KYC Article

EU banking regulator set to strengthen remote onboarding checks

Allied to this, remote onboarding is a central pillar of the EU’s 2020 digital finance strategy. Due to this, a unified regulatory approach is needed to provide clarity and consistency about what is, and what is not, allowed in a remote and digital context within the union.

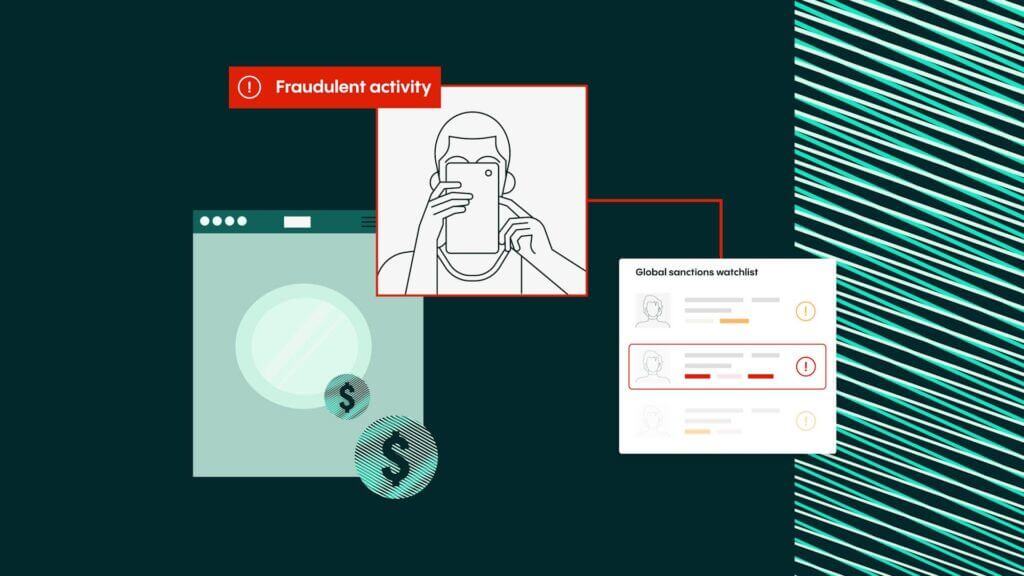

Last month, the European Banking Authority (EBA) announced plans to strengthen the anti-money laundering (AML) checks required for remote customer onboarding processes.

While launching a public consultation on new draft guidelines, the EBA announced a raft of new measures that aim to tackle apparent inconsistencies across EU countries. These particularly relate to checks conducted by financial institutions.

Over the past couple of years, remote services have become the norm for many EU customers. This is due to advances in technology and a growing demand for virtual services.

Allied to this, remote onboarding is a central pillar of the EU’s 2020 digital finance strategy. Due to this, a unified regulatory approach is needed to provide clarity and consistency about what is, and what is not, allowed in a remote and digital context within the union.

What do the new EBA guidelines say?

