Companies around the world trust Veriff

Identity Verification

- Protect your platform from fraud with smart checks that validate documents, data, biometrics, and risk signals in seconds.

- Stay fully compliant worldwide with built-in KYC, AML, age, and address verification that adapts to global regulations.

- Convert more real users through fast, automated decisions and a frictionless verification experience.

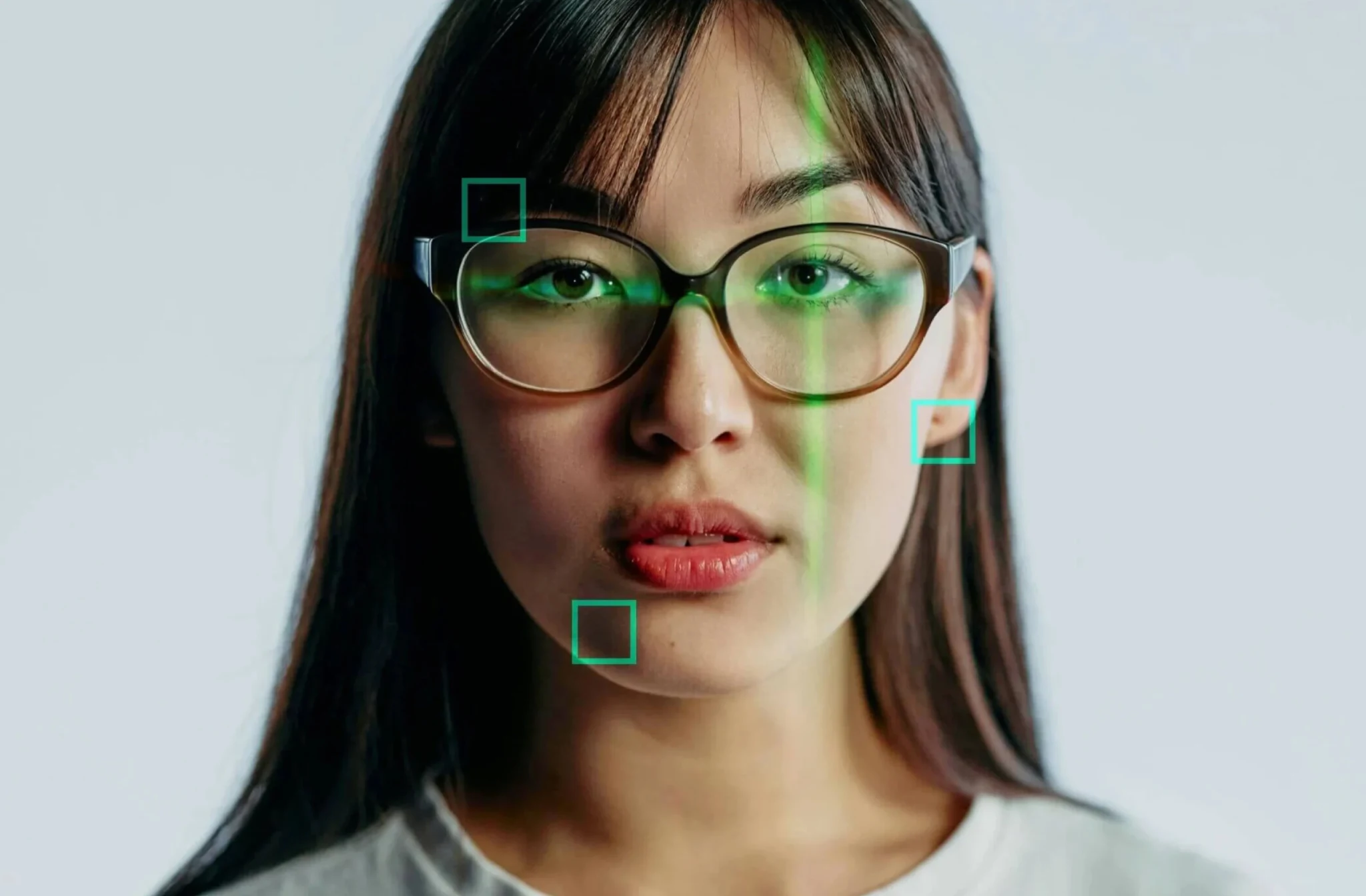

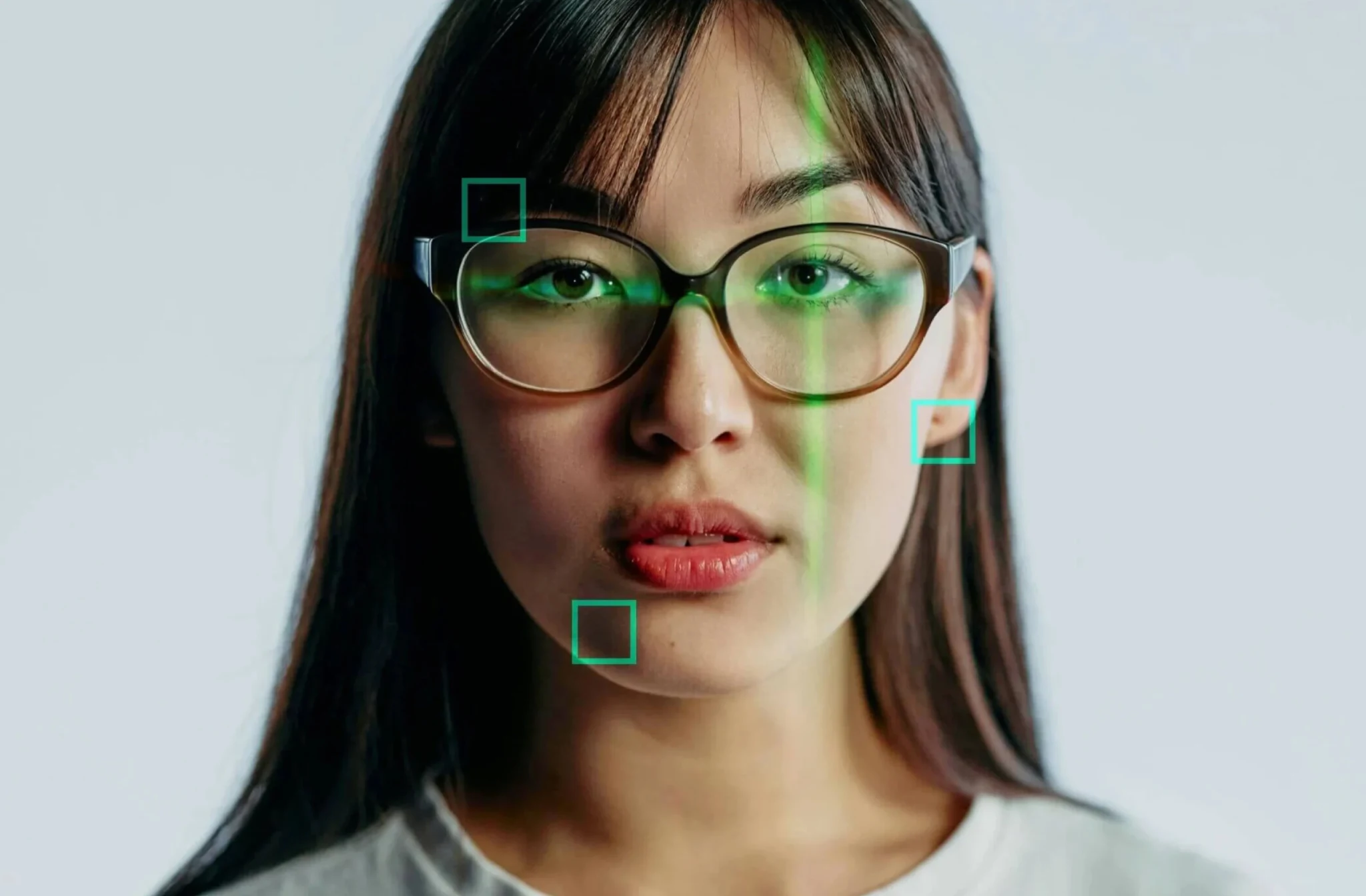

Biometric Authentication

Veriff’s Biometric Authentication and Age Estimation help you verify real users instantly with fast, secure, AI-powered technology.

