- Benchmarks from other fraud leaders

- Data on failed verifications and manual review rates

You’re not just a fraud lead — you’re a change agent.

5. Quantify the risk — and the ROI

Failure to verify means:

- Fines, losses, and damaged reputation

- Missed conversion goals

- High onboarding friction (when users are flagged unnecessarily)

Success with multi-layered identity verification means:

- Reduced fraud

- Lower manual review costs

- Faster onboarding

- Trust built at every checkpoint

Why Veriff’s ahead — and how you can be too

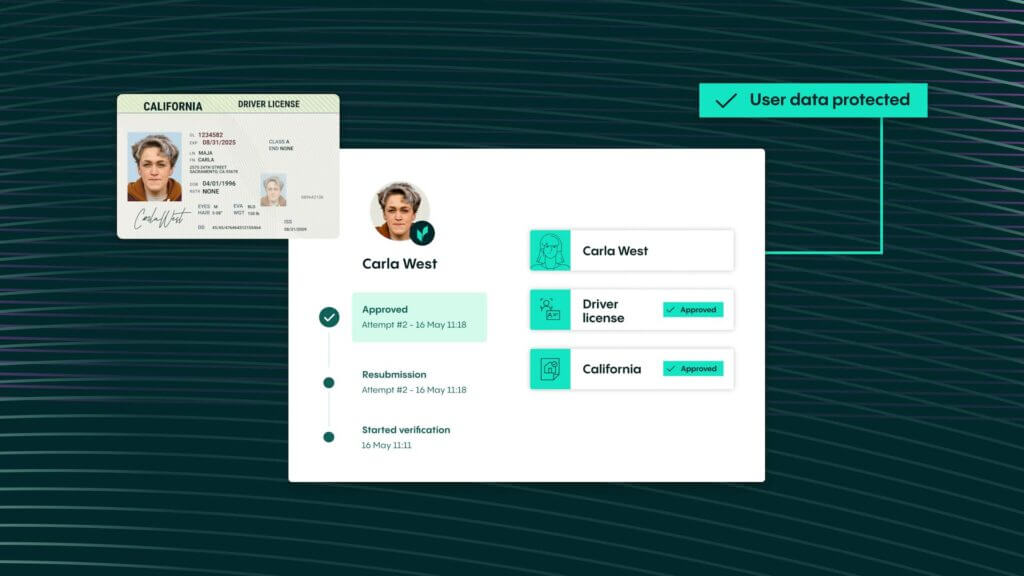

Veriff has spent nearly a decade perfecting resilient verification solutions, and their importance has never been greater. Our advanced document maker tools are built to create secure, verifiable documents that meet the highest standards of trust and accuracy.

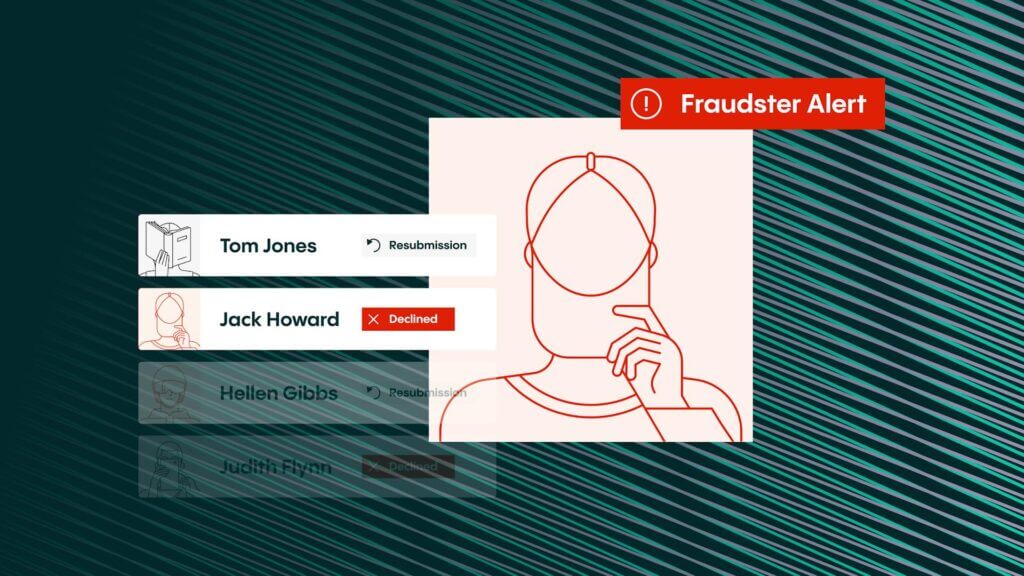

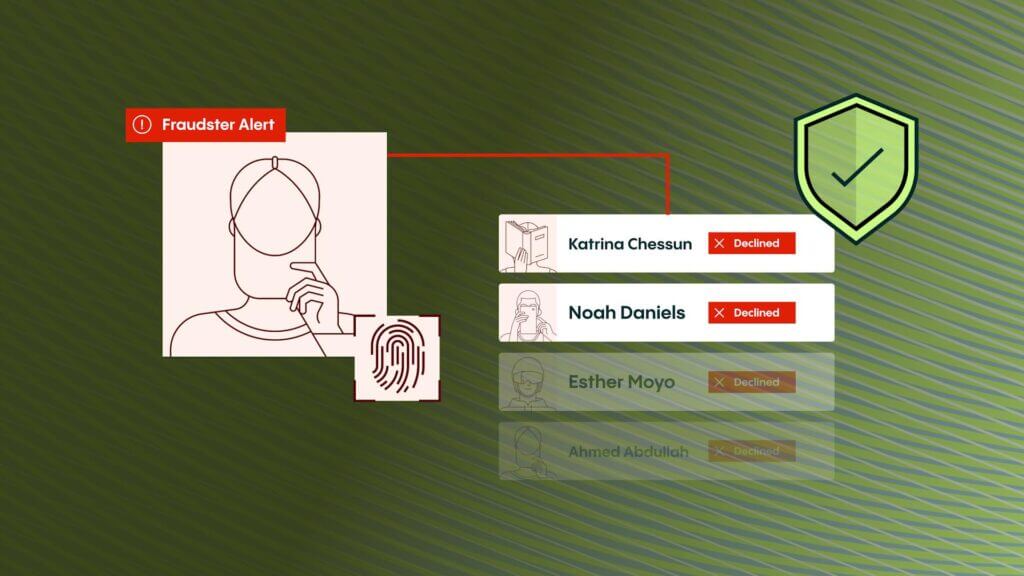

Our document and identity verification solution enables precise onboarding of legitimate customers while maintaining high conversion rates. Powered by Fraud Protect, it leverages machine learning and advanced fraud prevention techniques to counter evolving threats effectively. Fraud Intelligence adds another layer of value, offering enriched insights to optimize fraud investigations.

Our approach is multi-layered by design:

- Biometric Authentication with liveness detection

- Fraud Protect: 30+ risk signals analyzed per session

- Synthetic media detection: AI-powered fake spotting

- Actionable insights to help your team make smarter, faster decisions

We don’t just plug the gaps. We predict them — and build ahead of the curve.

Your shield against AI-Generated threats

See why Veriff is the best choice to prevent AI-generated fraud.