Baseball, banks, and biometrics: how Shohei Ohtani and bank fraud transcend boundaries

He may be the greatest athlete in the world right now and possibly the best baseball player of all time.

Abe Post-Hyatt

Shohei Ohtani’s meteoric rise in American baseball has not only captivated fans worldwide but also breathed new life into the league itself, as he challenges traditional norms and inspires a new generation of players. Typically a baseball player is either a hitter or a pitcher - but rarely both. Barry Bonds, for instance, holds the record for most career home runs (762) and most in a single season (73 in 2001) - but he never set foot on the mound. Cy Young, whose name adorns baseball’s annual best pitcher award, holds the record for the most career wins (511) and innings pitched (7,356) - but he averaged less than one home run per year in a career that spanned over two decades.

Ohtani's unique ability to dominate on the mound and at the plate has made him a global phenomenon; he dazzles as both a pitcher and a hitter. In 2022, following his unanimous selection as MVP he displayed a triple-digit fastball, a standout 2.33 ERA, and 200-plus strikeouts. At the plate he was equally formidable, recording a .273 batting average with 34 home runs and 95 RBIs. His ability to dominate both pitching and hitting at the highest levels has not only earned him multiple All-Star nods and the most lucrative contract in American sports history, but also redefines what is possible in modern Major League Baseball.

1. Veriff isn’t a baseball blog…So what am I getting at?

Veriff isn’t a baseball blog or a sports network. So, what on earth am I getting at?

Shohei is Japanese, and he moved to the US in 2018 to play for the Los Angeles Angels. He hired a translator, Ippei Mizuhara, to help him in his day-to-day responsibilities while learning English himself. For years, they have been together almost 24/7.

Late last month, reports emerged that Mizuhara had gambled on MLB games, breaking Major League Baseball's rules. In fact, in the weeks since the story broke it’s been reported that Mizuhara gambled over $16M, netting a loss of well over $40M in total - and the kicker: it was all Ohtani’s money, stolen and gambled without his consent. According to the MLB’s investigation, Mizuhara had the ability to configure settings within Ohtani’s bank account to intercept notifications and (as his job was to be familiar with Ohtani’s speech) impersonate him to gain access to his account and execute massive, fraudulent transactions.

Ohtani insists he was totally unaware of the ongoing situation. Federal prosecutors have corroborated his claim that Mizuhara, his close friend and translator, committed identity theft and fraud.

2. So now it’s a little clearer how baseball, banking, and biometrics intersect.

So now it’s a little clearer how baseball, banking, and biometrics intersect - or, rather, where they should.

Having worked in digital identity for almost half a decade myself, my first thought (after “wow, that guy is not very skilled at sports betting”) was this: where was the bank’s identity verification system? How easy was it for someone to obtain another individual’s personal information, then take control of their financial affairs under false or fraudulent pretenses and defraud a financial institution?

