Onboarding Article

Veriff enhances Face Match with new authentication capabilities

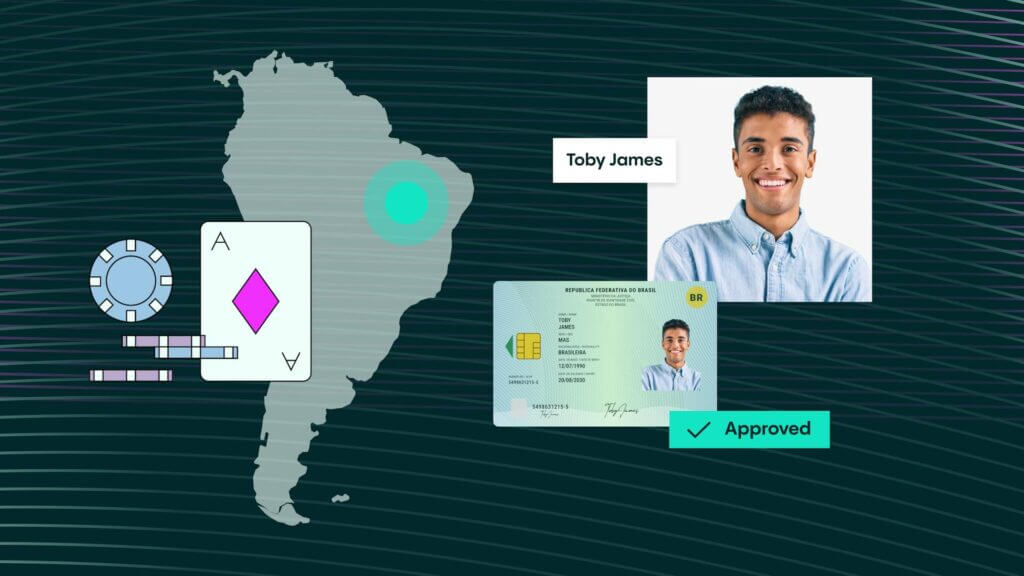

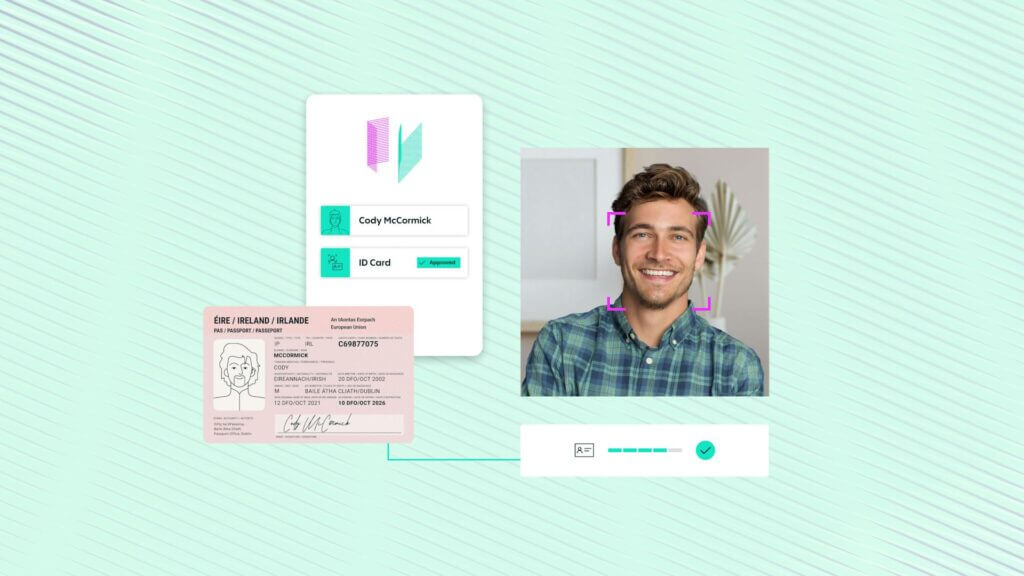

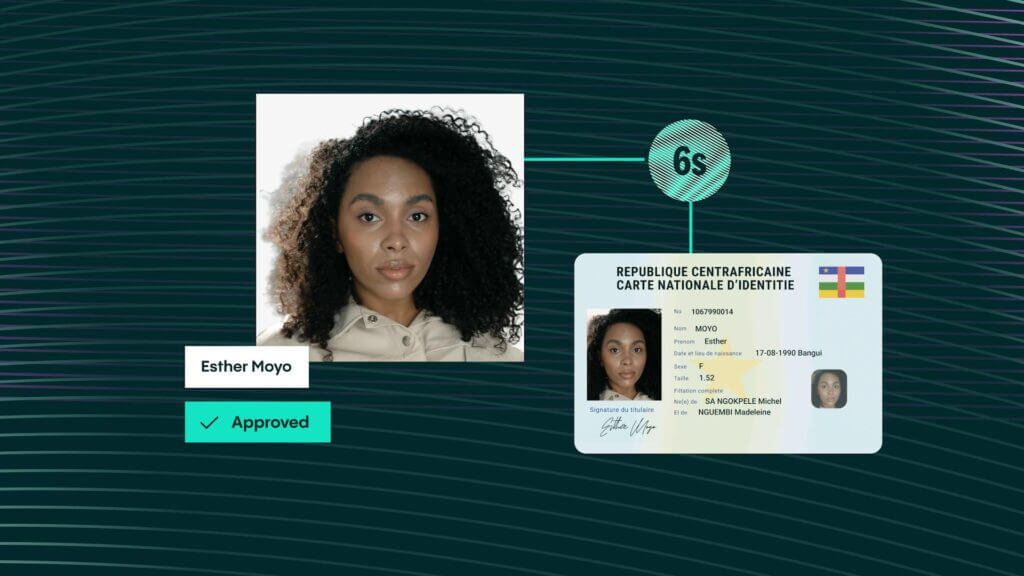

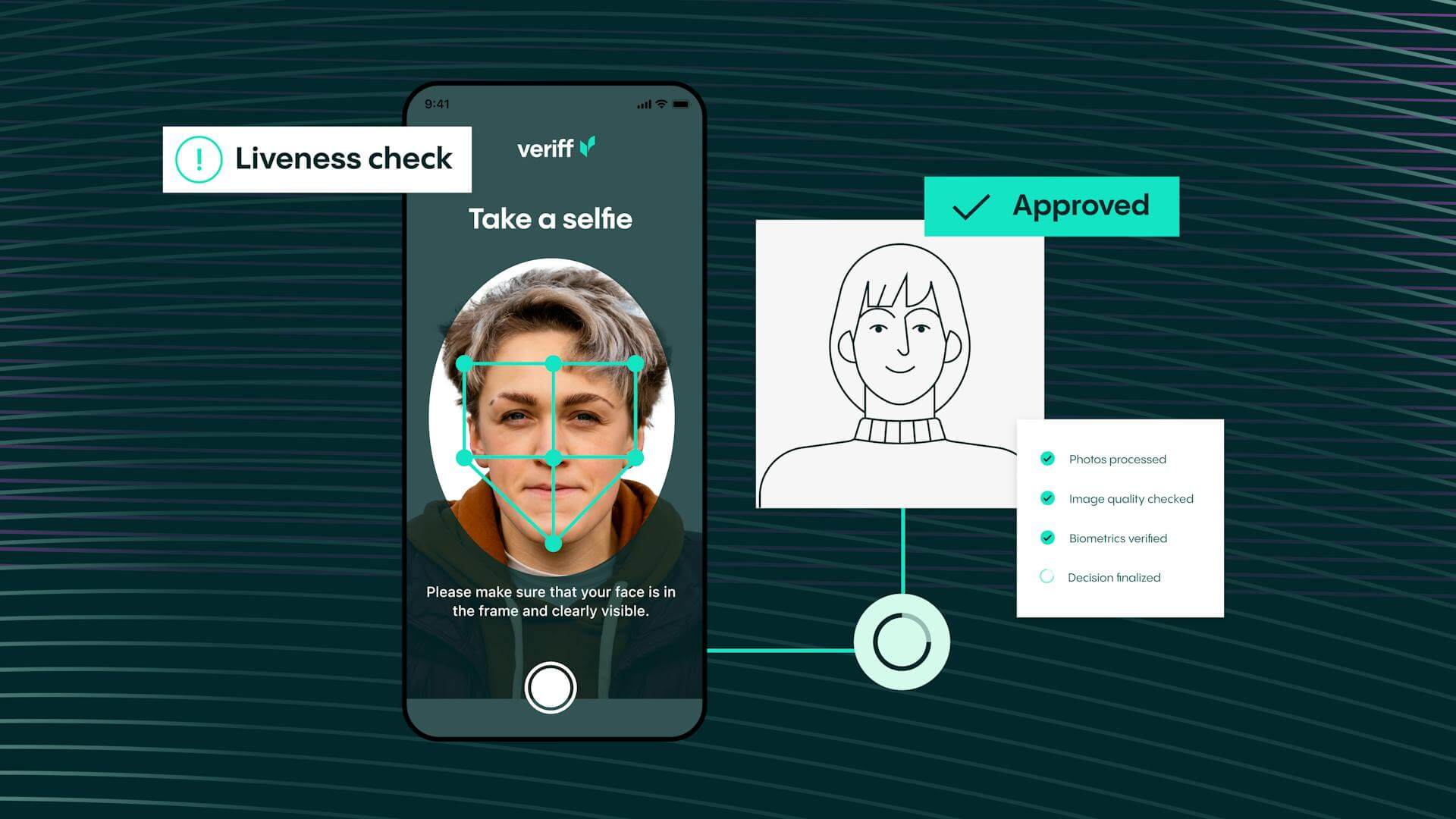

We have released a newly enhanced version of its Biometric Authentication identity verification solution. This latest version of Face Match accelerates the user authentication process, utilizing facial biometrics (via the use of a selfie) to match the returning user.

It compares the person’s selfie with Veriff’s existing session data, quickly identifying the user and activating their re-authentication preferences, eliminating friction and facilitating a smoother user experience.

There is a current market demand for strong customer authentication and continuous KYC across all businesses online. As the cryptocurrency sector thrives on the concept of frictionless digital currency exchanges, verification continues to be a necessity for organizations operating in this space as the need for real end-user security grows.