- Prevent biometric fraud with passive liveness detection and anti-spoofing that stop deepfakes and impersonation attempts.

- Deliver instant verification through sub-second biometric checks that keep onboarding and access flows fast and seamless.

- Strengthen security and compliance by adding biometric layers to high-risk actions, account recovery, and age-restricted experiences.

Fraud Prevention

Veriff’s Fraud Protect and Fraud Intelligence solutions help you detect and block threats in real time with AI-powered analysis and expert insights.

- Block fraud fast. With Fraud Protect you mitigate impersonation, synthetic identities, document fraud, and account abuse during onboarding.

- Gain deeper insights. Fraud Intelligence gives you a consolidated RiskScore and actionable data to strengthen decision-making and investigations.

- Keep genuine users flowing. Real-time detection combined with minimal friction ensures trusted users get through smoothly while threats are stopped.

Open the door to users in more than 230 countries and territories across the globe

verified on the first try

second verification

documents supported

languages & dialects

Calculate your ROI

What industry do you operate in?

How Veriff provides ROI:

$61,500

Up to $61,500 saved in monthly identity verification costs

$87,500,000

Improved conversion rates could bring upwards of $87,500,000 extra in monthly revenue

5.4%

Reduce your fraud rate by 5.4% or more

Take the Veriff challenge: Start a live A/B test

Stop comparing features and start comparing results. We challenge you to test our solutions to see how your fraud prevention capabilities can be transformed. We’ll help you run a live traffic test against your current provider to see the difference firsthand.

FAQs

What is identity verification and how does Veriff help?

Veriff’s identity verification (IDV) uses secure, AI-powered verification solution to confirm that a real person is behind every interaction and help businesses onboard users safely, reduce fraud, and meet global KYC and AML compliance requirements.

How does Veriff integrate with large-scale enterprise systems?

Veriff supports flexible integration through its REST APIs, Web and mobile SDKs, and no-code options like Zapier, allowing verification flows to be embedded directly into apps, websites, or internal systems. With the SDKs, you can customize branding elements such as colors, logos, and UI components, while the APIs give you full control over data flows — including collecting user media yourself, submitting it to Veriff for analysis, and receiving results via webhooks.

Can Veriff handle high verification volumes across multiple regions?

Yes. Veriff scales globally, supporting 12,000+ document types from 230+ countries and territories. Our platform handles high verification volumes, with APIs enabling up to 600 sessions per minute, while keeping onboarding fast, secure, and fully compliant.

Can Veriff adapt to industry-specific compliance requirements?

Yes. Veriff tailors its identity verification to meet industry‑specific compliance needs — whether you’re in financial services, crypto, or iGaming. With features like AML & KYC screening, PEP/sanctions checks, age validation, and continuous re‑verification, Veriff helps you comply with regulations while giving users a fast and secure onboarding experience

Which security and compliance standards does Veriff meet?

Veriff follows strict global security and privacy practices to protect every verification. Our platform is audited against SOC 2 Type II requirements and is built to support GDPR compliance for handling personal data. We apply strong encryption, access controls, and continuous monitoring to help businesses stay secure and meet regulatory expectations with confidence.

What are the next steps if I want to see Veriff in action?

You can book a demo call with our sales team to get a personalized product walkthrough. We’ll show you how Veriff works, explore your use case, and help you understand how automated identity verification, fraud prevention, and compliance tools can support your business. It’s the fastest way to experience Veriff’s speed, accuracy, and global coverage firsthand.