Lenders: Prepare for regulations without compromising customer experience

Future-proof your KYC and AML process with Veriff. This eBook is a key resource for professionals looking to discover insights and strategies to counter fraud in today’s lending sector. Download for free now.

Chris Hooper

Unsecured debt, or loans not secured by an asset like a home or, occasionally, a vehicle, is a burgeoning market with more money being lent globally than ever before. It can take the shape of long-term contracts with lower interest rates because they are repaid over longer periods of time, or credit cards with higher interest rates and shorter payoff terms.

Rising interest rates are thought to be reducing demand for unsecured loans in the post-pandemic climate, but this is contrasted with the skyrocketing cost of living, which will continue to drive up activity in the short-to-medium term.

Additionally, in an effort to lessen instances of bad actors processing dirty money, authorities are tightening the rules surrounding unsecured funding options to tackle money laundering. However, the unsecured lending sector remains a prime target for bad actors, whose ever-evolving strategies pose substantial legal, financial, and reputational risks.

Organizations must safeguard against risk while maintaining a quicker time to revenue, providing optimized onboarding and the kind of service that enables customers to receive swift loan choices and prompt payouts.

Scale, navigate growing regulations, and fight fraud

Unsecured lending is a multi-billion dollar global industry. With the right approach, your organization can gain a competitive advantage, retain a faster time to revenue with optimized onboarding, and help borrowers get quick loan decisions and fast payouts. Veriff helps lenders scale their business without increasing risk.

Meeting customer expectations while staying safe

Each year, the unsecured lending sector sees billions of dollars loaned on a worldwide scale. With an effective strategy it can be a lucrative industry to participate in, but organizations encounter difficulties in preventing fraud while upholding customer expectations.

You must safeguard against risk while maintaining a quicker time to revenue, providing optimized onboarding and the kind of service that enables customers to receive swift loan choices and prompt payouts. How can unsecured lenders strike the proper balance between expanding their businesses and reducing risk?

Read Veriff's new eBook, Lenders: Prepare for regulations without compromising customer experience, to discover how unsecured lending operators can use identity verification to scale effectively and overcome challenges.

Make faster loan decisions

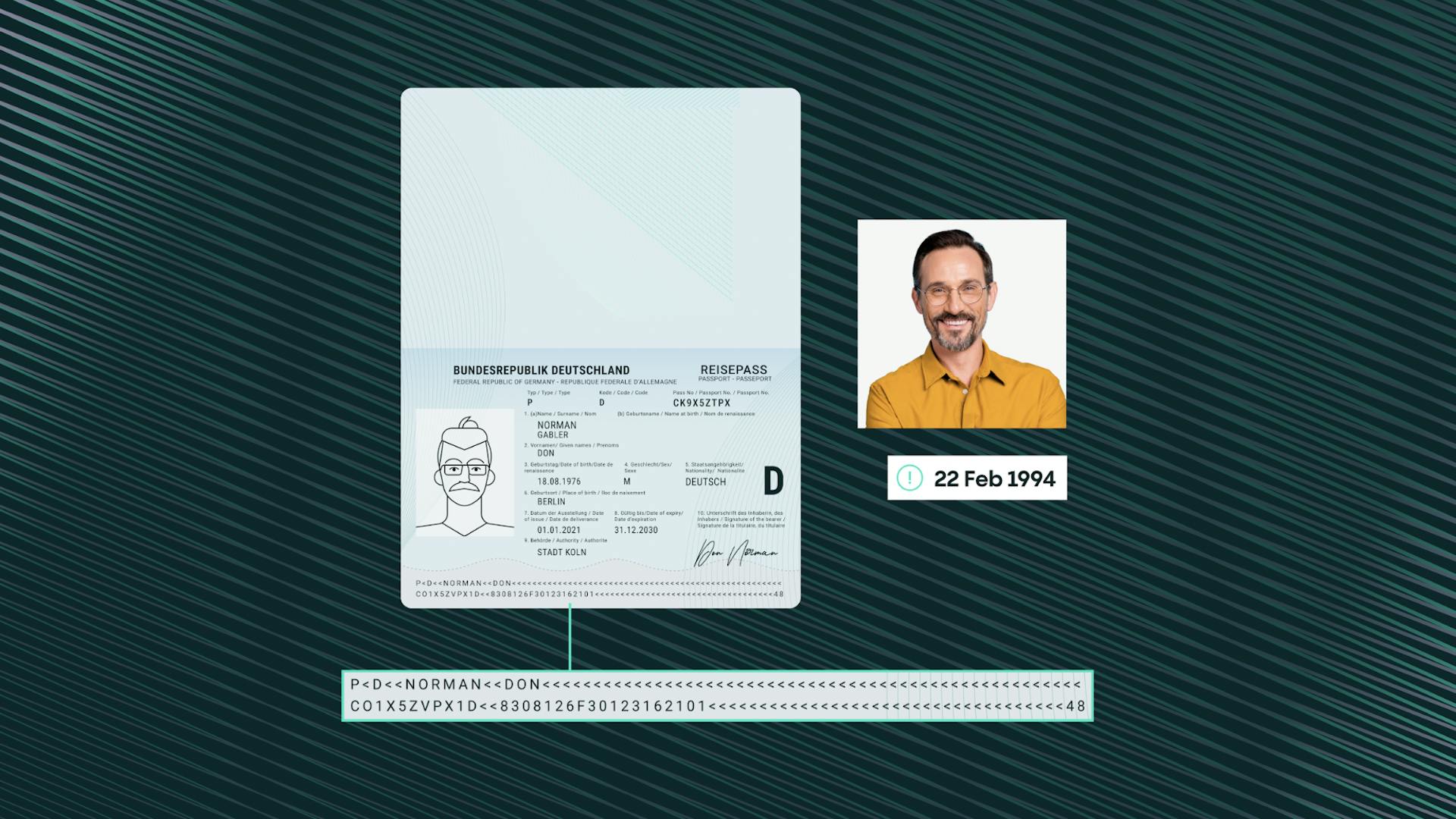

Automated identity verification gets borrowers verified in seconds, not minutes or hours. A simple UX makes it easy for the borrower.

Prevent fraud and comply with regulations

Stop fraudulent loans with industry-leading fraud prevention technology and comply with impending KYC regulations.

Go beyond one-time passwords

Make authentication for borrower accounts as simple as asking for a selfie rather than relying on outdated 2FA methods.