Case Study

Veriff & Fundvest: tackling global financial regulations with ease

Within any financial services space, businesses run into problems with verifying users identities, complying with regulators, and ensuring that the user experience does not impede users from interacting with the platform. So when searching for an IDV provider the biggest problems Fundvest had to solve were: compliance, fraud, and ease of use.

About Fundvest

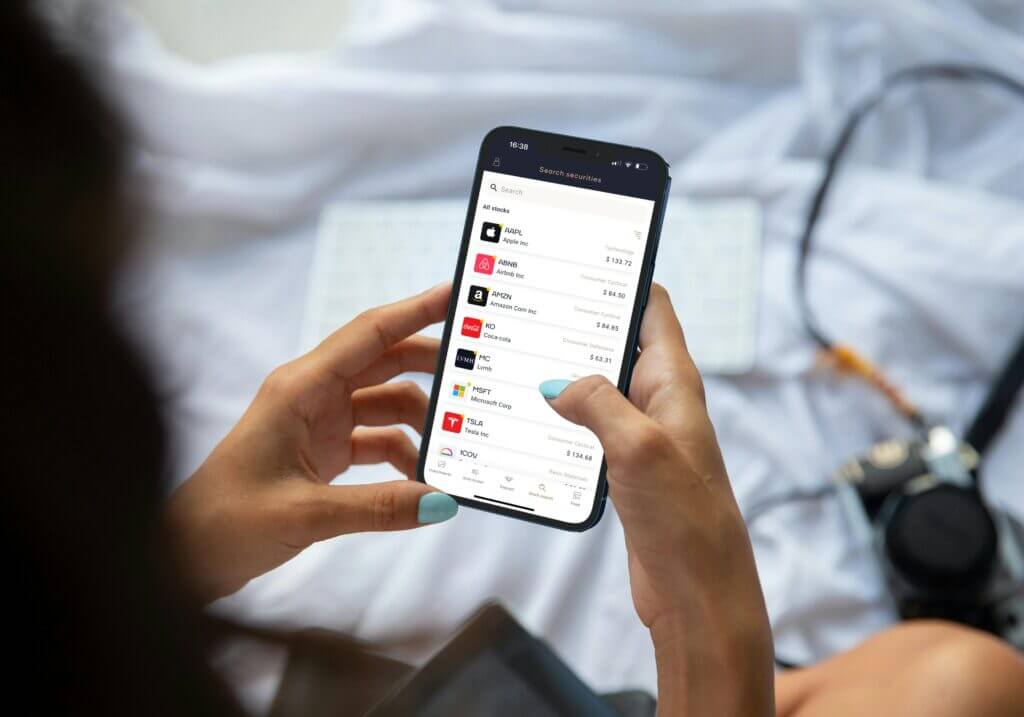

Fundvest is a mobile app that focuses on investment and allows users to invest in stocks and ETFs. It was founded in 2019 and serves Estonia, Lithuania, and Latvia. Fundvest was created to address a lack of specific investment opportunities and connection to stock exchanges for European consumers. Traditional banks often lack user centricity and have high minimum fees that make investment inaccessible. Fundvest offers a solution to these problems by offering access to EU and US stock exchanges with lower commission fees than traditional banks.

What business problem did Veriff solve for Fundvest?

Within any financial services space, businesses run into problems with verifying users identities, complying with regulators, and ensuring that the user experience does not impede users from interacting with the platform. So when searching for an IDV provider the biggest problems Fundvest had to solve were: compliance, fraud, and ease of use.

Fundvest was built to challenge established financial services in Europe, starting with the Baltic states. Fundvest saw that digital apps can compete with large banks by providing better UX and more accessibility than a typical bank. That doesn’t negate the fact that smaller businesses like Fundvest are still competing with some of the largest legacy institutions in the financial sector, so having a fast and easy onboarding process coupled with a great IDV solution was the key to success.

Having a fast and easy onboarding process coupled with a great IDV solution was a key to success. That, paired with certain regulatory and AML/KYC needs, made partnering with Veriff an easy choice to make.

What made the difference to Fundvest when choosing Veriff?

Veriff’s product scope is expansive, and includes AML checks which avoids the need for additional service providers that businesses need to use for IDV, KYC, and AML. Veriff’s flexibility with pricing and customization provides a solution for every type of business — and allowed Fundvest, as a startup, to scale as needed. Fundvest built Veriff into their platform from the beginning, which allowed them to automate onboarding processes immediately.

What specific products does Fundvest use from Veriff’s product suite?

Fundvest implemented Identity, document, PEP, and AML checks directly into their platform.

What was the immediate impact of implementing Veriff?

The onboarding process is sped up which helps increase conversions and provides a seamless user experience. Veriff’s Identity Verification Solution allowed Fundvest’s volumes to increase while the platform scaled and onboarded more users, while also providing a seamless user experience and layers of trust for the platform’s customers when submitting ID documents. Additionally, Fundvest was able to engage Veriff for both its onboarding, and its AML and regulations needs by providing PEP checks, creating an ecosystem for identity verification that ensures the platform is stopping fraud, and protecting its users and reputation.

About Veriff

Veriff is the preferred identity verification partner for the world’s biggest and best digital companies, including pioneers in fintech, crypto, gaming, and the mobility sectors. We provide advanced technology, deep insights, and expertise from our foundation in digital-first Estonia and honed over decades in leading the digital identity revolution. The partner of choice for businesses who need to rapidly and effortlessly verify online users from anywhere in the world, Veriff delivers the widest possible identity document coverage.

By supporting government-issued IDs from more than 230 issuing countries and territories and with our intelligent decision engine which analyzes thousands of technological and behavioral variables Veriff enables trust from the first hello. With more than 550 people from 60 different nationalities and offices in the United States, United Kingdom, Spain, and Estonia, we are dedicated to helping businesses and individuals build a safer and more secure online world.