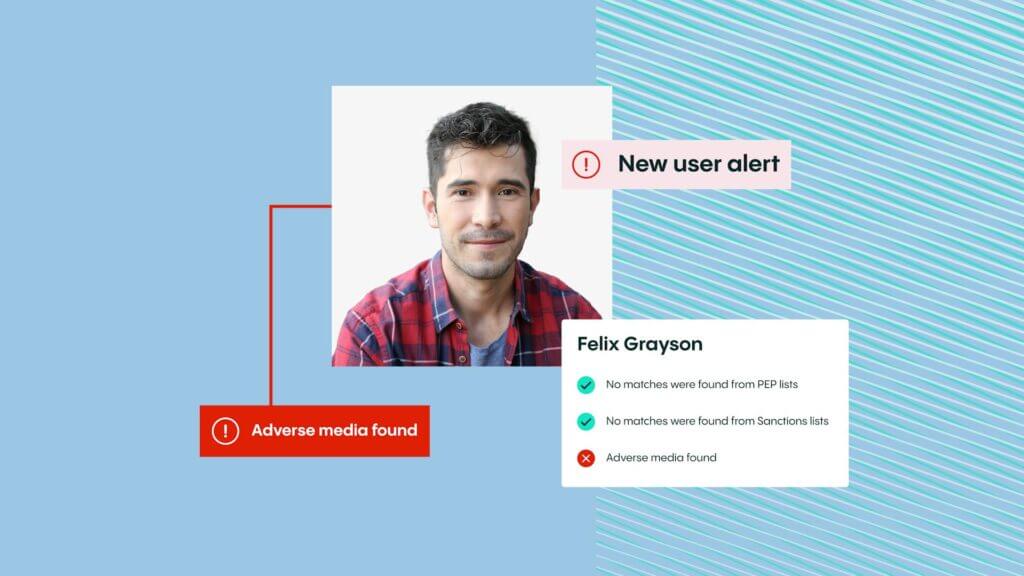

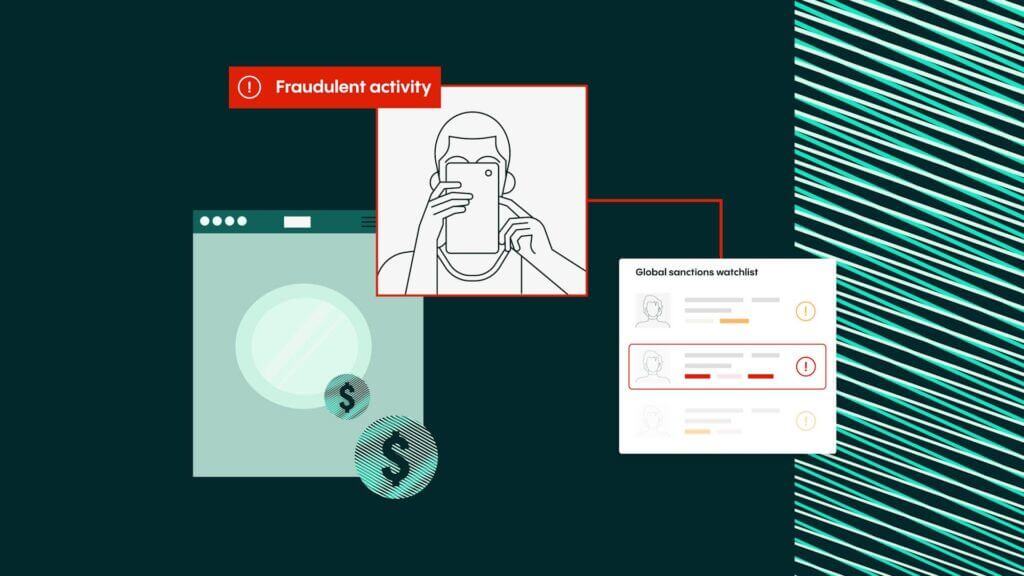

Veriff’s AI-powered Face Match technology confirms that a returning user is who they claim to be by using biometric analysis to identify and mitigate fraudulent activities such as account takeover and identity theft, eliminating user friction in the process.

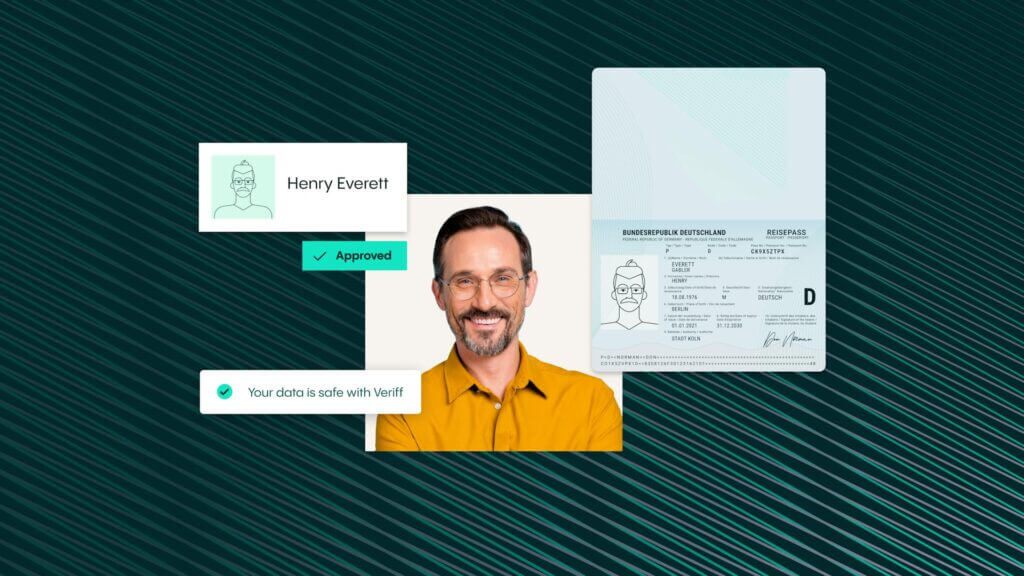

“For the past six years we’ve been working to build the most accurate verification service on the market,” said Kaarel Kotkas, Veriff founder and CEO. “Now we are ready to launch a continuous authentication Face Match product that represents another step in the identity workflow. It enables biometrics to secure accounts throughout their whole lifetime making account takeover fraud history.”

Users of Veriff’s enhanced Face Match solution will receive:

- Increased protection against account takeovers. Face Match will need to verify user actions such as a new bank account being added, a large withdrawal request, or a suspicious login from a different region.

- Reset credentials via a secured and trusted solution. If users need to reset their crypto account credentials, Face Match ensures only the account owner is accessing existing accounts.

- Maintained user security through one single set-up of the solution. Avoid time-consuming re-authentication processes with existing users and customers.

- Increased asset protection. Veriff’s biometric analysis increases safety across the board in a simple, secure, transparent and trustworthy manner.

To learn more about Veriff’s offering, please visit the Biometric Authentication page.