Blog Post

Customer due diligence with Veriff

At a basic level, CDD processes require a financial institution to collect a customer’s name and address, information about the business in which they are involved, and how they will use their account. In order to ensure that customers are being honest, companies must verify all of the information provided.

Obliged entities such as financial institutions are legally required to verify the identity of their customers. They’re also required to gain an understanding of the level of risk each customer poses and know the nature of the business in which they are involved. The process of establishing customer identities and risk levels is known as customer due diligence (CDD).

In this guide, we’ll explain everything you need to know about customer due diligence. As well as answering popular questions such as ‘what is customer due diligence?’, we’ll also look at why the process is so important and how our class-leading solutions can help financial institutions meet their regulatory obligations.

What is customer due diligence? (CDD)

Customer due diligence is the act of collecting customer information and performing checks on the information provided. In carrying out the CDD process, a financial institution can ensure that each customer’s identity is verified. They can then also accurately assess the level of money laundering risk posed by each customer.

At a basic level, CDD processes require a financial institution to collect a customer’s name and address, information about the business in which they are involved, and how they will use their account.

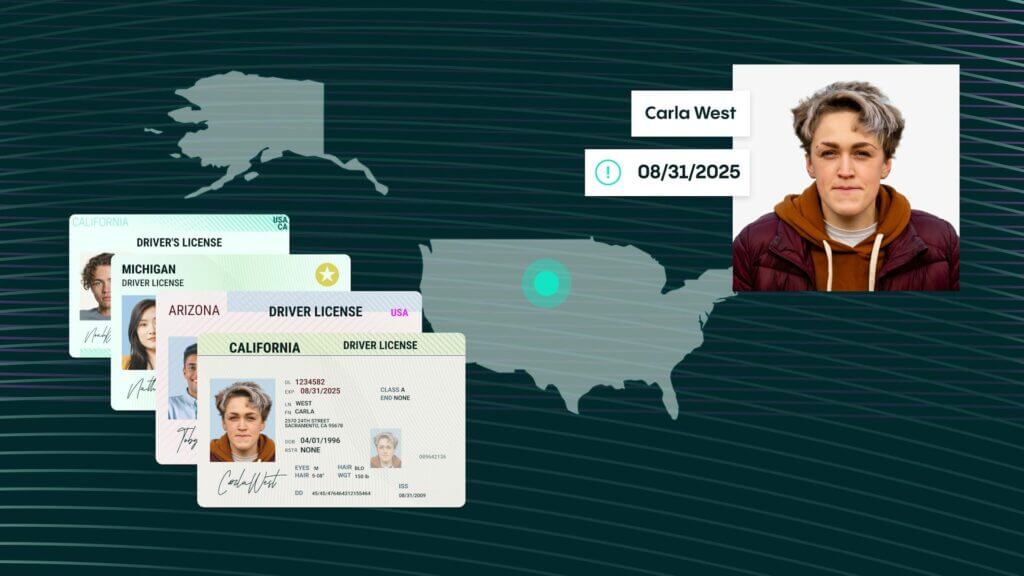

In order to ensure that customers are being honest, companies must verify all of the information provided. To do this, a company will usually ask the user to provide a government-issued document, such as a passport or driving license.

What does the CDD process look like?

So, with this in mind, how is the actual CDD process carried out by financial institutions?

Well, firstly the customer is usually asked to fill in an online form that asks for basic details such as their name, address, and other relevant data. Then, the customer is asked to provide a photo of their government-issued ID and a selfie.

The financial institution can then check this information against a variety of databases to ensure the customer exists and that the person in the photo matches the person on the ID. They can also check if the ID provided is legitimate.

