Why a Strong Fraud Prevention Process Is a Dual Triumph for You and Your Customers

Effective fraud prevention is essential to protect your business, but a rapid and accurate fraud detection process should be a major benefit for your customers too.

Chris Hooper

For many years, financial institutions have been at the risk of fraud. Common types of fraud include bad actors obtaining a bank account and credit cards by using false personal information, and sensitive customer information such as an account number and credit card numbers being stolen and sold online. Acts of fraud such as identity theft have proliferated due to the amount of personal information which is shared online, such as through social media. As such, financial institutions must remain vigilant, detect fraud and prevent it as far as possible.

With bad actors constantly targeting their customers’ accounts, Neobanks are on the frontline when it comes to fraud detection and prevention. However, at the same time, the growth of on-demand services based around ease of use has encouraged consumers to expect fast, frictionless interactions when they’re online. This creates a potential dilemma when it comes to ensuring effective fraud prevention while delivering the kind of seamless customer experience consumers want.

The threat of fraud

Neobanks are certainly not mistaken in seeing fraudulent activity as a major concern. Our 2023 Identity Fraud Report found that fraudulent activity in the fintech sector was 50% higher than the previous year. Identity fraud had doubled, to make up two-thirds of all fraud incidents. As well as the direct financial cost, neobanks need to consider the business risk presented by failing to meet requirements of increased oversight and regulation.

A potential dilemma occurs when it comes to ensuring effective fraud prevention while delivering the kind of seamless customer experience consumers want.

Unintended consequences

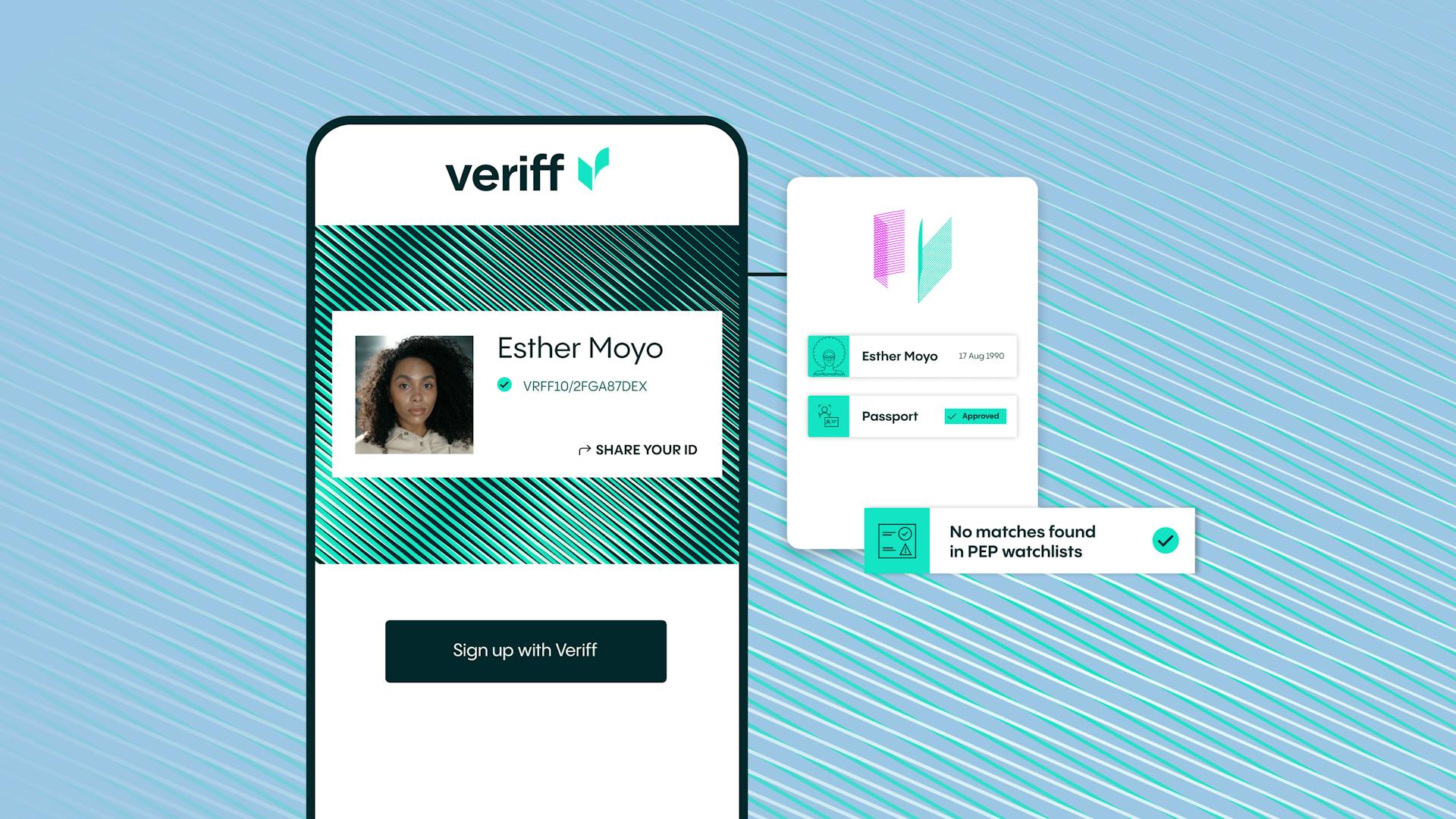

The natural reaction is to bring in stricter measures, such as identity verification (IDV) systems, to minimize the issue. But, there is a danger that the wrong IDV processes can behave more like the fishing net that captures and entangles any number of animals fishermen are not intending to catch. This can result in a severe decline in customer conversions that itself negatively impacts your bottom line.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 10K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.

Saving money, building for growth

A Total Economic Impact study by Forrester Consulting, commissioned by Veriff, found that a leading investment platform saw a 195% return on investment through using Veriff’s IDV platform over three years. That figure took into account increased headcount and tools costs. In addition, there was a 20% reduction in fraud risk, and an average of eight minutes was saved on each identity verification session.

Efficient and effective fraud prevention not only saves you money and minimises business risk, but it also contributes to a better user experience, boosting conversion and retention. That really is a win-win.