How does your P2P platform balance slick customer experience with high levels of compliance?

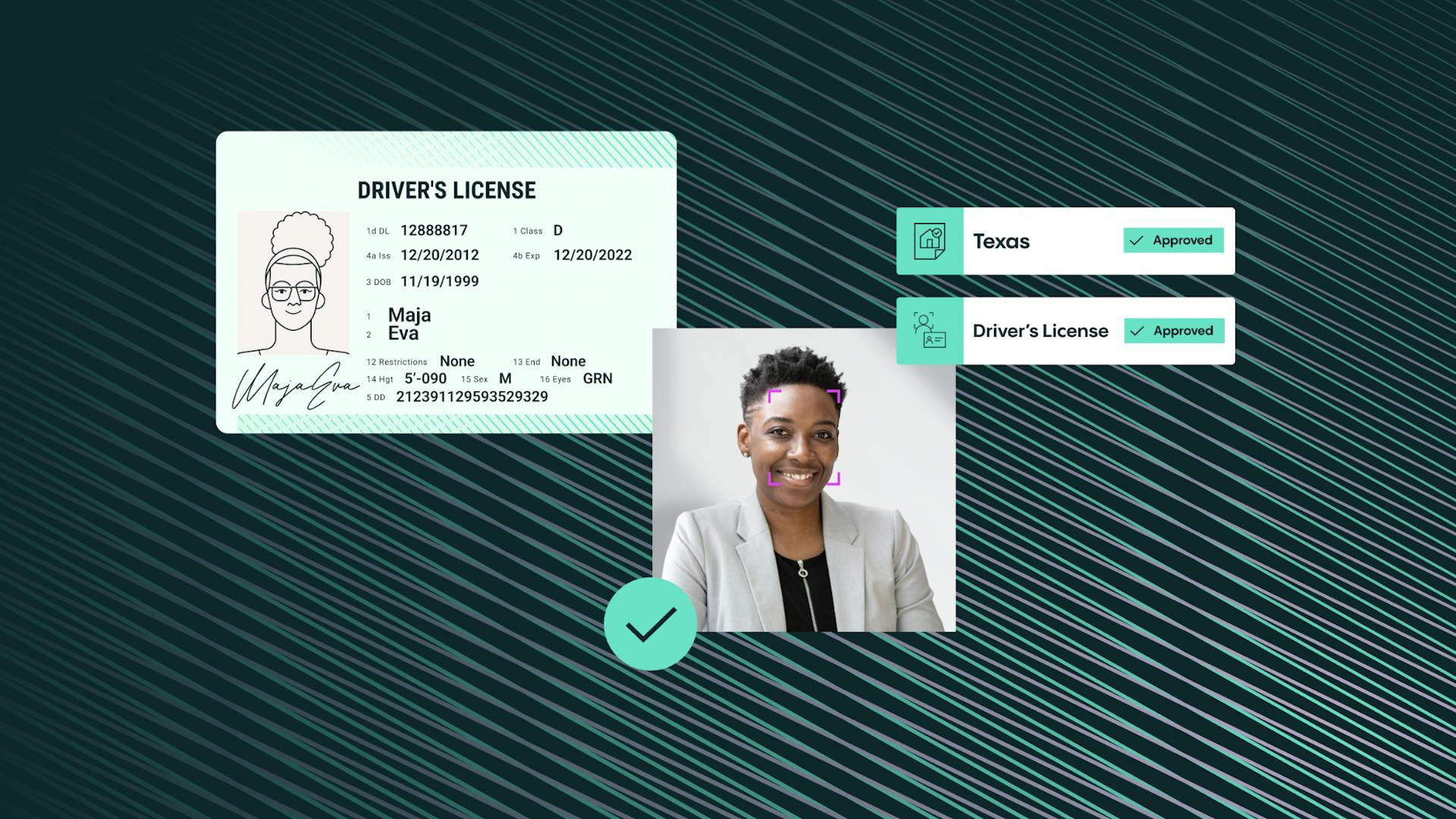

Peer-to-peer (P2P) payment platforms no longer need to choose between seamless customer experience and achieving compliance. Online identity verification helps businesses combine the two to create an effortless remote customer onboarding experience.

Chris Hooper

Online P2P payment platform users value a seamless customer experience, while the P2P payment providers must adhere to KYC and AML regulations. Identity verification (IDV) offers a solution for P2P payment platforms without compromising on users' values.

Fast decisions

A 98% check automation rate gets customers through in about 6 seconds.

Simple experience

Real-time end user feedback and fewer steps gets 95% of users through on the first try.

Document coverage

An unmatched 11K+, and growing, government-issued IDs are covered.

More conversions

Up to 30% more customer conversions with superior accuracy and user experience.

Better fraud detection

Veriff’s data-driven fraud detection is consistent, auditable, and reliably detects fraudulent forms of identification.

Scalability embedded

Veriff’s POA can grow with your company’s needs and keep up with times of increased user demand.