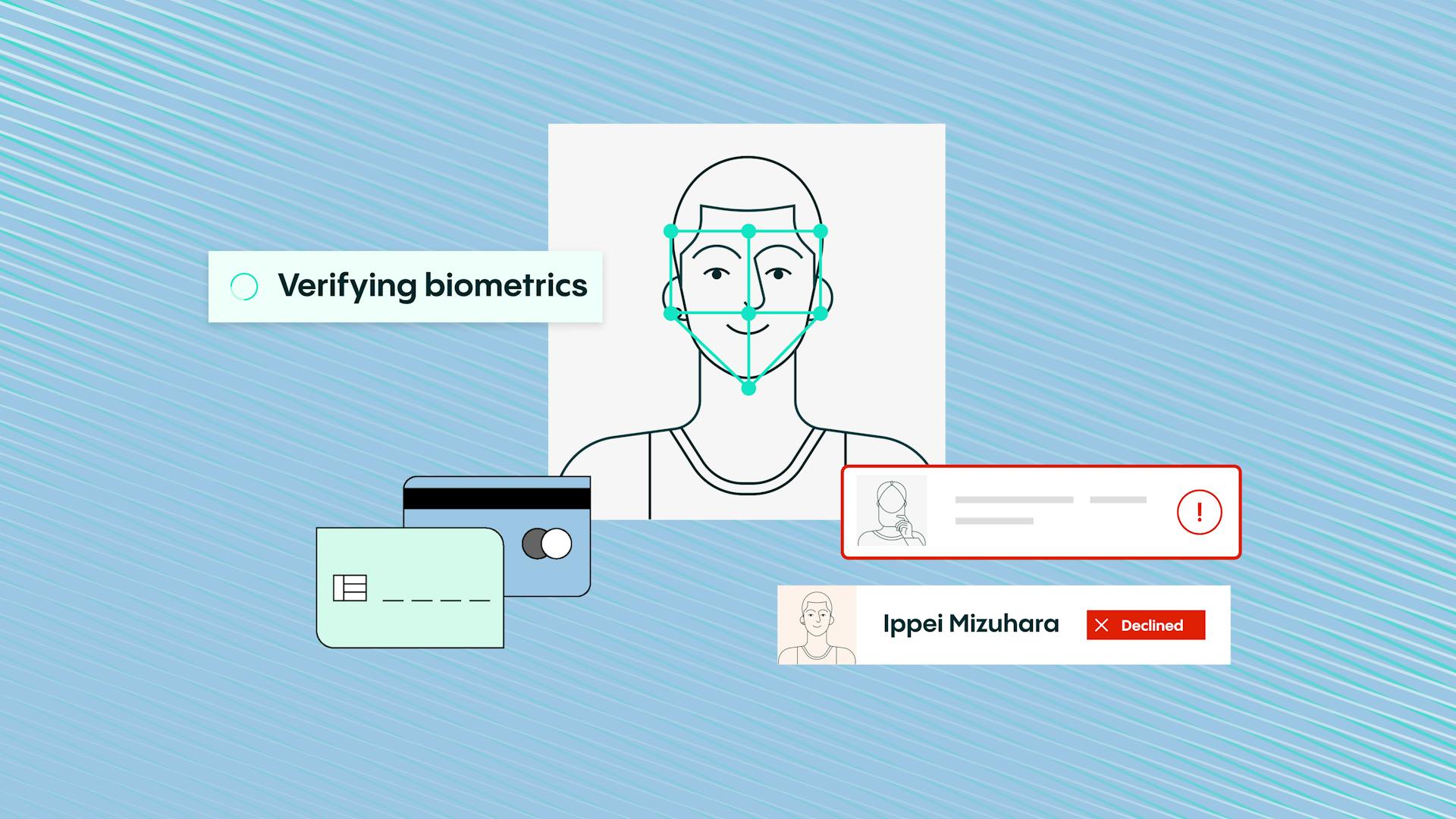

A simple biometric match could have prevented even a single transaction - not to mention other resources like device and network analytics, velocity checks, or any number of external database, SMS, or other checks that could have quite easily signaled to the issuing bank that Mizuhara was illegally withdrawing and transferring Ohtani’s funds.

Earlier this month, federal prosecutors slapped Mizuhara with felony bank fraud charges, carrying a maximum sentence of 30 years in prison. While this story garnered tons of media attention and commandeered headlines, it truly just scratches the surface of a much larger global tidal wave of identity theft and fraud.

3. Especially in times of economic change and uncertainty, fraud and theft are rampant.

While Mizuhara’s actions as a fraudster warrant legal repercussions, I would argue that financial institutions should be equally culpable in neglecting to provide sufficient security practices.

Especially in times of economic change and uncertainty, fraud and theft are rampant. Fraudsters are executing or attempting elder abuse, support scams, credit card fraud, and phishing attempts - leading to financial ruin and worse. Despite the fact that fraud grows more complex and its tooling more accessible every day, those of us whose lives are deeply intertwined with anti-fraud technology are keenly aware that situations like Ohtani’s are, quite simply, avoidable.

4. Yet some of the world’s largest banks appear not to be optimized for security.

Banks and financial services companies have plenty of access to biometric data and KYC tools that enable them to validate end users in no more than a few seconds. Yet some of the world’s largest banks appear not to be optimized for security.

Though Shohei may have allowed Ippei access to his account, and this wasn’t necessarily a case of blatant account takeover or simple identity theft, there should be guardrails around banking activities in a fraud-ridden digital world to prevent a scheme or artifice based on false representations or promises. Even in a scenario where Ohtani opts to disable security measures he - due to the nature of their seemingly close friendship - deems unnecessary, seven-figure transactions of this volume are certainly irregular for an individual banking account and should be scrutinized.

For example, when wiring a downpayment for a home purchase, one does not simply click a button - there are several key security checks - perhaps via document verification, biometric analysis, or face-to-face interactions - that are mandatory to move five or six figures-worth of cash. Though these can seem cumbersome in the moment, they are the result of our financial institutions protecting our money and looking out for our well-being.

Veriff helps banks like Monzo and payment companies like Wise secure transactions and accounts with ease and at scale. From onboarding to account takeovers and high-risk transactions, automated, accurate, and cost-efficient tools like Biometric Authentication alongside consistent and automated tracking and monitoring should be commonplace.

The best part: the ideal tools don’t impose friction on honest users who, in fact, want to feel that their money is safe. And that’s true even for those who don’t have a contract that will earn them $700 million over the next ten years.