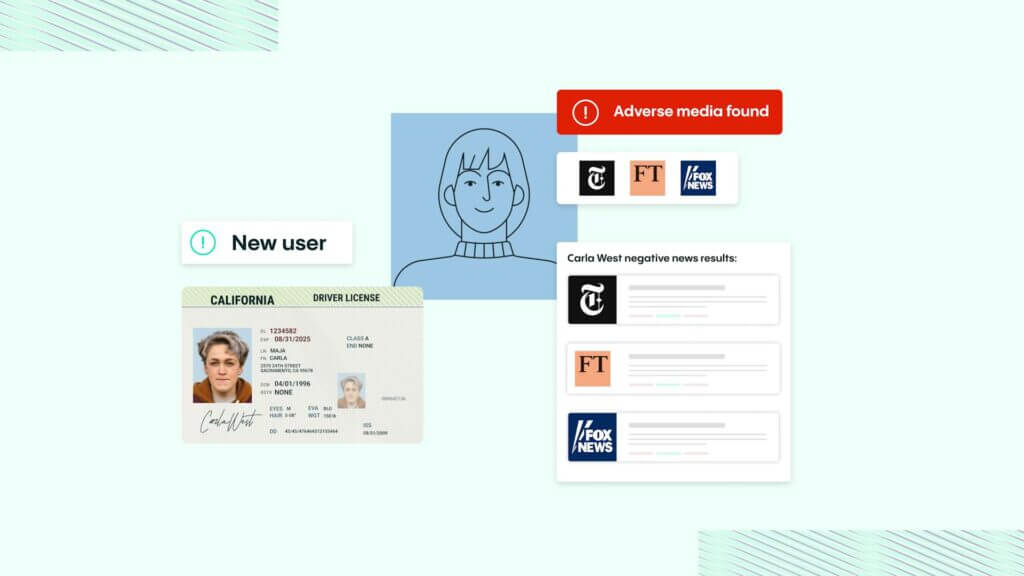

The new EBA guidelines outline a common process that firms across the EU should adopt in order to ensure that their customer onboarding processes meet due diligence obligations.

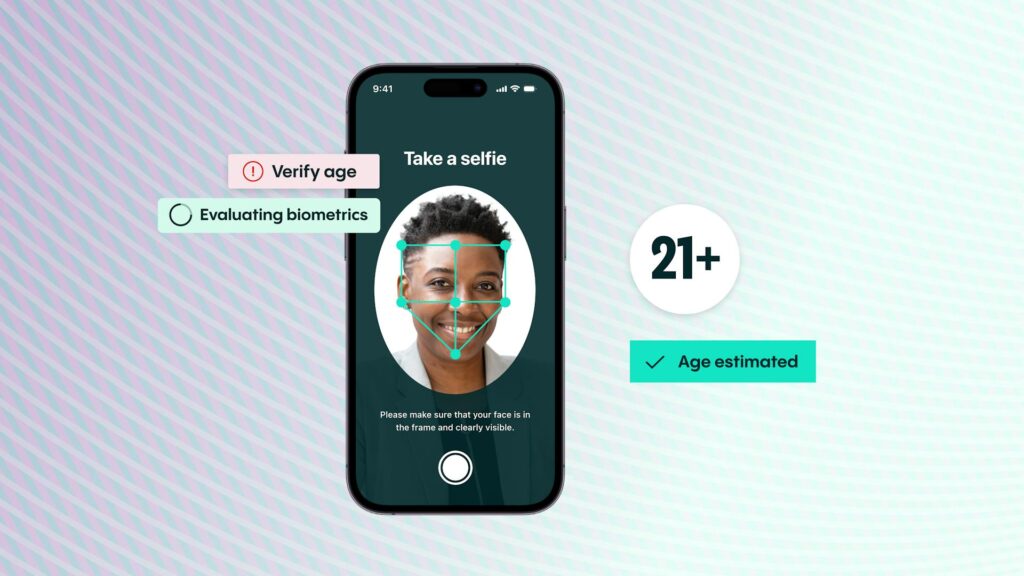

In addition to this, the EBA has also stressed that firms must understand the capabilities of new remote onboarding solutions. By understanding the technologies, the EBA believes that firms from across the union can support the responsible use of these technologies and ensure they’re aware of any money laundering risks that may arise. Firms can then also take steps to mitigate these risks effectively.

When will the new guidelines come into force?

At present, the EBA has launched a consultation on the new guidelines. This will run until March 10, 2022. A public hearing will also be held on February 24, 2022.

In the ‘overview of questions for consultation’ section of the guidelines, questions about the proposal highlight the acquisition of information, document authenticity, and integrity, digital identities, reliance on third parties, outsourcing, ICT, and security risk management.

Once the new guidelines are adopted, the standards will apply to all financial sector operators that are within the scope of the EU’s Anti-Money Laundering Directives (AMLD).

