Earlier this month, the Gaming Commission of Ghana stepped up its efforts towards enforcing KYC verification in the country’s gaming industry.

The move stemmed from a recent stakeholder engagement session, which was held between the Gaming Commission of Ghana and the Financial Intelligence Center at the Movenpick Ambassador Hotel. At the meeting, the two sides discussed the steps which operators in the fast-growing industry need to take in order to comply with mandatory KYC verification.

The move has become necessary due to the recent growth in gaming activities in the country and the need to fulfil Financial Action Task Force (FATF) recommendations.

It’s thought that the move to enforce KYC verification in Ghana’s gaming industry will boost the commission’s role in the fight against terrorist financing and money laundering. It’s also thought that the new legislation will safeguard the interests of all stakeholders.

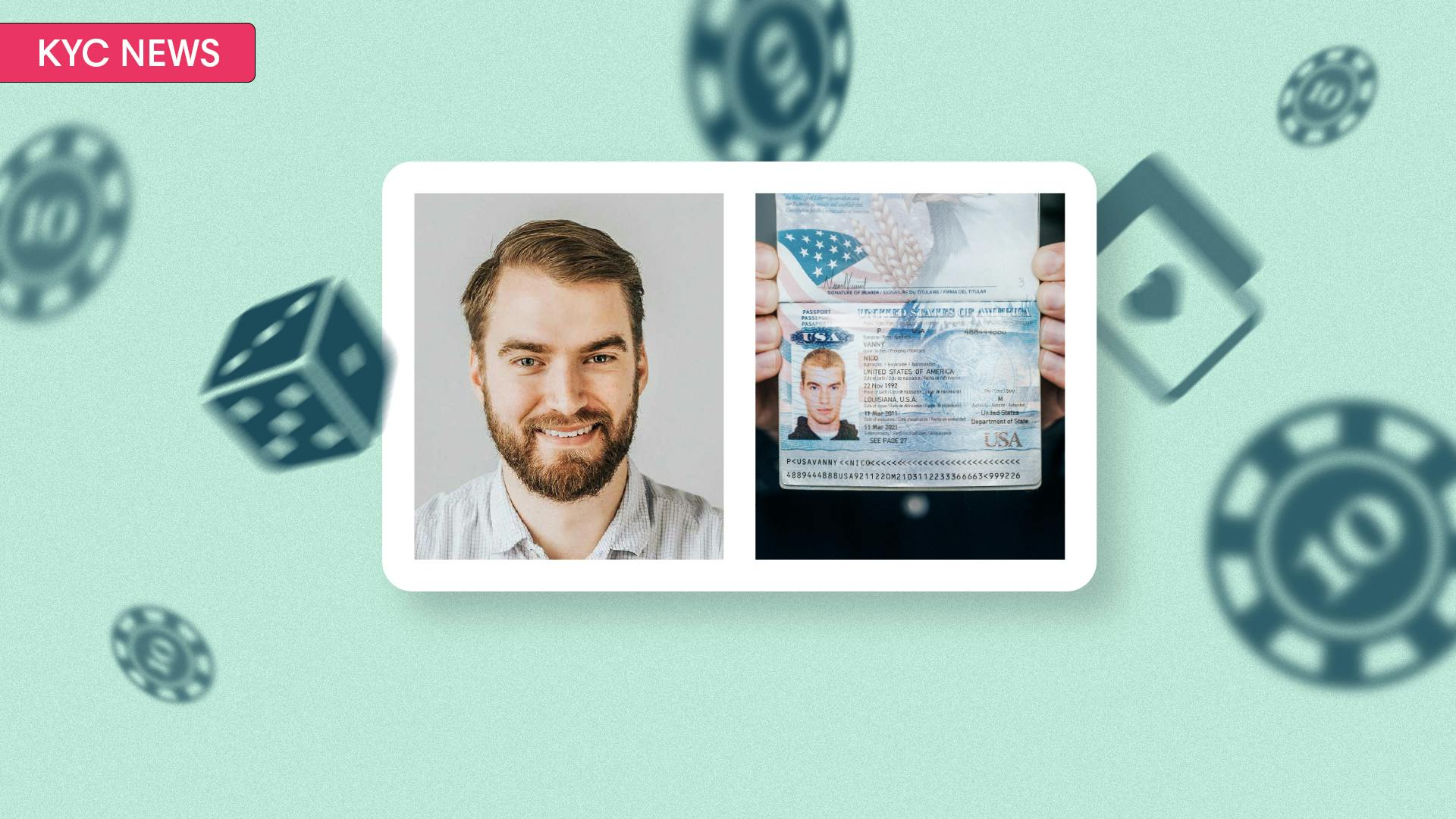

With KYC now becoming a mandatory requirement, all gaming operators in the country will be required to verify the identity of people who visit their website or use their services. As part of this, all casinos and online gambling entities will need to verify customer information when they sign up for an account. To ensure authenticity, online casinos must receive third-party, independent verification of an identity.

Betway leads the way

In Ghana, we have already seen some of the country’s betting brands and casinos employ KYC verification. Betway Ghana, for example, has made its staff members undergo training on combatting the financing of terrorism and anti-money laundering at its corporate office in Adabraka. The training, which was facilitated by personnel from the Financial Intelligence Center, was led by the Head of Compliance, Seth Nana Amoako.

Since its inception in 2016, Betway has pushed for greater regulatory compliance. To enforce this, the company has introduced player verifications through a specialized account management team that is tasked with verifying player information.

Speak to Veriff about your KYC processes today

If you’re concerned whether your business complies with KYC legislation or you need help fighting financial fraud, then speak to us today about our AML and KYC solutions. By employing identity verification alongside PEP and sanctions checks, you can ensure that your customers are who they say they are. Plus, you can show regulators that you take financial crime and compliance seriously.