KYC Article

IRS special agent sees “mountains and mountains” of fraud in NFTs and crypto

In a recent conference speech, a top special agent from the United States Internal Revenue Service (IRS) stated that although non-fungible tokens (NFTs) and cryptocurrencies are “the future”, fraud and manipulation are still rampant in the space.

In a recent conference speech, a top special agent from the United States Internal Revenue Service (IRS) stated that although non-fungible tokens (NFTs) and cryptocurrencies are “the future”, fraud and manipulation are still rampant in the space.

IRS recognizes drawbacks to NFTs and crypto

Speaking at a virtual event held by the USC Gould School of Law, Ryan Korner from the IRS Criminal Investigation’s Los Angeles field office told the audience that “we’re just seeing mountains and mountains of fraud in this area.”

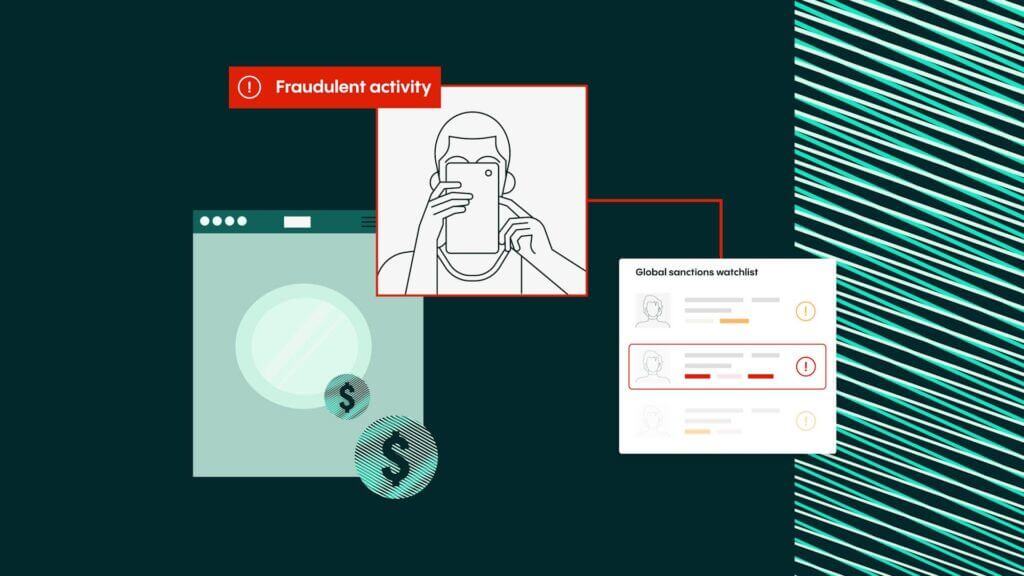

During the 2021 fiscal year, IRS investigators seized $3.5 billion worth of cryptocurrencies tied to financial crimes. This accounted for 93% of all the assets seized by the division in that time frame.

The IRS Criminal Investigation division “ended the year with 80 cases in its inventory that it was still actively working on where the primary violation was tied to crypto,” Korner said.

On top of this, he outlined various illicit behaviors such as fraud, money laundering, market manipulation and tax evasion, which are all linked to the space.

He then spoke about market manipulation in greater detail, outlining how the IRS Criminal Investigation division is currently looking at the role celebrities are playing in promoting coins and digital assets. Both Kim Kardashian and Floyd Mayweather Jr. have recently been accused of promoting an allegedly fraudulent token.

But… “this space is the future”

But, although Korner was keen to highlight some of the negatives associated with NFTs and crypto, he was also quick to say that “this space is the future”. As a result, he also noted that the IRS is actively training and educating its agents on crypto and NFT regulation.

He went on to add that the IRS has collaborated with other federal agencies, including the Justice Department, to “make sure everyone is on the same page and staying ahead of the criminals.”

