KYC Article

AML vs KYC – What’s the difference?

What do they mean? And why are they crucial to understand? Discover just that in our guide below, which looks at what they do, how they work & how they can help you.

An entity wanting to provide financial services, in addition to other regulatory requirements, needs to implement an AML and KYC program to protect itself against fraud and increase the level of security against funds being used for illicit activities. Of course, it is mandatory for financial service providers to comply with regulations, and they’re subjected to a range of different regulatory penalties if they fail to do so. That’s why it is essential to have a clear understanding of what anti-money laundering (AML) and know your customer (KYC) mean in real terms, and learn about the key differences between the two.

These terms are commonly used in the same context, but they mean different things. The significant difference between these two terms is that KYC is a specific process which takes place, upon fulfilling certain conditions (e.g. establishing business relationships, conducting an occasional transaction that exceeds certain amount, etc.), whereas AML is a entire set of procedures and processes aimed to combat money laundering and financing of terrorism, which can include KYC. This is the process of obtaining the information about the customer from a reliable and independent source, verifying it, and determining the risks from the establishment of a business relationship with said customer. The KYC process is used to ensure that entities obligated under the AML framework have sufficient knowledge about their customers and certainty about their identity. AML, on the contrary, can be described as an umbrella term for the entire set of regulated mechanisms and procedures that has to be implemented by a variety of financial actors to combat money laundering and financing of terrorism

In this article, we’ll tell you more about both AML and KYC programs, talk in-depth about the key differences, and explain the relevant processes, requirements, guidelines, and tools.

What is AML & what does it do?

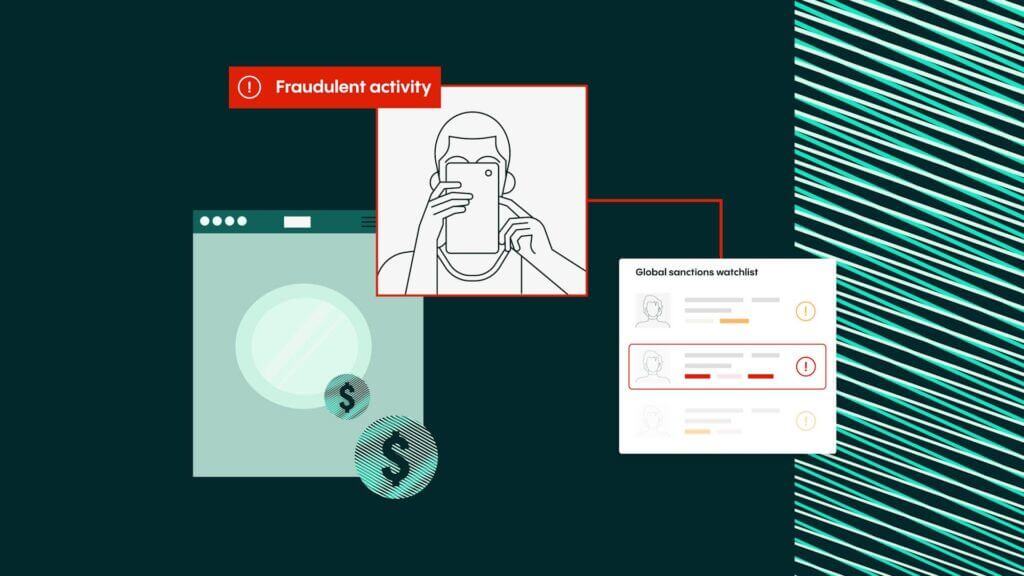

AML refers to the activities that financial and credit institutions, and companies in other fields, such as gambling providers or lawyers providing specific services, perform to actively monitor clients and prevent financial crimes. The anti-money laundering process helps prevent a wide range of illicit activities such as money laundering or financing of terrorism. Companies, in any case, need to take these measures in order to avoid the potential aftermath of regulatory action taken against them.

The goal is to implement specific regulatory provisions to prevent illicit financial activities by addressing the risk factors inherent to the service, product, or the customer of the company. The AML framework consists of numerous elements – among these are risk assessment of clients, risk management systems, KYC (or customer due diligence) programs, and relevant reporting obligations. It is particularly important for the companies exposed to higher risks of financial crimes to implement an effective anti-money laundering compliance program to avoid facilitating monetary crimes and ensure regulatory compliance. The system should be comprehensive, detailed, regulation-specific, and well-planned.

What is KYC & what does it do?

We can define KYC as the process of obtaining and verifying a customer’s identity against independent and reliable sources to protect an entity against various risks of financial crime. One of the steps of this process requires potential customers to provide credentials, such as identity documents, to prove that they are who they claim to be. For example, financial institutions may require individuals to verify themselves before opening an account to ascertain their identity. This allows companies to make sure that their services are used only for lawful purposes and to be able to assist relevant authorities throughout an investigation when any issues occur.

Besides preventing crime, KYC processes help banks and other financial service providers understand their customers, improve services, and effectively manage risks. Hence, it is vital for financial institutions to correctly implement such procedures to minimize the chances of aiding any unlawful financial activities. The financial institutions are encouraged to consult different stakeholders, both internal and external, to understand their specific regulatory obligations with regards to the KYC procedures.

