KYC Article

KYC fintech solutions: A guide for startups and SMBs

Navigating the fintech world isn’t easy—startups and SMBs are constantly juggling strict regulations while trying to deliver a flawless customer experience.

Best practices to streamline verification, reduce fraud, and build digital trust

Discover how KYC fintech solutions empower startups and SMBs to streamline compliance, prevent fraud, and earn user trust. Learn how best-in-class tools like Veriff help you build a secure and scalable digital future.

Key takeaways

- KYC fintech solutions are critical to lowering fraud risks and ensuring regulatory compliance.

- Startups and SMBs can automate onboarding with scalable, cost-effective KYC platforms.

- Fintech compliance demands a smart balance of speed, user trust, and regulatory demands.

- Veriff’s AI-driven technology accelerates verification, detects advanced fraud, and maximizes approval rates for legitimate users.

What are KYC fintech solutions?

KYC fintech solutions are advanced digital tools that enable financial technology companies to verify customer identities, stay compliant, and curb fraud. Leveraging automation, biometrics, and real-time regulatory intelligence, these platforms make onboarding seamless and secure.

KYC—“Know Your Customer”—is mandatory for all financial institutions to combat identity theft, money laundering, and terrorist financing. While traditional banks utilize slow, manual checks, fintechs must onboard users anytime, anywhere, often within seconds. This makes dedicated KYC fintech solutions essential in today’s digital-first landscape.

Why startups and SMBs need them

For fintech startups and SMBs, an efficient and secure onboarding process isn’t optional—it’s vital for survival and growth.

- Build trust instantly: In a competitive market, a clumsy or unsafe sign-up process drives users to rivals. Frictionless verification boosts immediate credibility.

- Enable rapid scaling: Manual compliance reviews can’t match the pace of tech-driven growth. Automation is the only viable route for fast onboarding.

- Reduce operational burden: External KYC solutions are far more affordable and sustainable than building in-house systems or risking steep non-compliance penalties. FATF provides solid guidance for global standards.

- Combat fraud: New fintechs are a magnet for fraudsters seeking weak spots. Sophisticated KYC stops fraud at the front door.

Benefits of KYC fintech solutions

Modern KYC solutions not only shield businesses from regulatory fines and fraud losses—they also accelerate onboarding and fuel sustainable growth.

Compliance and fraud prevention

Security is the foundation. Strong KYC solutions automate AML (Anti-Money Laundering) and CTF (Counter-Terrorist Financing) compliance.

- Avoid fines: Automated solutions document every step, supporting regulatory audits by the FCA, FINCEN, and global authorities.

- Stop fraud before it starts: Tools powered by biometrics, liveness detection, and document forensics block fake accounts and synthetic identities.

Enhanced user experience and growth

KYC is often the friction point in sign-ups. Modern solutions flip this bottleneck into a competitive advantage.

- Accelerate onboarding: Cut verification from minutes or days to under 30 seconds.

- Reduce drop-off: Simpler, faster processes keep more users in your funnel.

- Raise approval rates: AI precision approves legitimate customers who may be wrongly rejected by legacy systems.

