KYC Article

What is Address Identification and why it matters for regulated industries?

In today’s digital-first world, verifying someone’s identity isn’t just about confirming who they are—it’s also about proving where they live. That’s where address identification becomes critical.

Whether you’re onboarding a new banking client, a crypto investor, or a gaming customer, verifying a user’s residential address plays a central role in compliance, fraud prevention, and building trust. But what exactly is address identification, and why is it so important—especially in regulated industries?

What is Address Identification?

Address Identification refers to the process of verifying an individual’s current residential address using documents or trusted data sources. It’s often a core component of Know Your Customer (KYC) and Customer Due Diligence (CDD) processes—especially under Anti-Money Laundering (AML) legislation.

Acceptable Proof of Address documents

In the UK, the Government’s Proof of Identity Checklist outlines acceptable documents for proving both identity and address. For proof of address, these include:

- Utility bills (dated within the last 3 months)

- Bank or building society statements

- Council tax bills

- Mortgage statements

- Tenancy agreements

- Government-issued letters

Importantly, the document must clearly show the customer’s name, current address, and a recent date to be valid.

Why is Address Identification so important?

1. Regulatory compliance

For businesses operating in regulated sectors—like banking, payments, insurance, or online gambling—address identification isn’t optional. Under the UK’s Money Laundering Regulations, firms must conduct risk-based identity verification, including gathering evidence of a customer’s residential address.

Financial institutions are expected to assess the credibility of the documents and implement ongoing monitoring to detect inconsistencies or changes in customer details.

The FCA Handbook reinforces this obligation. For example, when opening a new account, a firm must take reasonable steps to ensure it has verified the address of the account holder to prevent fraud or misuse of financial services.

2. Fraud prevention

Fraudsters may use stolen or synthetic identities to open accounts, access financial services, or launder money. Address identification provides an extra layer of verification that deters fraud and makes it harder to impersonate real individuals.

Especially in sectors like fintech or crypto—where onboarding happens online and at scale—automated address verification is essential to flag suspicious behavior early.

3. Customer trust & operational efficiency

Verifying someone’s address helps businesses establish trust and reduce downstream issues like failed transactions or regulatory breaches. When done digitally, address checks also speed up the onboarding process and reduce friction—leading to better user experiences.

Real-world examples by industry

- Banking & Payments: Customers must provide proof of address to open current or savings accounts, apply for loans, or access credit. According to Citizens Information, banks require both photographic ID and proof of address under EU regulations.

- Insurance: Confirming address ensures policyholders reside in eligible regions and helps prevent false claims.

- Online Gambling: Operators must verify user location and age to comply with regional licensing rules and protect underage users.

- eCommerce & Marketplaces: Address checks help prevent fraudulent returns, account takeovers, or delivery scams.

How Address Verification works in the digital age

Modern identity verification platforms simplify the process by allowing users to upload documents or verify their address through secure data lookups. Advanced solutions may include:

- Optical Character Recognition (OCR) to extract data from scanned documents

- Liveness detection and biometrics to match documents to users

- Geolocation and IP analysis to ensure consistency

- AI-based fraud detection to flag anomalies

This layered approach enhances security while minimizing manual review and onboarding delays.

Key features of Veriff PoA include:

- Rapid results: response with less than 30 seconds, improving onboarding speed and reducing user drop-off

- Global reach: recognizes documents in over 40 languages across major global scripts, including Arabic, Cyrillic, Japanese, and Latin.

- Document tamper detection: advanced, multi-layered checks detect signs of tampered, fake, or reused documents to reduce the risk of fraud.

- Non-document-based verification: this option verifies addresses against trusted third-party databases, reducing the need for document uploads.

- Integration flexibility: the solution can be incorporated into existing onboarding processes or used for standalone checks.

“As industries race toward digital transformation, proof of address checks often remain manual and slow, yet it’s an important step in building trust and meeting regulations,” explained Oana Barbacaru, Senior Product Manager at Veriff. “Our new AI-based solution delivers a decision in less than 30 seconds, with top-tier accuracy and built-in fraud prevention. It’s reliable, fast, reduces friction – built for the future of KYC,” she added.