How does AML work vs KYC?

The main objective of the AML framework is to prevent criminals from easily accessing financial systems with the intention of laundering funds or conducting other financial crimes. The overall process aims to implement specific regulatory provisions to prevent illegal activities, mostly related to the financial system, and to avoid the usage of such a system for laundering funds. KYC, on the other hand, is one of the core elements of an AML framework as explained earlier. By obtaining the information about the customer as well as verifying their identity, it aims to prevent criminals from using a specific financial service for their unlawful activities.

There are various components that help companies adjust their AML and KYC processes to suit their needs. An excessive library of regulations, opinions of supervisory authorities, and guidelines, have been issued by the financial supervisors to help companies to prevent financial crime. Let’s take a look at these components and talk about the major differences between AML and KYC systems in depth.

AML & KYC processes

In order to understand these processes, it is important to know about the risks associated with Money Laundering. This criminal activity can produce a massive negative impact on society, companies, and individuals. That’s why businesses worldwide must strive for compliance with money laundering prevention practices.

AML practices put procedures and systems in place that prevent criminals from being able to easily access financial products and services. Upon correct implementation of such systems, it is almost impossible to hide the illicit origins of money within transactions. One of the most important components of the AML system is the KYC process. Companies are obligated to establish their customer’s identities and verify them before providing services or products.

AML & KYC requirements

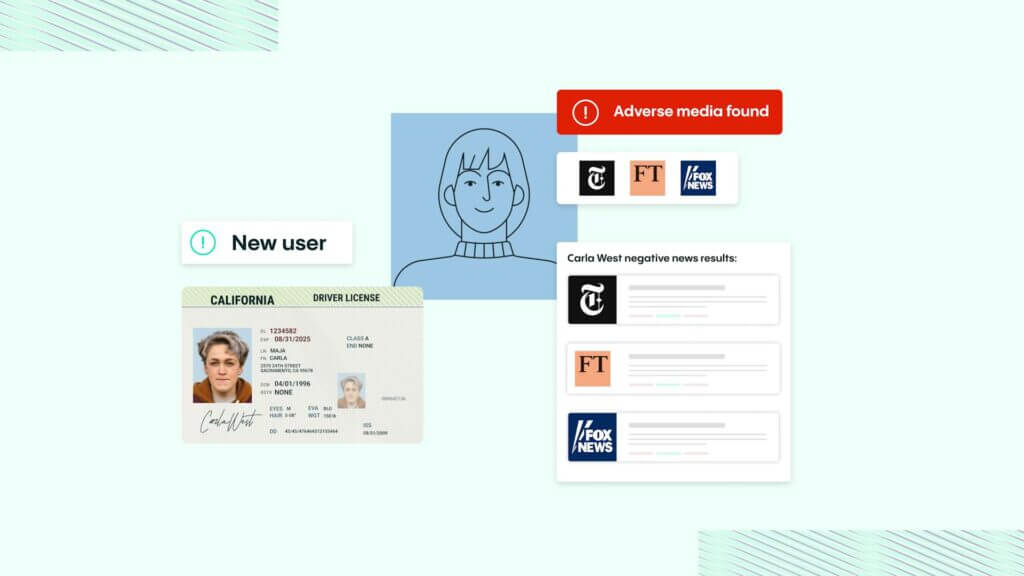

During client onboarding, AML-obligated companies need to identify and verify the information on their customers to complete the procedure. According to the regulations, companies must take extra steps when the relationship with a customer has numerous higher-risk factors, in order to prevent circumvention of money laundering systems. They should actively monitor their customers’ behaviour with regards to the usage of their services. However, in certain cases, publicly available information may also give grounds for suspicions, and institutions must report suspicious activities when they occur, in accordance with the relevant regulatory requirements.