SECURE YOUR BUSINESS

We help you onboard new customers from all over the world and frow your business

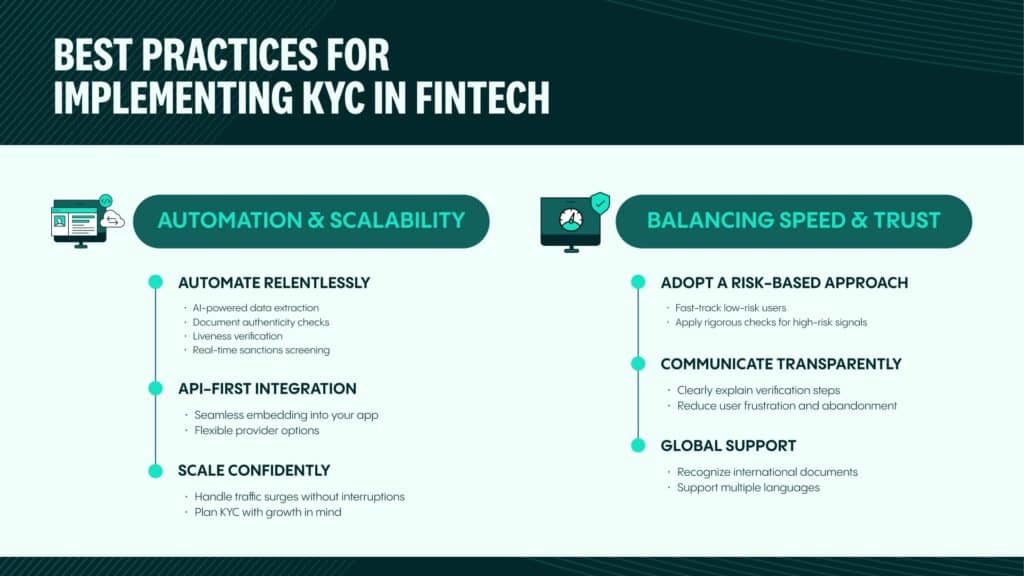

Best practices for implementing KYC in fintech

The best results come from combining automation, tailored compliance flows, and a risk-based approach that adapts to both regulations and user experience.

Automation and scalability

Plan your KYC for future growth—even if you’re just getting started.

- Automate relentlessly: Use AI for extracting data, checking document authenticity, verifying liveness, and running real-time sanctions checks.

- API-first integration: Choose flexible providers that embed directly into your app for a seamless experience.

- Scale confidently: Your solution should handle surges in traffic (like after a product launch) without hiccups.

Balancing speed and trust

- Adopt a risk-based approach: Fast-track low-risk users; apply more rigorous checks for high-risk signals.

- Communicate transparently: Clearly explain verification steps to users—this builds trust and reduces abandonment.

- Global support: Make sure your platform recognizes a broad range of international documents and languages.

Read the KYC guide to gain actionable insights and proven best practices that protect your business and foster lasting trust.

How Veriff helps fintechs succeed

Veriff delivers KYC solutions tailored to the fast pace and high stakes of fintech. Our powerful AI detects and blocks sophisticated fraud—including deepfakes, forgeries, and account takeovers—while maximizing conversion rates for real users. Veriff’s API-first platform is easy to integrate and future-proofs your onboarding, scaling from small pilot programs to global rollouts. With support for hundreds of ID types and best-in-class regulatory coverage, Veriff empowers fintechs to enter new markets quickly and compliantly.

Veriff’s decision engine continuously learns from a global set of fraud patterns, making it one of the few platforms ready for tomorrow’s threats today. By choosing Veriff, fintechs can shorten onboarding to seconds, minimize operational costs, and maintain a digital trust standard that users and regulators expect. Veriff helps financial services build global trust with fast, secure identity verification and seamless compliance. Learn more. https://www.veriff.com/industry/financial-services

Case study: Neobank scales securely

One European neobank saw a dramatic shift after implementing Veriff: 93% of users were approved automatically, and verification times dropped below 30 seconds. For SMBs and startups, this kind of efficiency isn’t just a luxury — it’s a competitive edge. Read the case study.

For fintech startups and SMBs, KYC is not just a regulatory hurdle—it is a foundational element of your business. In a digital world, trust is your most valuable currency.

Choosing the right KYC fintech solution allows you to meet compliance obligations, deliver the fast experience users demand, and build a secure platform for growth. By automating verification and stopping fraud at the source, you can focus on what you do best: building the future of finance.

Building digital trust with KYC fintech solutions

For startups and SMBs, KYC is the backbone of credibility and protection. Modern platforms like Veriff allow you to automate compliance, streamline onboarding, and focus on innovation—giving your business a foundation of trust in the digital economy.

Frequently Asked Questions

How do KYC fintech solutions help startups?

They allow startups to scale quickly by automating user verification, which is cheaper and faster than manual review. This reduces customer drop-off, builds user trust, and ensures compliance from day one, helping to avoid massive fines.

What regulations must fintechs comply with in KYC?

This varies by region, but most fintechs must comply with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. Key regulations include the Bank Secrecy Act (BSA) in the U.S., the FCA’s guidelines in the UK, and the EU’s AML Directives.

Are KYC fintech solutions affordable for SMBs?

Yes. Modern SaaS (Software-as-a-Service) providers like Veriff offer flexible, usage-based pricing models. This is far more affordable for an SMB than building a compliant system in-house or hiring a large compliance team.