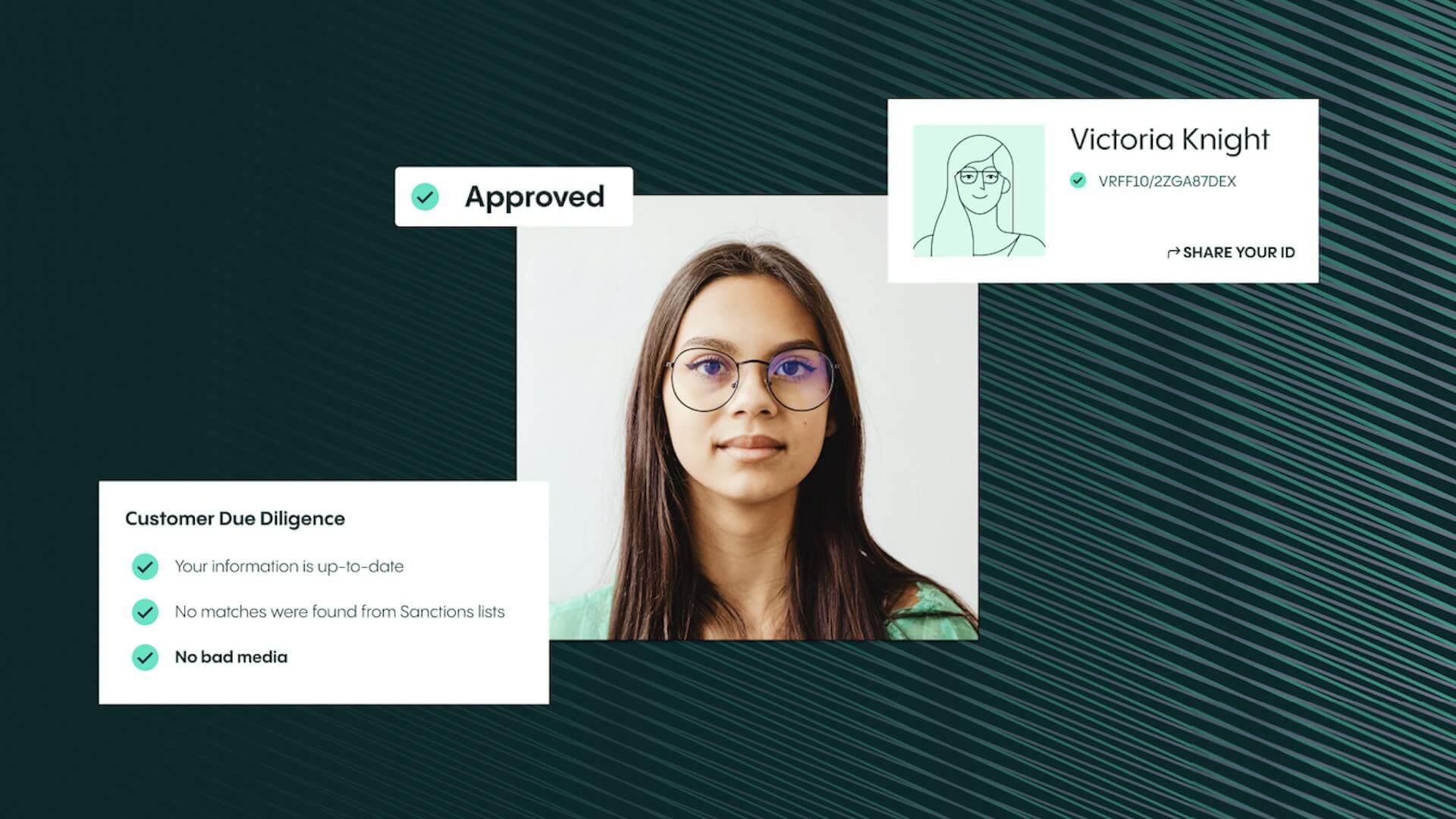

At this point, the financial institution can also check for fraud signals and screen the user against government-issued watchlists and politically exposed persons (PEP) lists. Based on the results of these checks, users can then be verified and assigned to risk pools. Verified users can then be onboarded.

Although the CDD process is a major part of customer onboarding, it’s also important to add that the CDD process is never complete. After a new customer has been onboarded with a financial institution, they must be continually monitored. This is because a customer’s activities may change. If they do, then this will affect their risk profile. Due to this, many financial institutions will also monitor and analyze the transactions of their customers as part of the ongoing due diligence process.

Finally, it should also be noted that most international KYC standards require financial institutions to take a risk-based approach to customer due diligence. This means that customers that pose a higher risk level will be subject to enhanced due diligence (EDD) processes, while those who pose a lower risk level will face a more streamlined form of CDD for efficiency.

Why is CDD important for the finance industry?

Effective CDD processes are vital for financial institutions. This is because CDD is at the heart of anti-money laundering (AML) and know your customer (KYC) initiatives. For this reason, the CDD process has been designed to help banks and financial institutions prevent financial crimes like money laundering, terrorist financing, human and drug trafficking, and fraud.

On top of this, there are a number of other reasons why financial institutions carry out customer due diligence. These include:

- Ensuring the organization remains compliant with regulations and laws

- Ensuring that the customer is exactly who they’re claiming to be

- To guard against fraudulent activity

- Assisting law enforcement professionals

- Avoiding huge compliance fines

- Maintaining the company’s reputation and standing

How does Veriff help?

Complying with AML and KYC requirements can be tricky for banks and financial institutions. After all, if customers are asked for vast amounts of information, then the onboarding process can become burdensome which can turn customers away. Plus, if the process is lengthy, it can also be costly for banks.

Thankfully, investing in our solutions can help streamline the process. As a result, you can save money and time while also maximizing your conversion rates.

For example, our identity verification platform can smooth out and speed up the onboarding process for new customers. It allows you to only enable the checks that you need, so you can scale fraud prevention up or down, as required.

On top of this, a user’s identity can be verified in only 6 seconds. This means you can streamline the onboarding process and make it simple for honest customers to access your services. Your team can also monitor results in real time, so you’ll always have a clear overview of where your users are in the verification process.

Similarly, if you’re looking to fight financial crime, then our AI-powered AML and KYC compliance solution is perfect for the job. As well as verifying the identity of your customers, our powerful solution also screens PEP and sanctions watchlists (which are updated in real time), checks for adverse information and media about a customer, and provides ongoing monitoring and alerts you if anything changes.

With accurate, automated decision-making, Veriff stops bad actors from exploiting financial services, crypto companies, and industries of all kinds.

Speak with the due diligence experts at Veriff

To discover how our identity verification and AML and KYC solutions can help you, speak to our due diligence experts today. Simply provide us with some basic details and we’ll offer you a personalized demo that shows exactly how our solutions can streamline your CDD processes.