Blog Post

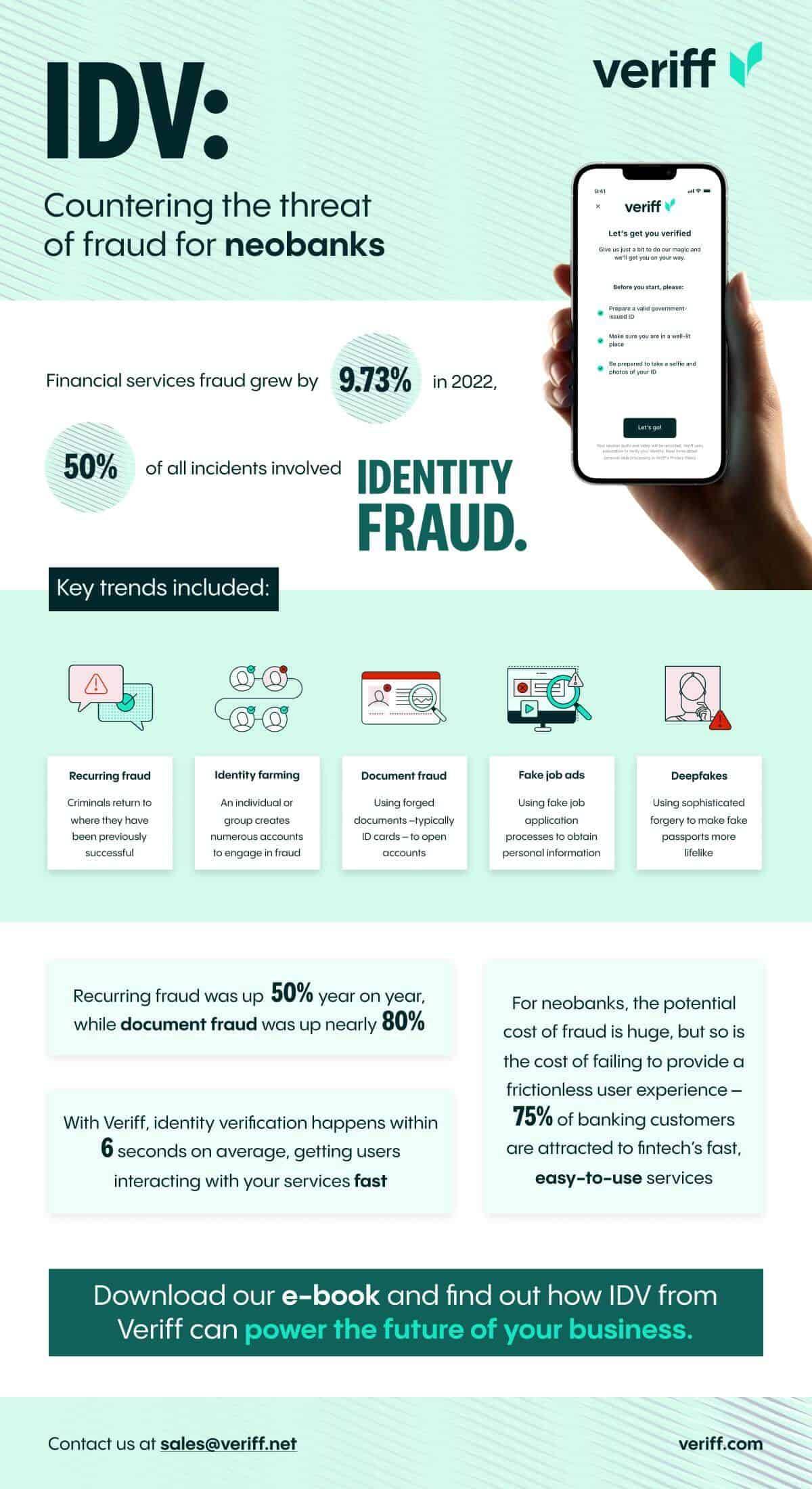

IDV: Countering the threat of fraud for neobanks

New research from Veriff outlines the challenges that bad actors online pose to neobanks, including how fraud rates have changed and the most common forms of fraud.

Online fraud remains a prevalent threat to today’s neobanks; discover new research from Veriff which outlines the how fraud has grown worldwide and types of fraud which have proliferated.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 12K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Find out more

Discover how Veriff is helping financial services firms to onboard more customers, achieve compliance, and prevent fraud.