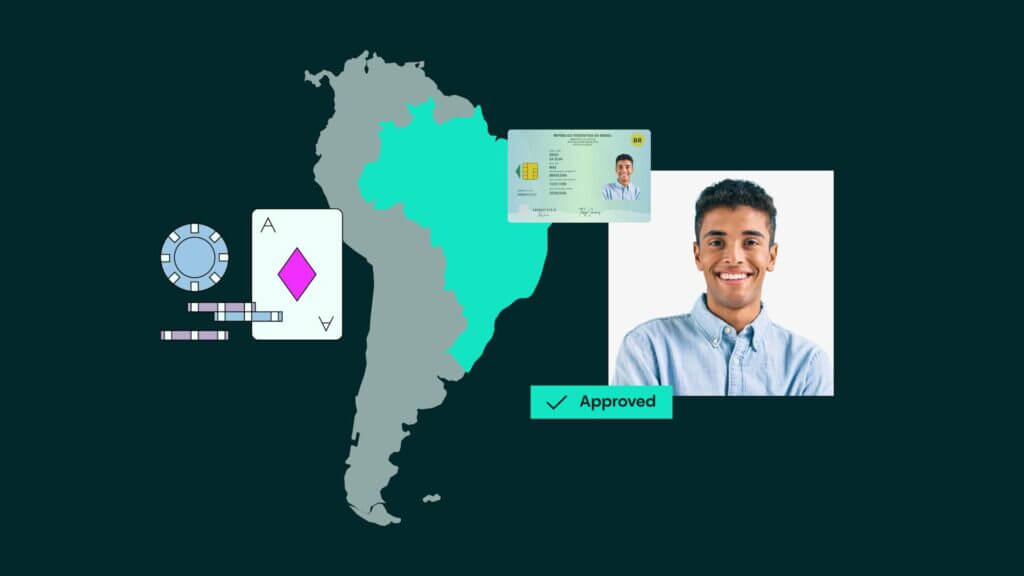

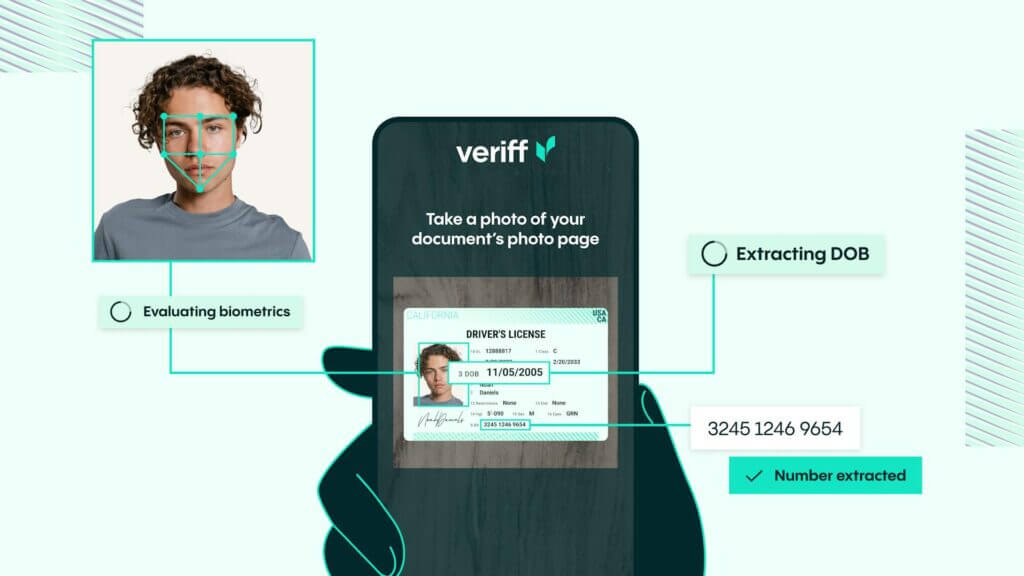

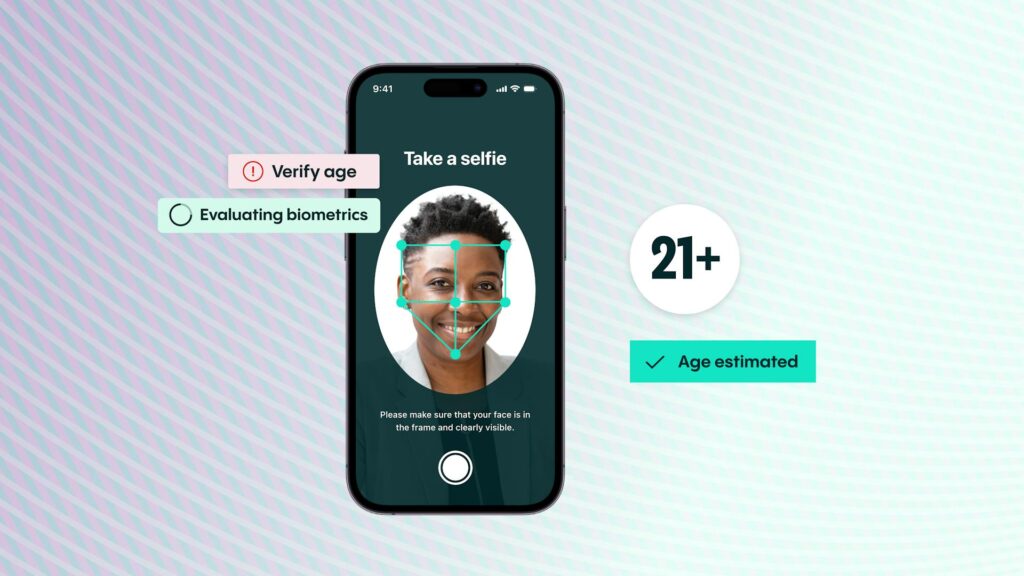

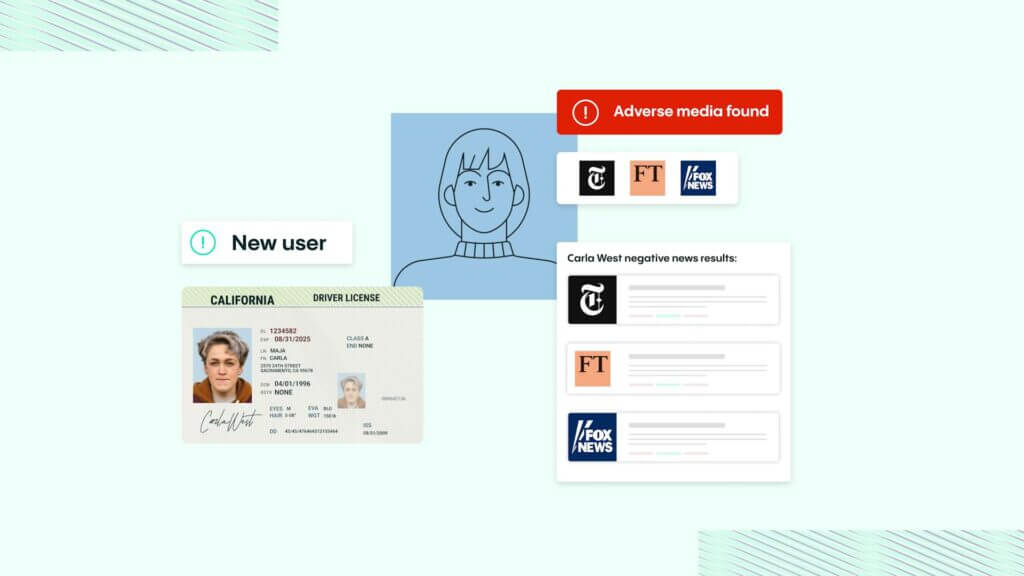

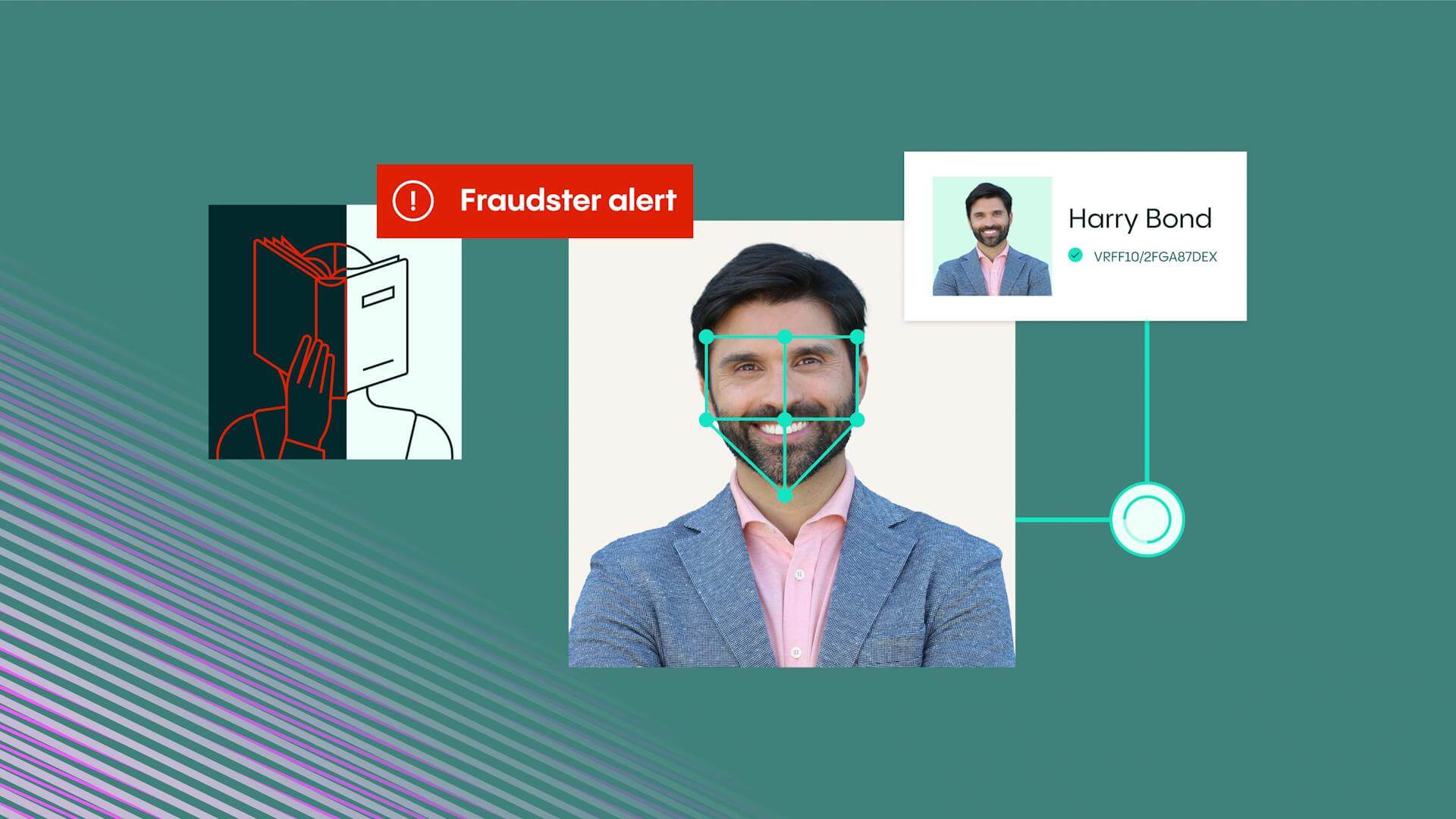

Ensure compliance with Veriff

Here at Veriff, we’re the perfect partner for crypto. Our crypto verification solution will prevent fraud, guarantee compliance, convert real customers, and will ensure you always know your customers. With over 12,000 ID documents, and 230+ countries and territories covered in 40 different languages and dialects, we’ve got you and your customer covered. No matter where in the world you both are. To discover more about how we can help your business, talk to us today.