KYC Article

2025 Guide to acceptable KYC documents

With online KYC, the user is asked to upload a picture of an officially valid document (OVD), which a piece of software scans. The document’s details are checked against government databases for validity and accuracy. They are also run past an intelligent predictive system to rank the client’s risk profile.

Know Your Customer (KYC) ensures that businesses verify the identity of their users and confirm they are who they claim to be. While the fundamentals of KYC remain the same across industries, the methods and document types used for verification have evolved—especially with the rise of digital onboarding, reusable digital identities, and machine-verifiable credentials.

Digital KYC (eKYC) has made verification faster, smoother, and more cost-effective. Instead of manual document checks, users simply submit a photo of an Officially Valid Document (OVD) or authenticate using a government-issued digital ID. Automated systems validate the information against government databases, assess authenticity, and evaluate customer risk using predictive analytics. In this guide, we outline traditional KYC documents and introduce modern OVDs and digital credentials increasingly recognized in 2025.

KYC document categories

Most regulatory frameworks classify KYC documents into three main categories:

- Identity proof documents

- Address proof documents

- Income proof documents

1. Identity proof documents

Identity proof verifies that the individual is real and authorized to access a service. Traditionally, one of the following documents is accepted:

Traditional Identity Documents

- National ID card

- Passport

- PAN card

- Voter card

- Driving license

- Central or state government ID

- Letter from a recognized public authority

- Banking book with photo ID

- Employee ID card (usually alongside another document)

- University or student ID card (supporting document)

Required elements for KYC validity

An identity document must include:

- Full name

- Document number

- Residential address

- Clear face image

- Date of birth

- Issue/expiry date

2. Address proof documents

Address proof confirms where a customer currently resides. Typically, customers must provide one identity proof and one separate address proof.

Common address documents include:

- Passport

- Voter card

- Driving license

- Electricity or phone bill (≤ 6 months old)

- Bank statement (often physical copy)

- Gas bill (≤ 6 months old)

- Credit card statement

- House purchase deed

- Rental/lease agreement (often with 3 months’ rent receipts)

- Employer’s residence certificate

3. Income proof documents

Businesses may request income verification for financial services, credit products, or risk assessments.

Accepted income documents:

- Income tax returns

- Salary slips/pay slips (typically last 3 months)

- Bank statements

4. Modern identity documents & digital credentials

As global KYC shifts toward digital-first onboarding, governments and regulators increasingly recognize machine-verifiable digital IDs and API-based credentials as legally valid OVDs.

A. Government-issued digital IDs (e-IDs)

These digital identities enable secure, reusable, and cryptographically verifiable authentication.

Examples include:

- EU Digital Identity Wallet (EUDI)

- Estonia e-Residency ID

- India Aadhaar (when used with OTP/Biometrics for eKYC)

- Singapore SingPass

- UAE Pass

- Nordic BankID (Sweden, Norway, Finland)

✔ Legally valid

✔ Strong authentication (MFA/biometrics)

✔ Machine-verifiable and tamper-evident

These digital OVDs dramatically reduce friction, prevent document forgery, and support instant identity verification.

B. Verified digital documents via government APIs

Rather than uploading physical documents, users can now authorize businesses to retrieve verified credentials directly from government systems.

Examples:

- India DigiLocker documents

- UAE Digital Document Vault

- Brazil gov.br digital credentials

- Singapore MyInfo API

These integrations eliminate manual errors, reduce fraud risk, and enable near-instant approval workflows.

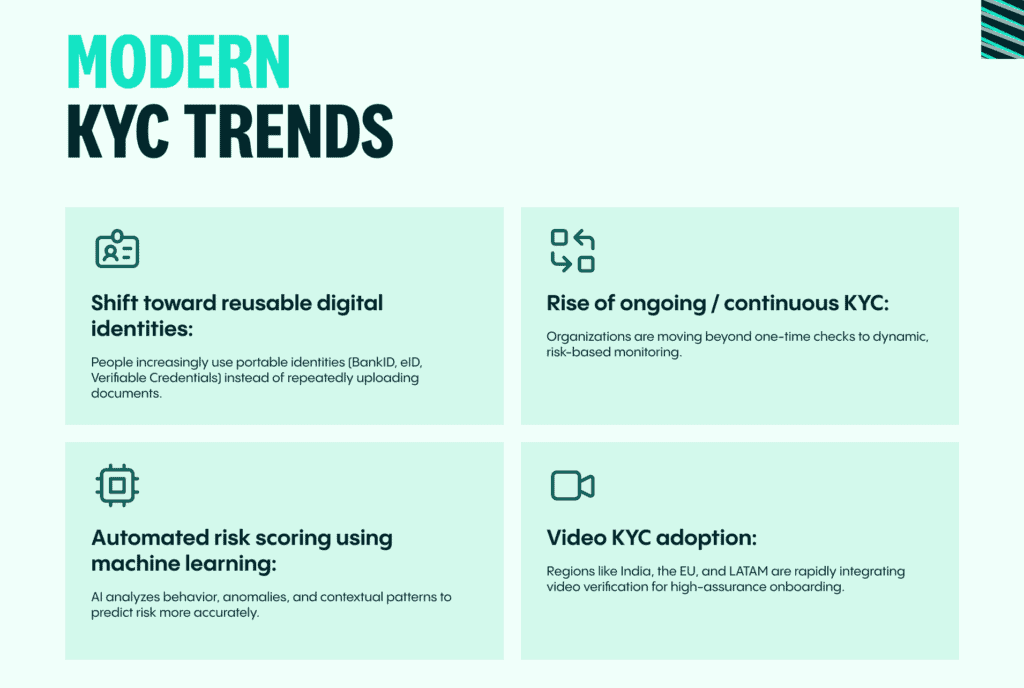

Modern KYC trends

- Shift toward reusable digital identities: People increasingly use portable identities (BankID, eID, Verifiable Credentials) instead of repeatedly uploading documents.

- Rise of ongoing / continuous KYC: Organizations are moving beyond one-time checks to dynamic, risk-based monitoring.

- Automated risk scoring using machine learning: AI analyzes behavior, anomalies, and contextual patterns to predict risk more accurately.

- Video KYC adoption: Regions like India, the EU, and LATAM are rapidly integrating video verification for high-assurance onboarding.

How Veriff helps

Veriff provides a modern, compliant KYC and AML screening solution powered by advanced identity verification, PEP & sanctions monitoring, media checks, and continuous risk assessment. Our platform supports both traditional documents and emerging digital credentials, helping businesses stay compliant while delivering seamless customer onboarding.

If you’d like to explore how Veriff can strengthen your compliance strategy, our team would be happy to provide a personalized demo.