Why the buy now pay later sector needs strong IDV

The buy now pay later (BNPL) sector is experiencing massive growth and the prospect of increased regulatory oversight. To convert more customers and achieve legal compliance, identity verification (IDV) can be a key tool for today's operators.

Chris Hooper

The rise of ecommerce has seen the growth of a flexible short-term payment option, buy now pay later (BNPL), which offers consumers the option to acquire a product without having to pay its entire price upfront.

Although BNPL can be offered in a range of different formats, one of the fastest growing is integrated online shopping apps, or IOSAs, which are particularly popular among Millennials and Gen Z customers because of their link to smaller ticket options under roughly £200 or $250 in value.

Responding to the market explosion, regulators are tightening the rules surrounding online payments and finance options in a bid to protect people and businesses alike.

Responding to the market explosion, regulators are tightening the rules surrounding online payments and finance options in a bid to protect people and businesses alike.

Securing growth in BNPL through IDV

Buy now pay later market growth is predicted to pick up in the coming years as more consumers adopt it and lenders expand into new geographies and the higher-value unsecured lending market.

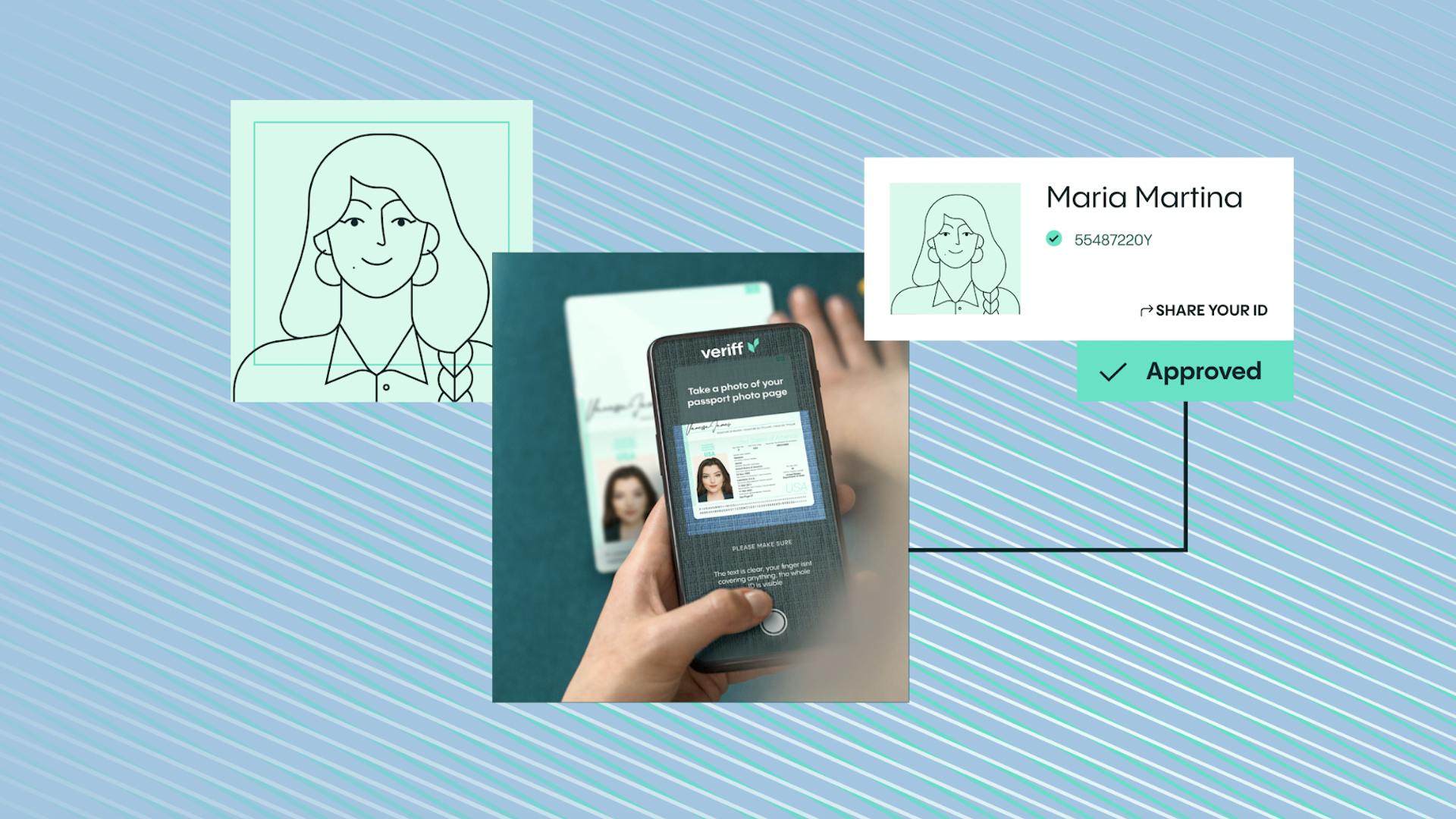

However, unless organizations take proactive measures, incoming regulation could act as a brake on progress. Identity verification (IDV) is a crucial tool in your cyber security toolbox because it ensures that legitimate customers can access your product quickly while easily filtering out bad actors. Since fraud is a serious, global problem that is only getting worse, it makes sense to mitigate the risk of online fraudsters.

To find out more, click below to access Veriff's new ebook, Why the buy now pay later sector needs strong IDV. You'll discover up-to-date research into the growth of BNPL, common inhibitors to operators scaling, and top tips for converting more customers.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 10K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.