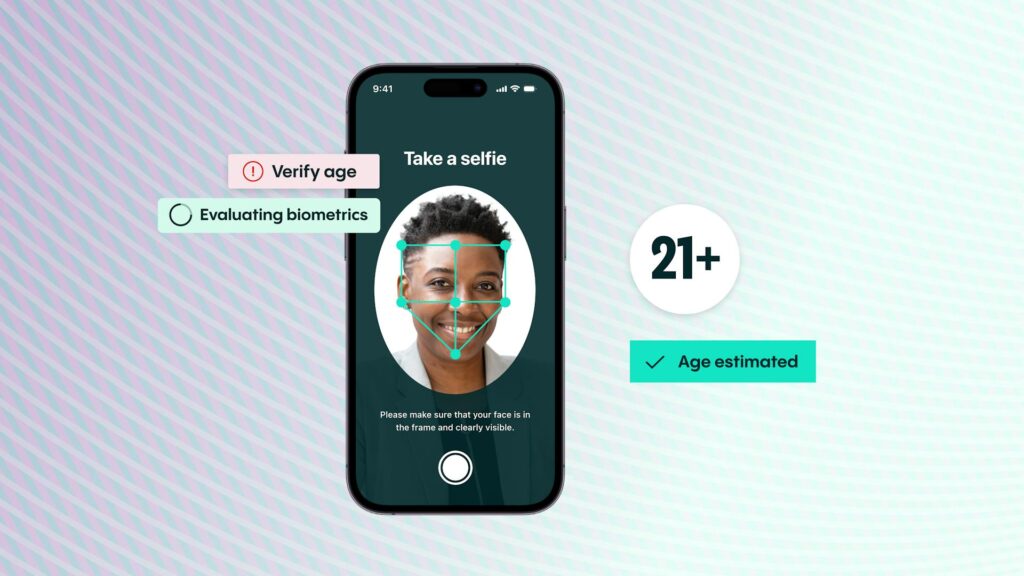

The KYC procedure is a mandatory step during this operation. It is essential to identify a client and verify their identity when providing services to them. This obligation helps companies fight fraud and avoid penalties from regulators. Businesses must ensure that they have a proper identity verification system set up, capable of verifying individuals using their ID documents and maintaining a track of high-risk customers to take actions when the need arises.

AML & KYC regulations

Different countries have different AML and KYC regulations for banks, and other credit and financial institutions to be considered compliant. Generally though, these steps are quite similar to each other because they’re based on the same practices. Companies at risk of financial crime are required to implement an anti-money laundering program in order to avoid facilitating monetary crime and ensure compliance with the relevant regulations. The primary goal of these regulations is to detect, and respond to, the risks of money laundering and terrorism financing, thus preventing both.

On the other hand, we can describe KYC compliance as a regulatory obligation to develop customer identification processes, verify the information obtained about the customers on the basis of trust-worthy sources, as well as identifying and addressing the risks related to a particular product and customer. Consistent and effective application of the KYC procedures forms an integral part of the compliance with AML regulations.

AML & KYC tools

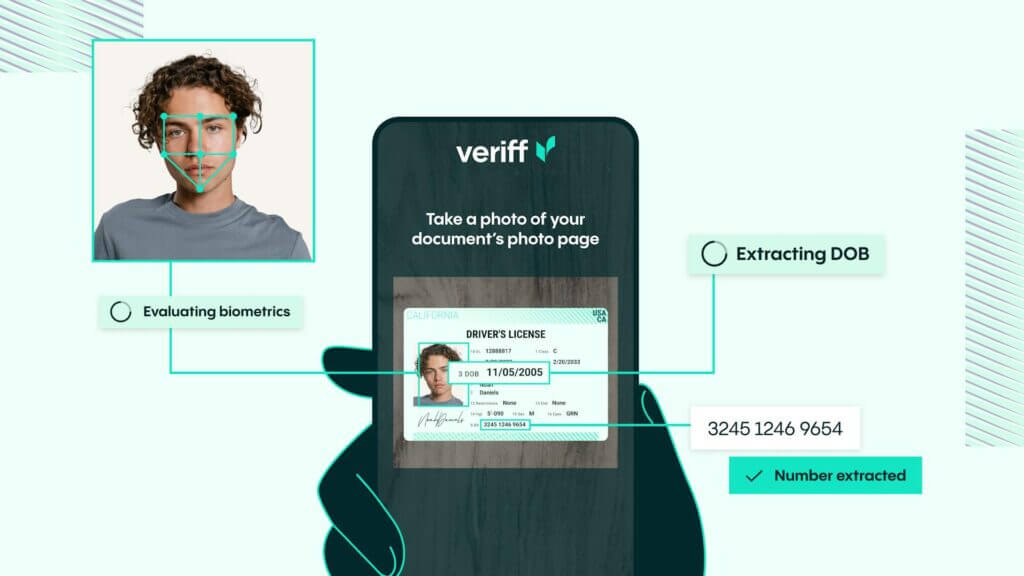

There are several tools that help companies be compliant with AML and KYC regulations worldwide. For example, here at Veriff, we offer a full-stack AML and KYC solution. The core components are Identity Verification, checking PEP & Sanctions databases, considering adverse information & media, and ongoing monitoring.

Using these tools you can ensure that your customers are who they say they are, and fight identity fraud effectively. Our verification engine makes automated decisions in a matter of seconds, which can help companies run their operations smoothly. Veriff also allows developers to deploy the end-to-end compliance technology with a single integration.

How AML vs KYC works in Crypto

Cryptocurrency is a solution for many people worldwide to have cheaper and faster international transactions. Unfortunately, this is not the only reason why people are getting involved in the growing industry. The crypto sector has also enabled criminals to launder money and fund terrorists in an easier way by being a product that strongly favours anonymity.

Regulatory bodies have been on a quest to address money laundering issues in the crypto industry that would help combat it, while not limiting the digital nature of the service. Previously, only crypto asset exchanges and custodian wallet providers have been subject to relevant anti money laundering regulations, yet in anticipation of upcoming EU-wide AML Regulations, more and more countries are subjecting all crypto-asset service providers to abide by AML provisions.

Get help with AML & KYC services

Here at Veriff, we want to make it easy for companies to connect with honest people. Take a look at our full-stack AML & KYC Compliance solution that can help you fight financial crime effectively. It’s easy for developers to deploy Veriff’s end-to-end compliance technology with a single integration, backed by industry-leading support and account management.