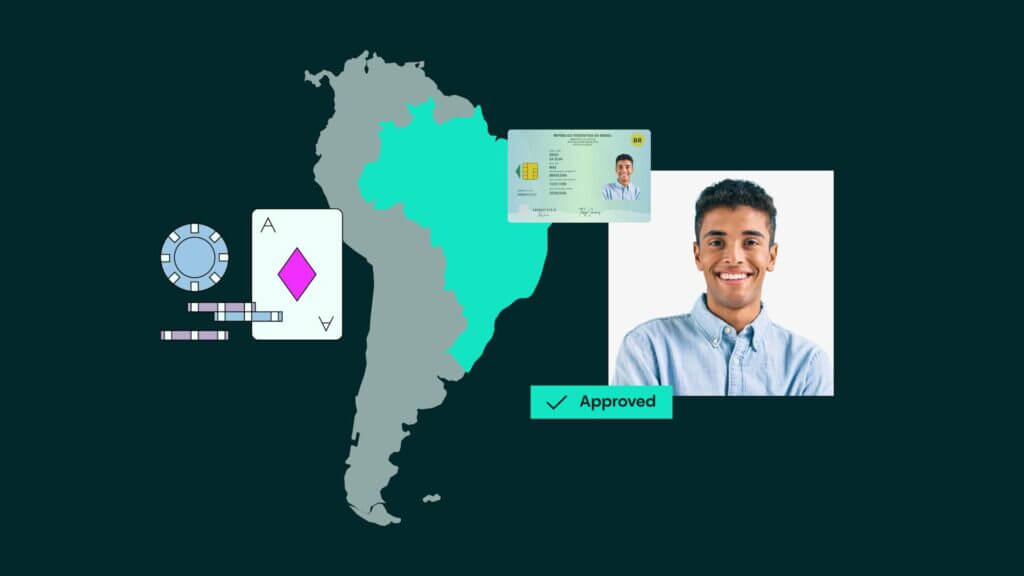

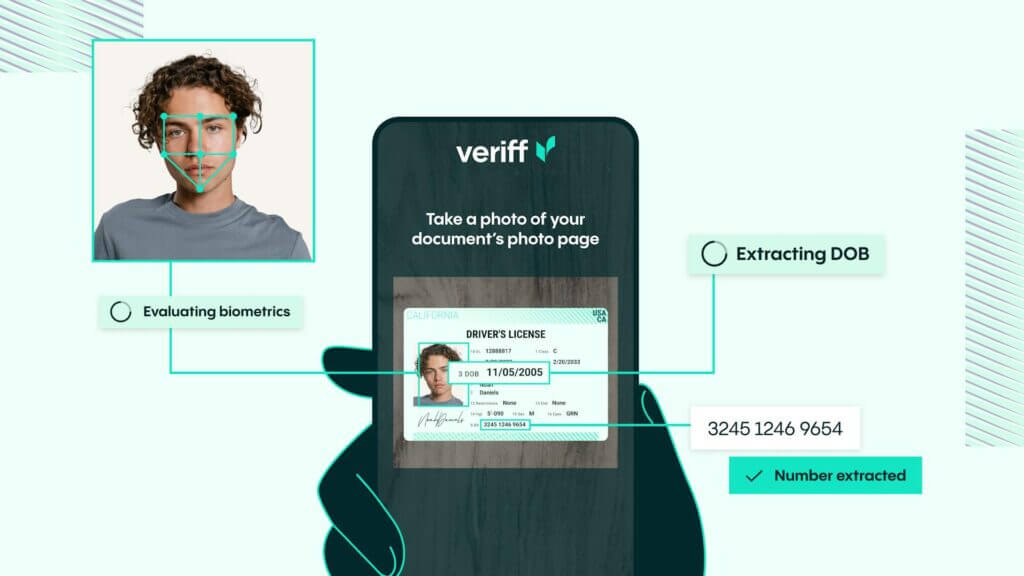

Ensure onboarding and KYC compliance with Veriff

With our customer onboarding tool, you can show regulators that you take financial crime seriously. Our tool will help ensure that you always know your customers. Plus, it will help you onboard more customers by making the process seamless from start to finish.

Talk to us today to learn how our new account onboarding tool could help your business.