Identity verification with a human touch

Podcast

ViewWe are sorry but this service is not available in your location.

The market for unsecured loans is in a period of flux, with higher interest rates and the cost of living affecting customers across the world. An uncertain market can increase the risk of fraud, requiring businesses to implement effective processes to keep themselves and their customers safe.

The necessity to comply with numerous regulations can prove a challenge in the fintech world. Choosing Veriff as your verification partner gives you that compliance while also integrating into your existing system, so simply it’ll be like we were always there.

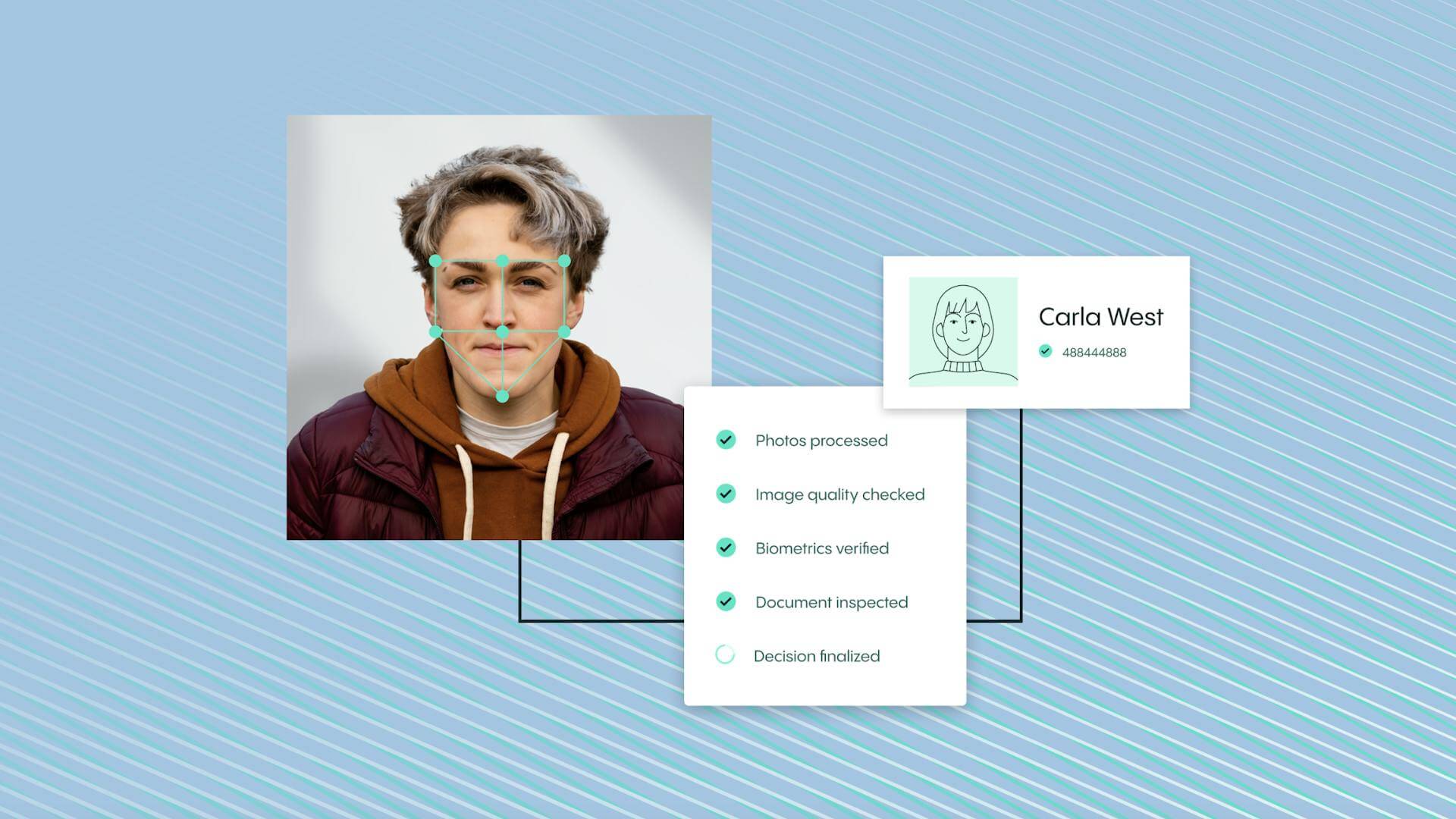

To achieve regulatory compliance, prevent the risk of bad actors, and help build customer trust, businesses in financial services, gaming, and many other sectors are increasingly adopting Veriff’s identity verification platform. Discover how you can be sure it’s the right call for your business.

ell Veriff a bit about you and we’ll put you in touch with our team right away.