Oana Barbacaru, Senior Product Manager at Veriff:

“Our new AI-based Proof of Address solution is reliable, fast, reduces friction – built for the future of KYC.”

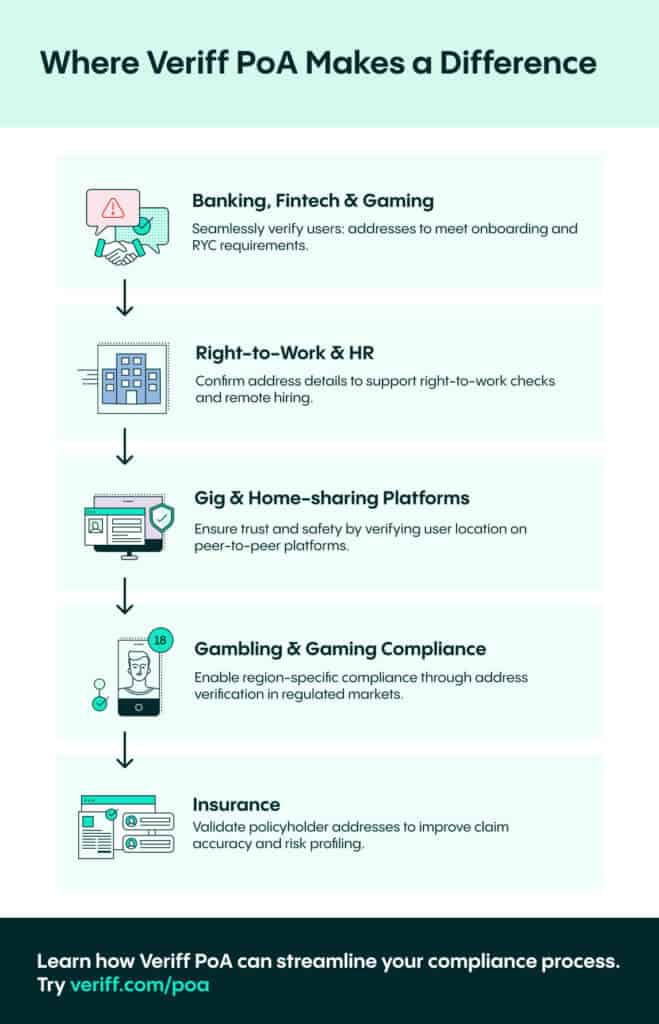

Veriff PoA can be applied to use cases such as:

- Customer onboarding in banking, fintech, and gaming

- Right-to-work checks and employee onboarding

- User verification for home-sharing and gig platforms

- Address confirmation for insurance policies and risk assessments

- Location-based compliance in gambling and gaming

Final thoughts

Address identification may seem like a basic step—but in regulated industries, it’s foundational. It strengthens compliance, deters fraud, and builds the trust needed for safe digital interactions.

As financial crime grows more sophisticated, so must your verification tools. Getting address verification right isn’t just about ticking boxes—it’s about protecting your business and your customers.

FAQs:

- Can a driver’s license be used as proof of address?

In some countries, a driver’s license is accepted as both photo ID and proof of address. However, in many regulated industries, you may still be required to provide an additional document—such as a utility bill or bank statement—for separate address verification.

- Why was my proof of address document rejected?

There are several common reasons for rejection:

- The document is too old (typically older than 90 days)

- The address is incomplete or illegible

- The name on the document does not match the ID

- The document type is not accepted (e.g., handwritten letters or mobile screenshots)

Always check the specific requirements of the institution you’re dealing with.

- Is a digital document or PDF acceptable?

Yes, many businesses and verification platforms accept digital documents, such as PDF bank statements downloaded from your online banking portal. However, screenshots may be rejected if they can’t be authenticated.

- How often do I need to provide proof of address?

You typically need to provide proof of address when:

- Opening a bank account

- Registering with a financial service

- Applying for credit or insurance

- Updating your KYC records

In regulated sectors, firms may also request updated proof periodically to comply with ongoing monitoring obligations.

Looking to simplify address identification for your business?

Discover how Veriff helps regulated industries stay compliant and onboard customers faster with seamless identity and address verification.